Stock-Split Watch: Is ASML Holding Next?

Dutch company ASML Holding (NASDAQ: ASML) is a big player in the semiconductor industry. Its proprietary lithography machines produce cutting-edge chips, including those powering the latest artificial intelligence (AI) technology. The company's stock has thrived on Wall Street's AI enthusiasm, making it a potential stock-split candidate now that it trades at more than $800 per share.

The company has split its stock multiple times before, but it's been more than two decades since its last traditional split, so it would make a lot of sense. Yet, something seems off at ASML, and the stock, despite trading at a high share price, has fallen 25% from its high.

Should investors anticipate a stock split from ASML anytime soon?

ASML is no stranger to stock splits

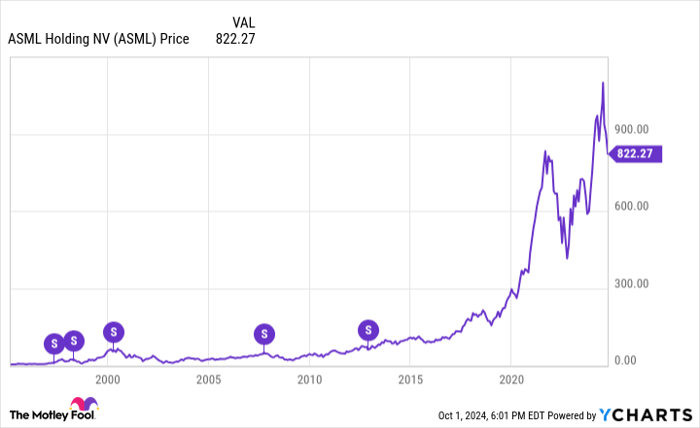

Naturally, if something has happened once or more before, it's plausible that it could happen again. ASML has split its stock four times, the last occurring in April 2000, not including a reverse stock split in 2007:

ASML data by YCharts

Stock splits are a way companies lower their share price by proportionately increasing the number of shares. The lower price helps investors accumulate more shares, and the additional liquidity from increasing the number of shares affords employees more control over how they cash out their stock-based compensation. Plus, it gets the company some easy publicity.

Most importantly, stock splits don't fundamentally change anything about the company or its stock. When you slice a pizza into more slices, there is neither more nor less pizza than before. Each slice represents a smaller portion of the pie. Stock splits never change a stock's valuation.

If not then, why now?

Sometimes, it's more about sending a message than the numbers. Stock splits can entice buyers with lower share prices, but it sends a positive message when a company splits its stock at an all-time high. Sort of like: Hey, things are going well, and we want more investors to get in on the good things happening here. It's harder to send that message if ASML splits its stock while it's down notably from its highs.

ASML's current high is over $1,100 per share. Why would management split the stock now if it didn't then? If anything, I would argue that splitting its stock after a 25% decline sends a message begging people to buy the stock rather than attracting investors to a good thing.

It can all seem silly, especially if you're a long-term investor who focuses on the businesses behind the stocks. However, there is a reason the business channel on TV scrolls stock prices along the bottom of the screen or shows price charts when discussing a company. Right or wrong, share prices often dictate the narrative around companies, so companies weigh all of this when considering a stock split.

Why is ASML down 25%?

The Nasdaq Composite, the benchmark U.S. index for technology stocks, which ASML is part of, is within a few percentage points of its all-time high. So, why might ASML be down so much in the first place?

Tensions between the United States and China have intensified over AI chips. ASML's extreme ultraviolet (EUV) lithography machines are essential in producing the high-end chips needed for AI. The United States wants ASML to restrict exports to China and cut off service on systems the company has previously sold into the country. The United States has cited national security reasons. In response, China has threatened the Netherlands and ASML with economic retaliation if the company implements restrictions. Roughly half of ASML's sales through the first half of this year came from China, so this is a potentially big deal.

Whether this will boil over and impact ASML remains to be seen. ASML is the company building EUV machines, so China would need a workaround if it opted not to use ASML's equipment. Additionally, it seems unlikely that the Netherlands would allow its largest technology company to suffer over politics. Still, it's something to monitor, and it makes sense that the stock, which peaked at an expensive price-to-earnings ratio of almost 60, would cool off in the face of this.

Is this dip a buying opportunity? It could be given ASML's dominance in the technology that makes AI possible, though a stock split shouldn't be much of a factor in that decision. If you were rooting for a stock split, you could be waiting a while longer.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML. The Motley Fool has a disclosure policy.