Why Trump Media & Technology Stock Lost 18% in September

Shares of Trump Media & Technology (NASDAQ: DJT) were among the losers last month. Investors sold shares of the parent of Truth Social in anticipation of the expiration of the lockup period. This was expected to prompt insiders to sell the stock following what was generally seen as a weak debate performance by Donald Trump.

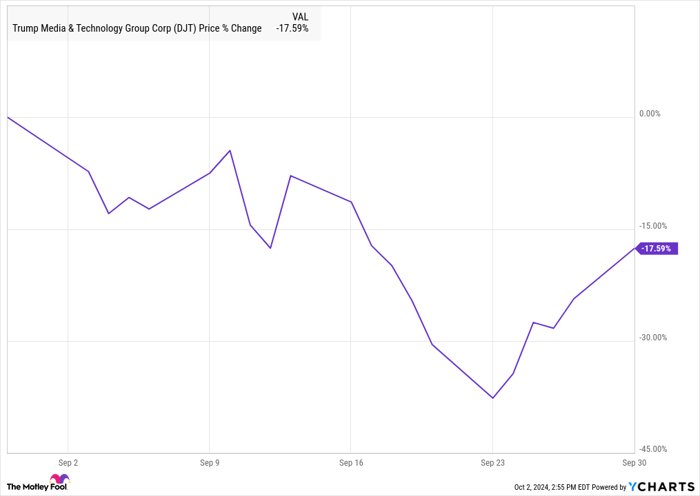

According to data from S&P Global Market Intelligence, the stock finished September down 18%. As you can see from the chart below, the stock was down even further before recovering in the last week of the month.

DJT data by YCharts.

Trump Media continues to slide

Shares of Trump Media have continued to fall since it went public through a special-purpose acquisition company (SPAC) merger back in March.

The stock has historically moved in line with Donald Trump's political prospects as the business is negligible at this point with less than $1 million in quarterly revenue and wide losses.

One of Trump Media's worst days of the month came on Sept. 11, the day following the presidential debate. Shares of Trump Media fell 10.5% on high volume as most pundits believed Vice President Kamala Harris won the debate.

However, shares of the Trump-namesake company soared that Friday after Trump said he wouldn't sell any of his shares even after the lockup period expired. The stock gained 11.8% on the news, again on high-volume trading.

The following week, however, the stock fell in each session in anticipation of the lockup period expiring. Newly public companies often decline after the end of the lockup because insiders dump their shares, eager to take profits.

After falling for six straight sessions, Trump Media stock gained over four of the last five sessions, closing out the month on an upswing.

Image source: Getty Images.

What's next for Trump Media stock

The presidential election is on track to be one of the closest in history; presumably, a Trump victory would send the stock soaring.

However, there's no guarantee the business will be successful. The company has made big promises, including the launch of a streaming service, but thus far, Truth Social has struggled to gain a critical mass of members, and Trump's own return to X (formerly, Twitter) shows that his copycat app hasn't been the draw that some of his followers might have hoped.

Expect the stock to continue to move with Trump's political fortunes, but given the state of this business, this stock is best avoided, at least until it can demonstrate a path to profitability.

Should you invest $1,000 in Trump Media & Technology Group right now?

Before you buy stock in Trump Media & Technology Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Trump Media & Technology Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.