2 Overlooked and Unloved Dividend Stocks to Buy and Hold Forever

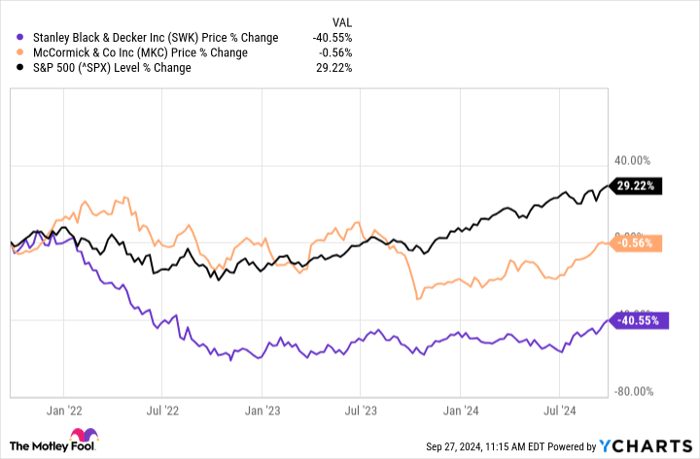

For income investors, sometimes the best combination is finding stocks that are oversold and that also offer dividends. Not only are dividends a fantastic way to grow wealth long-term, the reliable income can aid investors while they wait for the stock to rebound. Here are two stocks that have largely trailed the S&P 500 over the past three years, but that offer long-term stable businesses and respectable dividend yields.

SWK data by YCharts.

Spice up your portfolio

McCormick (NYSE: MKC) is a global leader in flavor, spices, and seasoning, in two segments that generate over $6.5 billion in annual sales across 150 countries and territories. It has a long list of name brands that boast leading share positions in many markets.

Just this week, McCormick declared a quarterly dividend of $0.42 per share, marking the 100th year of consecutive dividend payments by the spice company. The dividend yield currently sits at a respectable 2%.

One of the growth drivers in the business comes from management's Comprehensive Continuous Improvement (CCI) savings program, which helped drive a 60-basis-point improvement in gross margins during the second quarter, compared to the prior year. Management expects the trend to continue with higher gross margins during the second half of 2024, compared to the first half.

Management is also focusing innovation on specific higher-growth product opportunities, which should help reverse slowing sales volume overall. It's also true that McCormick's divestment of a small canning business is currently weighing on sales results.

As management focuses on higher growth opportunities while improving gross margins with its CCI program, the company has proven it will continue to return value to shareholders while they wait for the stock price to gain traction in the future.

Household name

While investors might not recognize or follow Stanley Black & Decker (NYSE: SWK) stock, chances are it's still a household name for you. The company is a global leader in tools and outdoor products, and operates manufacturing facilities globally. Stanley Black & Decker owns an impressive list of other brands that include DeWalt and Craftsman, among others.

Stanley Black & Decker finds itself in a similar position to McCormick as it works diligently to reduce its cost structure and expand margins. The good news is that it's seen significant progress, with Q2 gross margins jumping 28.4%, or up 600 basis points compared to the prior year.

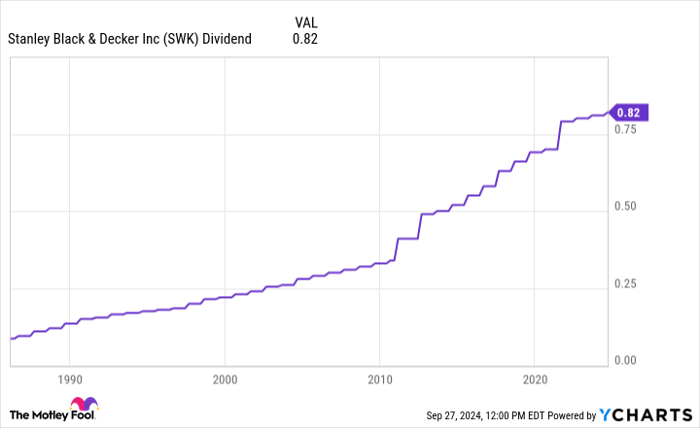

As Stanley Black & Decker uses these cost-cutting savings to further growth in its powerful brands, it's also reducing debt. The company's cost cutting and strong cash generation during Q2 supported $1.2 billion in debt reduction. Investors shouldn't forget its respectable dividend yield of 3%.

As the company continues to cut costs and reinvest in high-opportunity products and brands, it remains a solid long-term hold for income investors. Just look at how consistently Stanley Black & Decker has dished out dividends over time.

SWK Dividend data by YCharts.

Buy now

Both of these companies have trailed the broader S&P 500 for the past three years, but they are working diligently to improve operating efficiencies and cut costs. Both companies own a list of stellar brands that can and will power growth again with innovation and reinvestment. It will take time for their stocks to regain traction in the market, but they're positioned to rebound in the years ahead -- and offer respectable dividend yields while investors wait.

Should you invest $1,000 in Stanley Black & Decker right now?

Before you buy stock in Stanley Black & Decker, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Stanley Black & Decker wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $728,325!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Daniel Miller has no position in any of the stocks mentioned. The Motley Fool recommends McCormick. The Motley Fool has a disclosure policy.