Nike Shares Slide as Sales Slump. Can the New CEO Help the Stock Rebound?

Nike (NYSE: NKE) shares sank after the athletic apparel and footwear company reported disappointing sales and pulled its guidance for the year. The stock is now down more than 20% year to date.

The company also delayed its upcoming investor day as its new CEO is gearing up to take over later this month and lay out his plan for helping turn around the company.

Let's take a closer look at Nike's most recent quarterly results and see if its new CEO can implement a plan to help the stock rebound.

Stumbling over a low bar

Nike didn't exactly set a high bar for its fiscal first quarter -- it guided for a 10% revenue decline for a period in which it should have gotten an Olympic boost. However, it wasn't even able to clear that simple hurdle.

For its fiscal 2025 Q1 (ended Aug. 31), Nike's sales sank 10% year over year to $11.59 billion, falling short of the $11.65 billion analyst consensus. Nike brand revenue dropped 10% to $11.1 billion, while Converse sales decreased by 15% to $501 million. By selling channel, Nike direct revenue fell 13% to $4.7 billion, and wholesale revenue slipped 8% to $6.4 billion.

On a positive note, the company managed to expand its gross margin by 120 basis points to 45.4%, helped by lower warehousing and logistics costs as well as increased pricing. Management also reduced its operating expenses with total selling, general, and administration (SG&A) costs down 2%, despite a 15% increase in demand creation expenses.

Nonetheless, earnings per share (EPS) plunged 26% to $0.70. But that was more than the $0.52 that analysts were looking for coming into the report.

Given Nike's struggles, one metric to watch is inventory. If this metric starts to balloon while sales fall, it could lead to more troubles ahead through markdowns that drag down gross margins. Overall inventory fell 5% to $8.3 billion, but was up from $7.5 billion last quarter. The company said it had some elevated inventory, particularly in China, which led to higher promotional activity in the country. This is something to keep monitoring.

The company pulled its full-year guidance but said its revenue expectations have moderated since the start of the year. It also now expects gross margins to decline on the year.

Overall, Nike experienced weakness across all of its regions, in both the direct and wholesale channels. Its classic franchises, which include Air Jordan 1, Air Force 1, and Dunk, were particularly weak, as they saw a 50% decline in the digital channel. Traffic declines at Nike Digital and partnered stores in Greater China were also cited as areas of weakness.

The company expects the Jordan brand along with its lifestyle brands to continue to see double-digit declines through the rest of this fiscal year. However, Nike did say it was seeing some strength in global football (soccer), fitness, and running.

Image source: Getty Images.

Can the stock rebound under its new CEO?

I think Nike missed an opportunity by not just significantly lowering guidance ahead of its new CEO Elliott Hill taking over. This is a classic play that typically helps a stock rebound when the company eventually leaps over the low bar with its new CEO at the helm. It may have created a bit more short-term pain, but it would have had longer-term benefits.

Hill will now be in charge of helping bring Nike back to its past glory. The new CEO was a longtime Nike employee, starting out as an intern in 1988 and working his way up to president of consumer and marketplace when he left in 2020, shortly after the company hired CEO John Donahoe.

Donahoe is believed to have focused too much on direct sales, hurting wholesale relationships while not being focused on innovation. At the same time, it appears he oversaturated the market with Nike's classic brands, which is why the company is pulling back on them so much now.

Hill will be in charge of remedying these mistakes. Nike is one of the world's most iconic brands, and he has a lot of experience with the company. A turnaround won't happen overnight, but Hill looks like the right person for the job given his various roles with Nike over a long period of time. Nike typically hires its CEO from within, and it was a clear mistake bringing in an outsider with no brand experience.

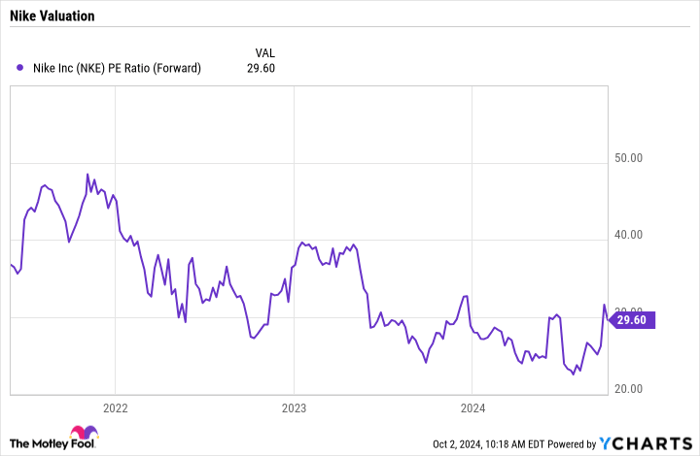

From a valuation perspective, the stock now trades at a forward price-to-earnings (P/E) ratio of just under 30, but that is largely due Nike's struggles and its earnings projections coming down.

NKE PE Ratio (Forward) data by YCharts

I think the stock looks like a rebound candidate under Hill's leadership, but it is going to take some time. Hill just can't flip a switch that will suddenly give the company a bunch of new innovative products. As such, I don't think investors need to rush in to buy the stock today, but I do think it will be a solid rebound candidate for next year.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nike. The Motley Fool has a disclosure policy.