Buy Everything With the Vanguard Total Stock Market ETF or Just 500 Stocks?

When it comes to investing, there are people who like to get into the weeds and select their own stocks. And there are people who prefer to focus more on the big picture, using broad-based index exchange-traded funds (ETFs) as their main investment vehicles.

But with the explosion of ETF offerings, it is getting more complicated to select the best options. Here's a quick look at the decision between the broadest possible equity ETF, the Vanguard Total Stock Market ETF (NYSEMKT: VTI), and something just a little more selective, the Vanguard S&P 500 ETF (NYSEMKT: VOO).

What does the Vanguard Total Stock Market ETF do?

The Vanguard Total Stock Market ETF isn't difficult to understand. It basically buys every stock that can be bought within the U.S. stock markets. The portfolio is market-cap weighted, so the largest companies have the greatest impact on the ETF's performance. Currently the ETF holds a whopping 3,650 or so stocks! And all you need to do is buy one ETF to get exposure to all of them. The expense ratio, meanwhile, is a minuscule 0.03%, which is very close to free on Wall Street.

There is one very material benefit to consider here: You literally own the market. Thus, you won't underperform the market. And if you pair this ETF with a broad-based bond ETF, you have a very low-maintenance, balanced portfolio. If simple is what you are looking for, the Vanguard Total Stock Market ETF will be a perfect fit for you.

That said, there is a notable negative in that there's absolutely no quality checks on the stocks this ETF buys. You get the market, but you get the good companies and the bad ones. You get the large ones with the small ones. You get the growing companies and the dying companies. The dichotomies could continue, but you probably get the idea at this point -- when you buy everything, there's no discernment going on.

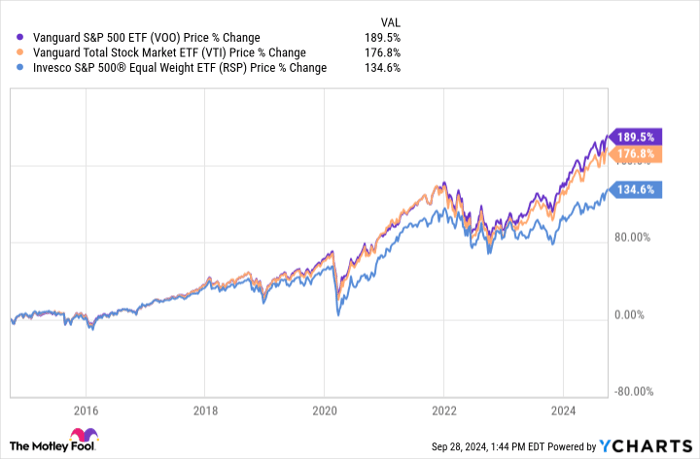

VOO data by YCharts

What does the Vanguard S&P 500 ETF do?

Some investors might find the lack of discrimination between companies undesirable. There's a solution to that, if you still want to own a broadly diversified ETF. You can buy the Vanguard S&P 500 ETF, which tracks the S&P 500 index. The stocks in this index are hand-selected by a committee based on how well they represent the broader U.S. economy.

Thus, the companies in the S&P 500 tend to be larger and more important entities. As the name implies, there are about 500 companies that make the cut that are then market-cap weighted. This ETF also has an ultra-low 0.03% expense ratio.

Which ETF is better for your portfolio?

In truth, both of these ETFs perform fairly similarly over time. However, as the most recent performance shows, there are times when one may outdistance the other. This highlights something important that you have to consider. With more stocks in the Vanguard Total Stock Market, the ETF's winning positions will inherently face more dilution from the laggards it will inevitably hold in its portfolio. There's no way around that.

The Vanguard S&P 500 ETF, however, may at times benefit from the more restrictive approach that will, hopefully, weed out the worst companies over time. That allows the big winners to have a greater impact on overall performance.

That may sound like a great selling point, but there's a downside here, too. This is because the performance of the S&P 500 index can be driven by a small list of very large companies when Wall Street is in bull market mode. That's true of the Vanguard Total Stock Market ETF, too, but the added diversification should blunt the impact to some degree.

VOO data by YCharts

Right now happens to be an interesting time, because Wall Street's recent advances have been largely driven by, you guessed it, a small number of very large companies. To see that, you only need to look at the Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP), which owns the S&P 500 stocks but, as the name suggests, the ETF uses an equal-weighting approach. Thus, all of the stocks have an equal impact on overall performance.

Given the laggard performance of the Invesco S&P 500 Equal Weight ETF, it hints that there's a huge divide going on between the winners and laggards in the S&P 500 and it is the biggest stocks that are leading the way. The risk here is that when a bear market eventually hits, today's big winners are likely to turn into tomorrow's big losers, as investors run for the exits to lock in gains. That same dynamic will impact the market-cap weighted Vanguard Total Stock Market ETF too, but because of the 3,100 extra stocks in the index, the downside is likely to be less painful.

Take the time to dig into the details

Sadly, there's no right or wrong answer here. The best choice really depends on your investment beliefs and risk tolerance. But it is important to know that the Vanguard Total Stock Market ETF and the Vanguard S&P 500 ETF are similar, but different. Just because the S&P 500 tracker is doing a little better right now doesn't make it the better choice for you.

What really matters is the logic behind the ETF's structure and whether or not that approach fits well with the way you approach investing. At the end of the day, you may even prefer to go with the Invesco S&P 500 Equal Weight ETF.

Should you invest $1,000 in Vanguard Total Stock Market ETF right now?

Before you buy stock in Vanguard Total Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Total Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF and Vanguard Total Stock Market ETF. The Motley Fool has a disclosure policy.