Better AI Chipmaker Stock: Broadcom vs. Qualcomm

Over the past year, there's been explosive demand for the components needed to build the hardware foundations for artificial intelligence (AI) systems. This resulted in outsized sales for semiconductor chipmakers such as Broadcom (NASDAQ: AVGO) and Qualcomm (NASDAQ: QCOM).

Consequently, shares of Broadcom have climbed by 114% over the last 12 months while shares of Qualcomm gained 55%. Both companies could see years of further revenue growth as the technology sector transitions into the AI era, which is reshaping the traditional computing paradigm.

But between this pair of tech heavyweights, is one a better choice to invest in the burgeoning AI market? That's not an easy question to answer, since both Broadcom and Qualcomm possess compelling strengths.

Broadcom's AI success

Broadcom boasts an extensive array of semiconductor and software solutions for IT infrastructure, including cloud computing and cybersecurity. Its products are used across many industries, from data centers to mobile devices and automobiles.

These markets now need semiconductor components for AI that deliver high performance with low energy consumption. Broadcom's offerings are up to the challenge, which is why sales of its networking products increased 43% year over year in its fiscal third quarter, which ended Aug. 4. Networking sales accounted for 55% of its $7.3 billion in semiconductor division revenue in Q3.

AI-related solutions are expected to contribute $12 billion of Broadcom's projected $51.5 billion in sales for fiscal 2024, which ends Nov. 3. Moreover, the company expects strong sales driven by AI demand to continue into its fiscal 2025.

Broadcom management believes the rising use of AI could lead to a massive industrywide upgrade of IT infrastructure. The expanding sophistication of AI systems requires progressively better tech, including greater data storage, and faster, more resilient computer networks.

Such a transformation could lead to a period of sustained growth for semiconductor providers such as Broadcom. To help it meet the needs of businesses in this new era of AI, Broadcom acquired software company VMware last November.

Management anticipates VMware's software will help businesses run AI systems in the cloud. And the addition of VMware has boosted Broadcom's top line significantly. In Q3, its revenue reached $13.1 billion, a 47% increase over the $8.9 billion in sales it booked in the prior-year period.

The case for Qualcomm

Qualcomm is a leading provider of semiconductor components for smartphones and other mobile devices. However, its long-term strategy is, in the words of CEO Cristiano Amon, a "transformation from a communications company to a leading intelligent computing company." By intelligent computing, he's referring to AI.

It's moving quickly to fulfill that vision. In October, Qualcomm will reveal its Snapdragon 8 mobile platform, which boasts new AI capabilities. Management sees AI features becoming pervasive on smartphones, and that could boost the handset titan's sales for years.

Qualcomm is also working to extend beyond the mobile market, providing products for driver assistance and self-driving systems to the automotive sector, and integrated circuits for the Internet of Things industry.

Perhaps these expansion desires help justify the reports circulated that Qualcomm is considering a bid for chipmaker Intel, which would create a semiconductor colossus. However, this deal may not happen, particularly given the regulatory hurdles it would have to overcome, so no one should make a decision about investing in Qualcomm based on the anticipation of an Intel acquisition.

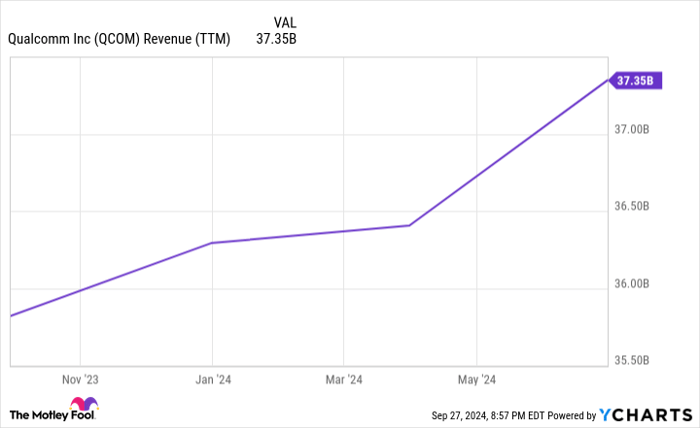

What matters most right now is Qualcomm's current performance, and it is doing well. In the company's fiscal Q3, which ended June 23, revenue rose 11% year over year to $9.4 billion, continuing its trend of rising revenues.

Data by YCharts.

Management expects this trend to continue in its fiscal Q4, forecasting sales of at least $9.5 billion, a double-digit percentage increase over the prior-year period's $8.6 billion.

Choosing between Broadcom and Qualcomm

With players across the IT industry upgrading their technology to support the processing power demands of increasingly complex AI systems, owning stock in both Broadcom and Qualcomm would be a smart bet.

Broadcom's comprehensive suite of hardware and software products makes it an attractive long-term investment. The same can be said of Qualcomm, given the pervasive role mobile devices play in society.

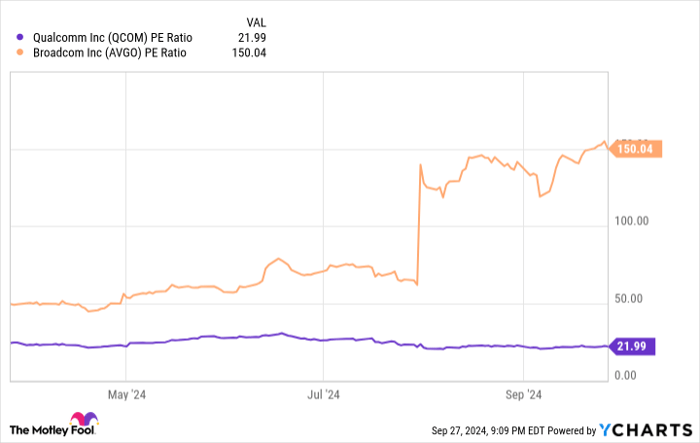

But between these two semiconductor giants, at this time, a few factors make Qualcomm shares the better investment choice. One is the difference between their stock valuations using the price-to-earnings (P/E) ratio, which compares the share price to net income. This helps to assess the relative value of a stock by seeing how much investors are willing to pay for every dollar of earnings.

Data by YCharts.

Based on Broadcom's elevated P/E ratio compared to Qualcomm, the latter looks like a much better value at this time. Further, while Qualcomm closed Monday trading at around $170, among the Wall Street analysts covering the stock, the median share price target was $212.50. Contrast this with Wall Street's median share price target of $195 for Broadcom, which closed Monday at $172.50. This suggests a belief that Qualcomm shares possess more upside than Broadcom.

In addition, while companies have solid records of boosting their dividend payments, Qualcomm's dividend yield of 2% is superior to Broadcom's 1.2%. Given these factors, Qualcomm edges out Broadcom as the better AI chipmaker to invest in right now.

Should you invest $1,000 in Broadcom right now?

Before you buy stock in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Broadcom wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Robert Izquierdo has positions in Intel. The Motley Fool has positions in and recommends Qualcomm. The Motley Fool recommends Broadcom and Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.