Could Buying Sirius XM Stock Today Set You Up for Life?

Last month, Sirius XM (NASDAQ: SIRI) completed a series of complex spin-off and merger changes involving privately held Liberty Media. The result consolidates ownership under one ticker, allowing the new company to function independently. Additionally, Sirius XM conducted a 1-for-10 reverse stock split to lift a falling share price in hopes of shedding the stigma that comes when stocks spend years scraping along at low prices.

The stock price initially plunged in response to the changes, partially because reverse stock splits are a classic red flag, a hail mary for companies circling the drain. But unlike with most reverse-split cases, Sirius XM's core business is financially sound. It's a fresh start that will hopefully spark big things for a company that's grown stagnant in recent years.

Is this the beginning of a bright future for Sirius XM and its shareholders? Or will this end badly?Here is what you need to know.

Can Sirius reignite growth?

Sirius XM is best known for satellite radio, which it has dominated since Sirius merged with XM in 2008. The company's primary sales channel is automotive; many new vehicles come equipped with a free trial in the hopes that you'll become a paying subscriber. Sirius XM has evolved in the pursuit of growth. In 2019, it acquired the internet streaming service Pandora to expand its reach outside satellite radio. The company also launched a free ad-supported service to generate advertising revenue.

Paid subscriptions are still Sirius XM's primary source of revenue. The company generated $6.3 billion from its 33 million paid subscribers last year, compared to $1.8 billion from ads directed at the other 117 million "free" listeners. Sirius XM's biggest problem is that its paid subscriptions have plateaued. The company had approximately 32.7 million paid subscribers at the end of 2017, so that number has risen only about 300,000 over the past six-plus years.

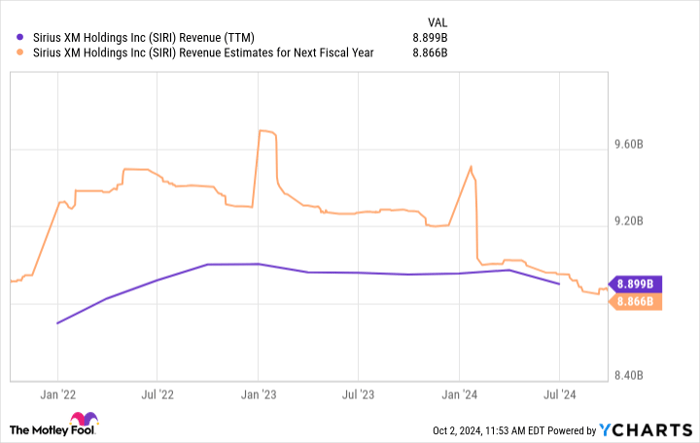

That stagnation is weighing down growth. Revenue has declined since mid-2022, and analysts expect more deterioration next year:

SIRI Revenue (TTM) data by YCharts

One challenge is that Sirius XM has trouble attracting younger generations to satellite radio, a somewhat dated technology. Today, vehicles come equipped with software to integrate smartphones into the entertainment system, and companies like Apple and Spotify offer easy and cheap access to quality audio content.

It's a challenge Sirius XM must solve to deliver the growth needed to make the stock a winner.

Potential double-digit returns at a bargain price.

Despite its growth hurdles, Sirius XM is a very profitable company. Its 60% gross margins are some of the best in the media industry, and Sirius XM holds onto paid subscribers well. Its 1.5% churn rate is well below Spotify's 3.9%. As a result, Sirius XM generates a fair amount of free cash flow that management can use to create value for shareholders.

The company pays a nice dividend that yields 4.7% at the current stock price. That will cost Sirius XM just $409 million of its $1.1 billion in anticipated cash flow this year, leaving plenty of room to pay down its debt. Additionally, analysts estimate Sirius XM will grow earnings by an average of 10% annually over the next three to five years. The company is expanding its pricing plans to give users more options that will hopefully drive subscriber growth.

If everything goes according to plan, the stock can hold its current valuation and potentially achieve 14% to 15% annualized returns. The stock's dubious track record has made the market somewhat skeptical. Today, Sirius XM trades at just 7 times its estimated 2024 earnings. That's very cheap for a company with anticipated double-digit earnings growth.

Can Sirius XM set you up for life?

Sirius XM is an established company occupying a niche in the competitive audio media industry. I don't see much room or opportunity for the company to reinvent itself, which means the stock's upside will boil down to how management runs the existing business and uses its cash flow to create value for investors.

The stock's low valuation gives investors a margin of safety and could boost returns if Sirius XM surprises Wall Street and earns a higher valuation. But life-changing investment returns require consistent long-term growth, and Sirius XM doesn't have a clear path here. Management has a target of 50 million long-term subscribers, but setting a goal isn't the same as achieving it.

Sirius XM looks like a solid trade, a buy for its attractive valuation and generous dividend, but right now, it's hard to go beyond that.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Spotify Technology. The Motley Fool has a disclosure policy.