Should Investors Pull Dollar Tree Stock Out of the Bargain Bin?

The last nine years have not been good for Dollar Tree (NASDAQ: DLTR). The ultra-discounter made an apparent misstep in its acquisition of Family Dollar. Nine years after closing this purchase, it has failed to turn around the retailer, and it has never fully incorporated into Dollar Tree.

Moreover, the stock has suffered in recent years as inflation has hammered the lower-income consumers it typically serves. The question for investors is whether the retail stock has fallen so much that it is now a buy. Let's take a closer look.

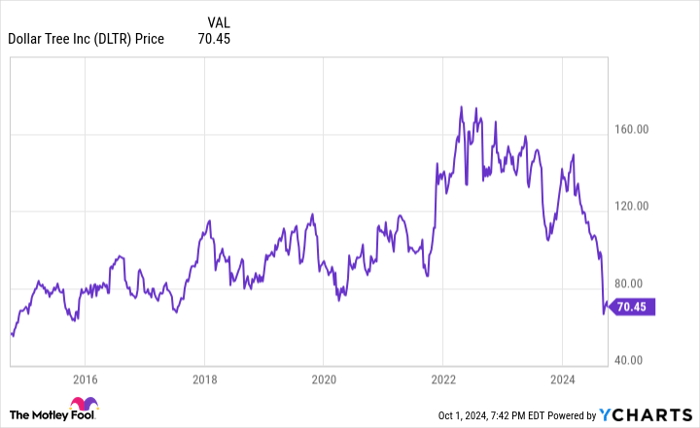

DLTR data by YCharts

The state of Dollar Tree

Dollar Tree is an ultra-discounter that operates more than 16,000 locations across 48 U.S. states and five Canadian provinces. It sells most items for $1.25 after abandoning its longtime $1 price point amid inflationary pressure. Additionally, it has begun to offer products in the $1.50 to $7 price range, hoping this category rises to 15% of its sales in the coming years.

On the surface, this looks like a recession-resistant business. It offers low prices that consumers might seek during a recession and opportunities for bargain hunters under all economic conditions.

Inflationary effects

However, in addition to the failure of the Family Dollar merger, it was hit by the one phenomenon it could not battle so easily: inflation, specifically, the high inflation from earlier in the decade. Since lower-income customers have increasingly faced credit card delinquencies, they have had less money to spend in stores like Dollar Tree.

Consequently, same-store sales rose in the second quarter (ended Aug. 3) by only 0.7% across the enterprise, rising 1.3% at Dollar Tree and falling 0.1% at Family Dollar. Also, its sales activity led to $15 billion in revenue for the first half of 2024, a yearly increase of just over 2%.

Despite that increase, net income fell 13% to $433 million. The company blamed rising depreciation expenses, "unfavorable" news on liability claims, the cost of rolling out its new pricing plan, and other factors. Amid these challenges, Dollar Tree stock lost around half its value since the beginning of the year.

Has the investment case changed?

Such a drop may have created a new investment case for Dollar Tree stock. Because of the stock price decline, the forward P/E ratio for the stock has fallen to 13.

Also, that low multiple occurs as conditions are set to improve. The high inflation that once topped 9% has fallen below 3%. Additionally, with the recent Federal Reserve rate cut, consumers may have more money to spend. Since Dollar Tree tends to increase sales in most economic environments, such conditions should improve its financial performance.

Furthermore, Dollar Tree announced in its Q2 report that it has explored "strategic alternatives" for the Family Dollar segment of the business, including a spinoff or sale of the company. Since this segment has long been a drag on this business, unloading Family Dollar could be bullish for Dollar Tree in the long run.

Consider Dollar Tree stock

Given the current state of Dollar Tree's business, it could pay for investors to take a chance on the stock at current levels.

Admittedly, its core consumers have struggled due to the higher inflation of the recent past. Also, its stock has experienced no net growth in the last 10 years, likely due to the failed attempt to merge Family Dollar into its business.

Fortunately for its shareholders, Dollar Tree appears ready to rid itself of Family Dollar. Moreover, these troubles have made it an inexpensive stock. Although its challenges are real, a forward P/E ratio of 13 is likely an overreaction to those troubles.

Hence, as inflation and interest rates fall, a leaner, more focused Dollar Tree could return to growth as all of its focus returns to its core Dollar Tree business.

Should you invest $1,000 in Dollar Tree right now?

Before you buy stock in Dollar Tree, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dollar Tree wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.