2 Dividend Growth ETFs That You Can Count on for Recurring Income for Decades

Dividend stocks can be extremely valuable long-term investments. Not only can their values increase over time, but you'll collect a consistent stream of income from them as well, so you don't have to sell your investment to generate a regular cash flow.

Rather than picking individual dividend stocks, you can just invest in an exchange-traded fund (ETF) that holds hundreds of them. Two ETFs holding dividend stocks that have grown their payouts over the years and that could be great options for long-term investors are the WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ: DGRW) and the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG).

Here's why these can be great ETFs to buy and hold, especially if you love dividends.

WisdomTree U.S. Quality Dividend Growth Fund

The WisdomTree fund invests in large-cap U.S. stocks that grow their payouts regularly. With 301 stocks in the fund, the ETF provides some excellent diversification while charging a fairly light expense ratio of 0.28%. The fund has a dividend yield of 1.5%, which is higher than the S&P 500 average of 1.3%.

The top holdings in the ETF include Microsoft, Johnson & Johnson, and Home Depot. These are big names that pay varying dividends, but all are reliable dividend stocks that have raised their annual payouts for years. WisdomTree's top 10 holdings represent just under 37% of the fund's overall weight.

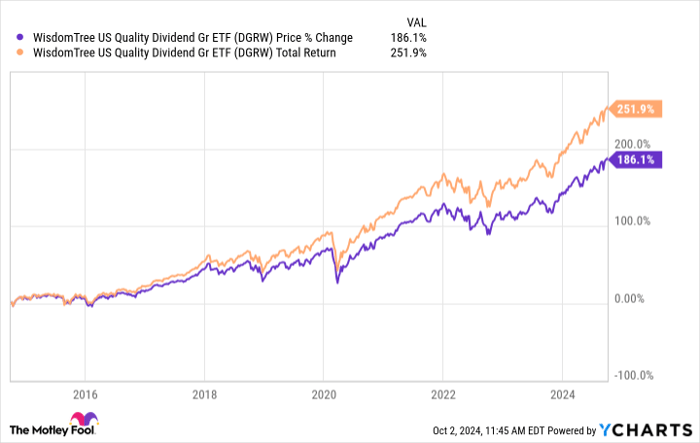

Data by YCharts

Over the past 10 years, the fund has increased in value by 186%. Including its dividend, the total return rises to around 252%. That means a $30,000 investment during that stretch would have ballooned to more than $105,560.

With fairly low risk and excellent diversification, the WisdomTree fund is a solid option for income investors to buy and hold for the long term.

Vanguard Dividend Appreciation ETF

A similar income-focused fund is the Vanguard Dividend Appreciation ETF. It tracks the S&P U.S. Dividend Growers index and has a minuscule expense ratio of 0.06%. With 337 stocks in the portfolio, it has a few more than the WisdomTree fund. It also has a slightly higher yield at 1.7%.

It contains many of the same stocks as the other fund. One key difference, however, is that it's less skewed toward tech stocks, with that sector accounting for 23% of its holdings versus 30% in the WisdomTree fund. But you'll still find Microsoft, Apple, and Broadcom among the Vanguard fund's top five holdings. The top 10 stocks in this fund make up just over 30% of its overall holdings.

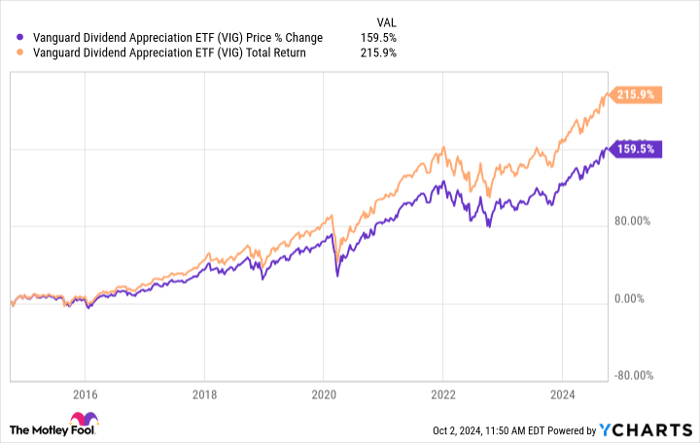

Data by YCharts.

In the past decade, this Vanguard fund has risen by nearly 160%, with its total returns coming in at around 216%. Its returns have been more modest than the WisdomTree fund's, likely a result of its lower exposure to tech stocks, which have been performing fairly well over the past decade.

But for investors who crave a bit more safety and diversification, the fund could be a better alternative -- as long as you're aware that you may earn a more modest return in exchange for that added safety. But both funds are excellent investment options if your priority is to generate recurring income over the long haul.

Should you invest $1,000 in WisdomTree U.S. Quality Dividend Growth Fund right now?

Before you buy stock in WisdomTree U.S. Quality Dividend Growth Fund, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and WisdomTree U.S. Quality Dividend Growth Fund wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Home Depot, Microsoft, and Vanguard Dividend Appreciation ETF. The Motley Fool recommends Broadcom and Johnson & Johnson and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.