Could Constellation's Nuclear Revival Make NuScale the Next Big Thing?

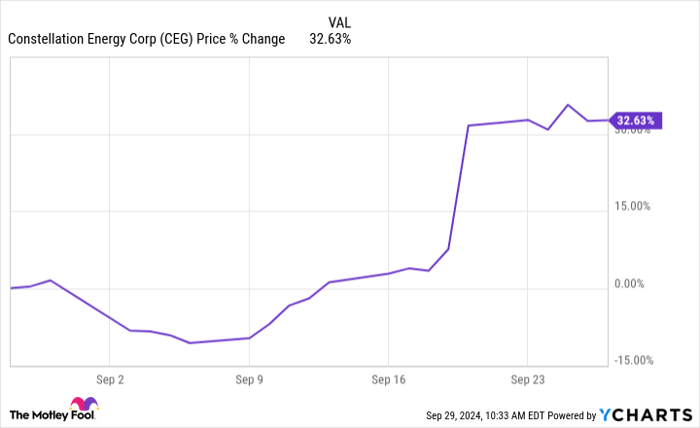

Wall Street has a habit of getting overly excited by the news, both to the downside and the upside. So the one-day rally in Constellation Energy's (NASDAQ: CEG) share price after a news release about reopening part of the nuclear power plant at Three Mile Island needs to be taken with a grain of salt. And yet the excitement still might be a sign of the long-term potential of nuclear power upstart NuScale Power (NYSE: SMR).

Here's what you need to know.

What does Constellation Energy do?

Constellation Energy is not a typical regulated utility. It describes itself as "one of the largest competitive electric generation companies in the country." That means that it sells power directly to other entities outside of the regulated framework that supports the business model of traditional utilities. It is a riskier business model since Constellation Energy does not have a monopoly in the regions it serves, and its customers can choose to acquire their power from other providers. One of the big selling points for the electricity that Constellation Energy sells, however, is that it is clean, largely derived from non-carbon sources like solar, wind, and, more to the point here, nuclear power.

Image source: Getty Images.

What does NuScale Power do?

NuScale Power is an upstart nuclear power company that is trying to build a small-scale modular nuclear reactor (SMR). It is still in the development process, slowly working through the many approvals required to gain regulatory permission to build a nuclear reactor. But the potential benefits are material. The company's SMR product will be built in a factory, which should reduce costs. The reactors are small, so they are expected to be safer than giant nuclear power plants. They can be linked together to modularly create larger amounts of power. And they can relatively easily be brought to remote locations. There's no question that NuScale Power's product will represent a material advance in nuclear technology if it gets the final nod of approval to start producing them at scale.

What just happened with Constellation Energy

Here's the interesting thing -- Constellation Energy's stock price rocketed higher after it announced that it was reopening Unit 1 of Three Mile Island sometime in 2028. If the name Three Mile Island is familiar to you, that's because it was the infamous location of a near meltdown on U.S. soil. That portion of the power plant (Unit 2), however, isn't the one being brought back online.

CEG data by YCharts

The big story here is why Unit 1 is being restarted. Microsoft (NASDAQ: MSFT) has agreed to buy power from the plant for 20 years. Microsoft is going to buy all of the roughly 835 megawatts of power the plant is capable of producing! The need for this power is largely driven by the huge energy needs of data centers.

According to Constellation Energy, data centers are expected to help boost electricity demand from a 2.5% annualized growth rate in 2022 to as much as 7.5% in 2030. Artificial intelligence (AI) is a particularly compelling driver of demand, as AI data centers use seven times more power than traditional data centers. The big problem for companies looking to build data centers of all kinds, meanwhile, is finding the power to run them.

Where does NuScale Power fit in this story?

There appears to be increasing support for nuclear power, which means that NuScale Power's SMR plans could receive more support. That might ease, or even speed up, the approval process. But the really exciting thing here is the demand picture. Assuming that traditional utilities continue to have trouble supplying power to data centers (which includes both producing enough electricity and building the wires to deliver it), NuScale's portable SMRs could be built in a factory relatively quickly and delivered right to the data center site. This removes a huge portion of the infrastructure that would have to be built by a traditional utility attempting to meet a data center customer's energy needs. It is a huge selling point for NuScale's SMR concept.

NuScale still has a long way to go

There's one big problem here. NuScale Power still doesn't have all of the approvals it needs to build its SMRs. The next big approval is expected to come in mid-2025. Even if regulators give the company the go ahead, it still has to ramp up production. There is likely to be a lot more red ink here before the company's full potential starts to come into focus.

Because of these uncertainties, only more aggressive investors will probably want to buy NuScale Power. However, if you have a glass-half-full mentality and don't mind being early to an investment idea, Constellation Energy's reopening of Three Mile Island is, indeed, a good sign for NuScale Power's future.

Should you invest $1,000 in NuScale Power right now?

Before you buy stock in NuScale Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and NuScale Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Constellation Energy and Microsoft. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.