1 Growth Stock Down 26% to Buy Right Now

It's been a tough past few weeks for Dutch Bros (NYSE: BROS) investors. Shares of the up-and-coming chain of coffee kiosks are down 26% from their late-June peak, unwinding what looked like a budding rebound effort.

Concerns about lingering economic weakness are the broad culprit. With spending money getting tight, the market is afraid that premium beverages are vulnerable. And it's not an unreasonable worry.

Investors are missing something about Dutch Bros, though, that makes this pullback a buying opportunity: Consumers aren't giving up everything, including their favorite Dutch Bros drinks.

Dutch Bros is different

Dutch Bros is a chain of coffee drive-thrus. As of the end of June, there were 912 locales, with a goal of 4,000 at some point within the next few years.

It competes with Starbucks (NASDAQ: SBUX) by being everything the dominant chain isn't. Whereas the industry's biggest name is known for its uniformity and formality, Dutch Bros is intentionally casual and personal. It's not unusual for its stores to support a local neighborhood cause, or for its baristas to carry on genuine conversations with customers.

And this makes a difference. Whereas retailing and other service-focused businesses in the 1990s and early 2000s were formal and polished, consumers now expect authenticity and personality. This is particularly true following the pandemic, which underscored how much we all crave at least some degree of real human connection. Dutch Bros delivers it.

That's what its results suggest anyway. Second-quarter sales were up 4.1% year over year, extending a well-established (even if somewhat erratic) trend. For comparison, Starbucks' same-store sales for the same quarter slumped 2% within the United States and fell 3% on a worldwide basis.

Nevertheless, if consumers are suffering the sort of fiscal hardship they're reportedly suffering right now, Dutch Bros could still be running into a growth headwind. That's the fear that surfaced following the release of its second-quarter report anyway, which included lackluster guidance on sales growth. The stock has struggled ever since.

But the sellers are missing something about this business and the current economy.

More bark than bite

Consumers are thinking more cautiously now than they have in a while. The Conference Board, a nonprofit organization that charts economic data, says its measure of consumer confidence fell the most it had in three years just last month, moving within sight of its actual multiyear low, reached earlier this year.

People are increasingly worried about the toll inflation is taking, which could eventually undermine the jobs market. Domestic shoppers are also up to their neck in high-interest debt. The Federal Reserve reports U.S. households' total credit card debt reached a record-breaking $1.14 trillion in the second quarter.

In other words, it looks tough out there, money-wise.

Largely left out of the equation, though, is that these underlying conditions are cyclical. The economy will eventually wiggle its way out of this hardship because that's what the economy does. It just takes time. And the time to invest in cyclically sensitive stocks is when they're down for these temporary reasons.

That being said, discretionary spending might not even be crimped nearly as much as feared right now. The U.S. Bureau of Economic Analysis reports personal spending improved 2.7% last month (when excluding food and energy costs), in line with year-over-year growth for the past several months. Wages are keeping up with this increased spending as well, while inflation itself continues to be curbed. These numbers also extend existing trends.

Then there's the fact that while Dutch Bros' current growth isn't red hot, it's certainly not bad in an environment where other similarly discretionary companies are struggling. Besides Starbucks' same-store sales slump, Home Depot and Macy's also reported lower same-store sales for the second quarter of the year.

Perhaps Dutch Bros' premium drinks are the satisfying splurge people are still willing to pay for.

Dutch Bros stock is a compelling buy no matter how you slice it

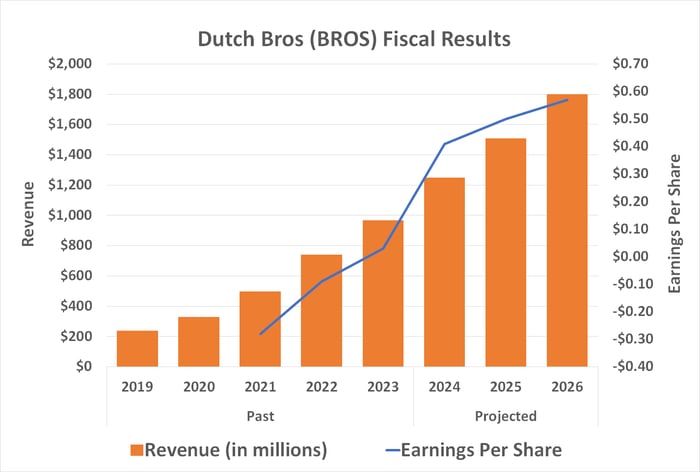

That's the bullish case in the wake of the stock's recent worry-driven 26% setback, anyway, not that it matters too much if you're a true long-term investor. Dutch Bros would still be a compelling buy 26% above June's peak. It's an increasingly profitable company successfully executing on an idea that resonates with modern consumers. If nothing else, the company's recent results say that much.

Data source: StockAnalysis.com. Chart by author.

This should drive the point home: Despite being surrounded by plenty of worry, most of the analysts following this stock consider it a strong buy. Their consensus target of $40.64 is also 28% above Dutch Bros stock's present price. That certainly isn't a bad tailwind for any new position.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $765,523!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Home Depot and Starbucks. The Motley Fool recommends Dutch Bros. The Motley Fool has a disclosure policy.