3 Hot Tech Stocks Poised to Crush the Market in 2025

With multiple Wall Street indexes trading near all-time highs, the opportunities to find deals are getting harder. In some ways, it's a fun problem to have, but it's also a challenge for those pondering where to deploy fresh funds. Ultimately, the stock market is exactly what its name implies -- a market of stocks. Just because some of those stocks are more expensive doesn't necessarily mean there aren't still deals to be had.

After an exhaustive search, SentinelOne (NYSE: S), Netflix (NASDAQ: NFLX), and Sea Limited (NYSE: SE) jumped out to three Fool.com contributors as hot stocks with market-beating upside for next year.

SentinelOne is outperforming in 2024, and it may not stop

Justin Pope (SentinelOne): SentinelOne combines cybersecurity and artificial intelligence (AI), two of Wall Street's hottest themes. The company's autonomous security platform uses AI to provide cutting-edge protection against cyber threats, garnering high praise from third-party testing throughout the industry. The expensive consequences of breaches have companies seeking high-end solutions like SentinelOne's, resulting in some of the best revenue growth you'll find on the market.

Not only did SentinelOne grow revenue by 33% year over year in the second quarter of its fiscal year, which ended July 31, but the company is also making strides toward profitability, which has made investors bullish on the stock and helped it soar nearly 40% over the past year. However, there could be more big returns on the way.

SentinelOne recently announced a deal with Lenovo, the world's largest PC manufacturer, to include its security software on new PC shipments. Since striking a similar partnership with Dell Technologies last year, CrowdStrike has added over $50 million in revenue thus far. Achieving similar results would move the needle for SentinelOne, which analysts estimate will generate $815 million in revenue this year and approximately $1 billion next year. These estimates could rise once SentinelOne speaks to the Lenovo partnership in future earnings calls.

For all the good stuff happening at SentinelOne and its stellar investment returns, the stock can still outperform the broader market. SentinelOne's valuation became so suppressed over the past few years that it still trades at a lower enterprise value-to-sales ratio than high-tech peers, including CrowdStrike, Zscaler, and Palo Alto Networks. So no, it's not too late to buy SentinelOne despite its meteoric rise this year.

The SentinelOne party started in 2024, but I expect this momentum to continue next year.

Netflix may have already won the streaming wars

Jake Lerch (Netflix): Up over 45% year to date, there's no doubt Netflix is currently a hot stock. However, I think 2025 could be an even better year for the streaming giant. Here's why.

The streaming wars aren't over, but it's clear that Netflix is gaining the upper hand.

For example, According to data compiled by Nielsen during June, streaming video now accounts for about 40% of total TV usage, with cable (27%) and broadcast (20%) trailing far behind.

And when you drill down on the streaming component, it's clear who the big winners are. Alphabet's YouTube leads the way with 9.9% of streaming usage, while Netflix is second with 8.4%.

The next closest streamers are Amazon's Prime Video (3.1%), followed by Disney-owned Hulu (3%) and Disney+ (2%), and Tubi (2%). None of the other major streamers, including Paramount+, Comcast's Peacock, and Warner Bros. Discovery's Max, crack the 2% mark.

In short, Netflix has maintained its competitive edge in the streaming market. Not only that, but the overall streaming market continues to take share from traditional sources of viewership, such as cable and broadcast television.

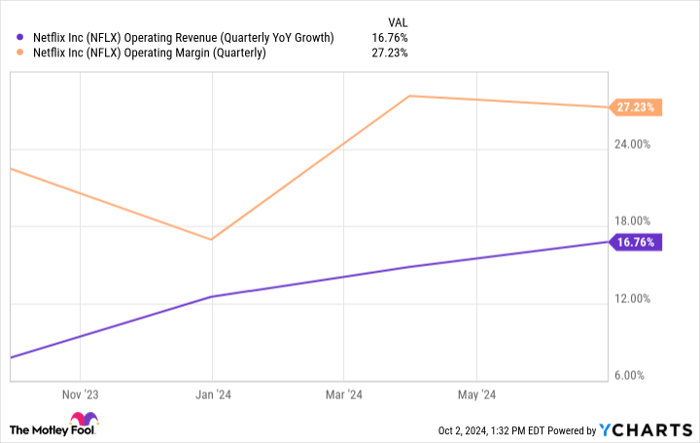

As a result, Netflix's fundamentals continue to shine. In its most recent quarter (the three months ending on June 30, 2024), Netflix reported year-over-year revenue growth of 17% and an operating margin of 27%. Both figures are up significantly from a year earlier.

NFLX Operating Revenue (Quarterly YoY Growth) data by YCharts

In summary, Netflix has not only survived a serious challenge to its business model, but it has also come through the streaming wars stronger than ever and is well-positioned to build on its past success. 2025 could prove to be an excellent year for Netflix as the company ramps up its ad-tier business. Investors would be wise to consider Netflix now, ahead of what could be a banner year.

The recovery is well underway in this pandemic stock

Will Healy (Sea Limited): After a brutal sell-off in the 2022 bear market, it might finally be time to pivot back to Sea Limited. The Singapore-based conglomerate prospered during the pandemic as its retail, gaming, and fintech segments served its locked-down customer base.

However, conditions turned negative as the lockdowns ended and economies reopened. Its formerly No. 1 smartphone game, Free Fire, lost some of its popularity after 2021, and it was banned in India over national security concerns. Moreover, instead of investing in logistics in its Southeast Asian markets, where it is the leading online retailer, its retail arm, Shopee, entered markets in Europe and Latin America, where it held no competitive advantage.

All of these factors led to the stock falling 91% between the fall of 2021 and the beginning of 2024.

Fortunately for Sea Limited shareholders, Shopee exited most of its non-Asian markets and has invested heavily in logistics infrastructure in its home region. Moreover, Free Fire experienced a resurgence in popularity, and Garena continues to work with the Indian government to bring Free Fire back to that country.

Additionally, fintech arm Sea Money has continued to prosper, and in the first half of 2024, it was a contributing factor in Sea Limited's revenue rising 23% year over year to over $7.5 billion.

However, a 73% increase in sales and marketing expenses sent net income plunging. The majority of that increased spending pertained to e-commerce investments, while it also spent heavily on its Sea Money operations. Still, these investments should lead to higher revenue and profits longer-term.

Investors seem to have taken to the company's new strategy, as the stock is up over 115% over the last year. Also, while the lower net income skewed the P/E ratio, its price-to-sales (P/S) ratio of 3.8 is not far above a much larger e-commerce conglomerate, Amazon, at 3.3 times sales. When considering that the stock is still 75% below its 2021 high, such a valuation should position Sea Limited for significant gains in 2025.

Should you invest $1,000 in Sea Limited right now?

Before you buy stock in Sea Limited, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sea Limited wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Jake Lerch has positions in Alphabet, Amazon, CrowdStrike, and Walt Disney. Justin Pope has positions in SentinelOne. Will Healy has positions in CrowdStrike, Sea Limited, and Zscaler. The Motley Fool has positions in and recommends Alphabet, Amazon, CrowdStrike, Netflix, Palo Alto Networks, Sea Limited, Walt Disney, Warner Bros. Discovery, and Zscaler. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.