The Best Rate-Cut Stock to Invest $1,000 in Right Now

The Federal Reserve recently announced a 50-basis-point reduction to the U.S. economy's benchmark interest rate to kick off what should be an easing cycle in which interest rates throughout the economy decline. The Fed had ratcheted up rates in 2022 to combat rampant inflation.

Rate changes affect consumers, businesses, and almost every other part of the economy. Companies that borrow or lend money are especially sensitive, so the rate cut is a big deal for a digital bank like SoFi Technologies (NASDAQ: SOFI). The stock has disappointed investors for the past few years, but SoFi could be a big winner in this new, lower-rate economy.

Here is why investing $1,000 in the fintech's stock today could generate significant returns.

First, how do banks make money?

SoFi is a digital bank that offers financial services and loans to consumers. It doesn't operate brick-and-mortar branches; customers can use SoFi's website or smartphone app to do their banking instead. However, as with all banks, interest rates directly affect the business.

At its core, banking is a two-sided business:

- Banks pay interest on the money people deposit. It's how they attract customers.

- Banks take your money and lend it out. That's how they make money.

A bank wants to earn more on loans than it pays on its deposits. The difference is called a bank's net interest income. That money then covers the bank's overhead and operating expenses to become its bottom-line profit. Banks can generate revenue with services and fees, but net interest income is the crux of banking.

Why SoFi benefits from lower rates

Technically, higher rates can make bank loans more profitable. Approximately 82% of SoFi's lending revenue was net interest income in the second quarter, a record high.

However, that's not all it's cracked up to be. Remember: The whole point of rate hikes is to slow the economy, and debt is the oxygen that fuels it. Higher interest rates make debt more expensive, so fewer people take out loans.

Lower rates facilitate more borrowing. While SoFi's net interest income on loans might decrease as rates fall, the origination revenue from increased lending activity should more than offset that.

CEO Anthony Noto emphasized in the second-quarter earnings call that a lower benchmark rate will aid his business, primarily by boosting volumes in home lending, purchase loans, home equity loans, and its existing financing business.

SoFi had its start in student loans and is a big player in refinancing. Higher rates suppressed that part of its business -- it originated $4.3 billion in student loans in 2021 but just $2.6 billion last year. That should bounce back in a big way as rates drop.

More loans and more customers should drive SoFi higher

SoFi has increased its customer base so well over the past few years that the company has still managed excellent growth despite high rates:

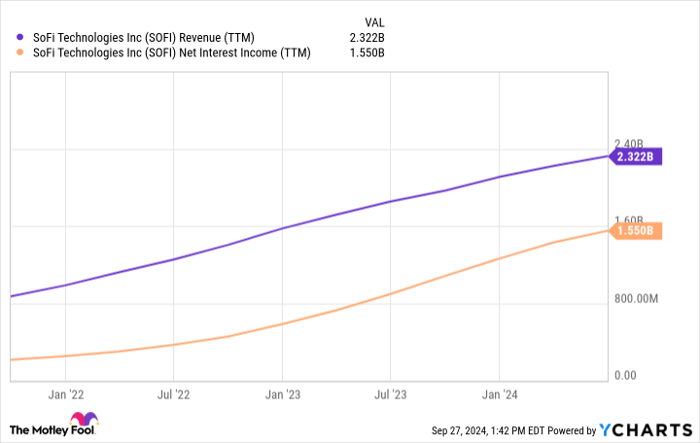

SOFI revenue (TTM), data by YCharts; TTM = trailing 12 months.

At the end of 2021, SoFi had 3.46 million members. That has grown to 8.77 million in just two and a half years. Customer growth was 41% year over year in the second quarter, so there is no evidence that this is slowing down. Not only should lending activity pick up, but SoFi also has a much larger customer base. It sets the stage for stellar top- and bottom-line growth.

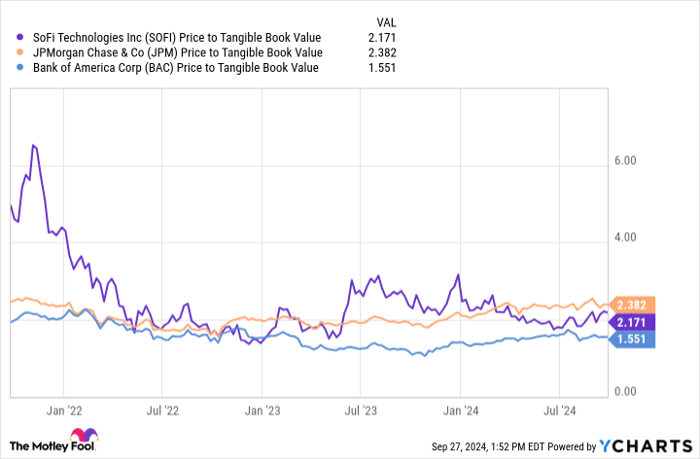

Yet, the stock still trades at a fraction of its all-time high. But you shouldn't let past price action tell SoFi's story. I've previously discussed that the fintech went public during a stock market bubble. As you can see, its growth and falling share price have slowly brought the company's valuation (as reflected in price-to-book-value) in line with other banks:

SOFI price to tangible book value; data by Charts

SoFi isn't a household-name megabank like JPMorgan Chase or Bank of America, but it's growing much faster. With the stock finally trading at a bank's valuation, SoFi's rampant growth should translate into investment returns. Holding the stock has been a nightmare for the past few years, but it could be on the verge of delivering the market-beating returns most investors dream of.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and JPMorgan Chase. The Motley Fool has a disclosure policy.