Will Oracle Be a Trillion-Dollar Stock by 2029?

Oracle (NYSE: ORCL) delivered a breakout year for investors, with shares returning 62%. It's been one of the best-performing technology sector stocks in the S&P 500 index for 2024.

The company is capturing strong demand for its cloud services, which are proving critical for enterprise customers to scale artificial intelligence (AI) infrastructure. Investors have plenty to cheer about as a new round of earnings growth momentum provides a major tailwind for the stock into 2025 and beyond.

Could Oracle reach a trillion-dollar market capitalization by the end of this decade? Let's take a look at the numbers and where this cloud computing giant may be headed next.

A big opportunity in AI infrastructure

The spectacular rally in shares of Oracle highlights the company's success in continuously innovating its market-leading database platform.

Oracle Autonomous Database, a fully autonomous cloud database management architecture, gained industry traction for its cost-effectiveness, performance, and scalability. Hybrid cloud solutions including infrastructure-as-a-service (IaaS), platform-as-a-service (PaaS), and software-as-a-service (SaaS) offerings are meeting the needs of customers in a climbing number of use cases.

Maybe the biggest development in recent years has been the emergence of AI as a new growth driver. The data-intensive requirements for companies building out AI infrastructure, including data centers running high-performance Nvidia GPUs for training AI models, made Oracle Cloud more important than ever.

Image source: Getty Images.

The trends have been impressive. In the fiscal 2025 first quarter, (for the period ended Aug. 31), revenue climbed by 7% while earnings per share (EPS) was up 20% from the prior-year quarter. Within the top line, the real story was a 21% increase in cloud revenue balancing the gradual decline in legacy hardware sales.

The financial metric that stands out is Oracle's remaining performance obligation (RPO), which reached a record $99 billion, up 53% from last year. This indicator, a measure of the contract backlog not yet recognized as revenue, provides some confidence for a growth runway. For the year ahead, management is guiding for double-digit revenue growth with an expectation that the cloud infrastructure business will be even stronger than in 2024.

The path to a $1 trillion market capitalization

Supported by the positive operating and financial outlook, Oracle has a path to become a trillion-dollar company. With a current market capitalization of $465 billion, Oracle stock essentially needs to climb by 115% to reach that valuation milestone.

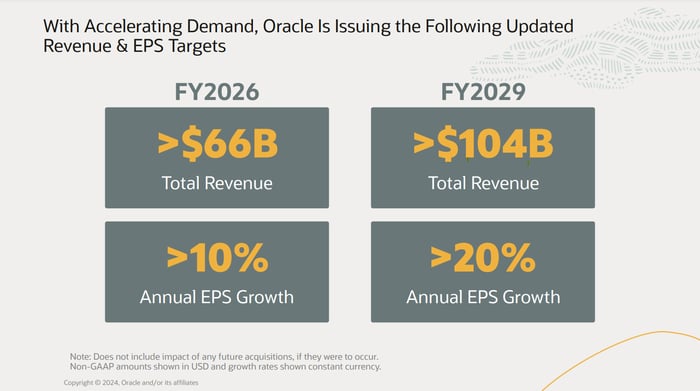

A major factor driving stock prices historically is earnings growth. The good news is that Oracle is delivering on that front. The company is targeting revenue above $104 billion by fiscal 2029, which is nearly double the $53 billion result in fiscal 2024, while it sees room for EPS to accelerate above a 20% annual growth rate in the next five years.

Image source: Oracle.

If Oracle stock just manages to climb alongside these financial trends, returning about 16.5% per year, the company would hit a trillion-dollar market capitalization with a stock price of around $358 by fiscal 2029. For context, the stock returned 27% per year since 2019.

Shares of Oracle are trading at 27 times its consensus year-ahead EPS estimate of $6.29. Based on management's EPS growth target, assuming EPS approaches $12 by 2029, a P/E ratio of 30 that year would imply the share price target necessary for a trillion-dollar capitalization.

The big picture for investors

The key for Oracle will be for it to continue executing an effective operating and financial strategy while consolidating its cloud database market share. Whether the stock reaches a trillion-dollar market value in 2029 or sometime in the next decade, I believe the shares deserve a buy rating. Recognizing a lot can happen in five years to reset expectations, Oracle is a high-quality sector leader well positioned to deliver positive long-term shareholder returns.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Oracle. The Motley Fool has a disclosure policy.