You'll Never Believe Which Beaten-Down Financial Stock Is Suddenly Outperforming the S&P 500 in 2024

Looking back more than 50 years, the S&P 500 goes up about 10% every year. But don't tell that to the market in 2024. As of Sept. 27, the S&P 500 is up over 20%, making this an above-average year so far and there are still three months to go.

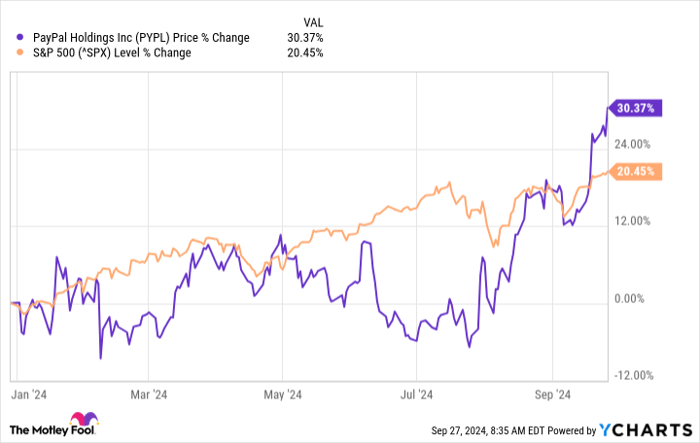

Beating the S&P 500 over the long haul is hard enough, and beating the market in a good year can be even harder. But if you bought shares of financial technology (fintech) company PayPal Holdings (NASDAQ: PYPL) on Jan. 1, then you'd be outpacing the market average.

PYPL data by YCharts

The outperformance is noteworthy. PayPal underperformed the S&P 500 in 2021, 2022, and 2023. And it was even underperforming again in 2024 until very recently. But the stock has suddenly surged back to life and for good reason, as I'll explain.

Why PayPal stock is suddenly soaring

In 2023, PayPal began a season of change by hiring new CEO Alex Chriss. His predecessor Dan Schulman had long planned to retire. And this had essentially caused the company to hit the pause button -- it didn't want to make long-term plans until it had its long-term leader.

Chriss' tenure didn't necessarily have a smooth start. In January, he said that PayPal would "shock the world" when it unveiled new features. But investors felt like its updates were ho-hum at the time. In short, it seemed like Chriss overpromised and underdelivered.

However, PayPal stock is suddenly soaring because it looks like its turnaround is finally getting some traction.

For starters, PayPal has secured some impressive partnerships in recent months. Most recently, it worked out a deal with Amazon. Amazon's Prime subscription service provides certain consumer benefits, and the company allows merchants to extend these benefits to consumers on their own websites with its Buy With Prime integration.

Starting next year, consumers can enjoy this inside of the PayPal app as well. The company's merchants will be able to link their Buy With Prime accounts. It's just one more way that PayPal is trying to put itself in a position to be used by as many consumers as possible as well as joining forces with important companies.

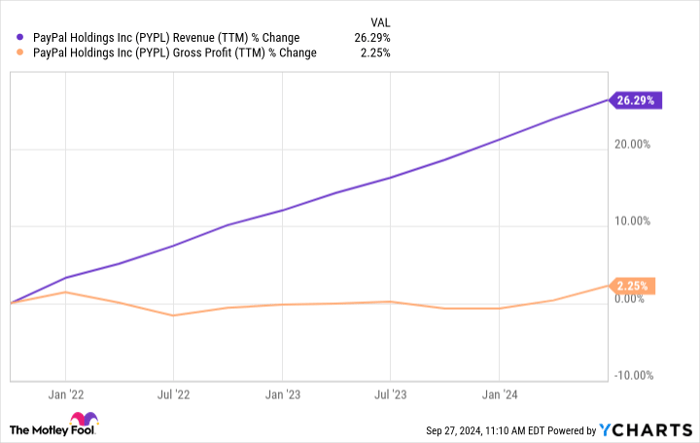

When it comes to many of its partnerships, PayPal often processes payments behind the scenes -- it's possible you've used it without even knowing it. While this helps PayPal from a volume and revenue perspective, these unbranded services are increasingly low margin. Consequently, the company's revenue increased nicely in recent years whereas its gross profit plateaued.

PYPL Revenue (TTM) data by YCharts

Under Chriss' leadership, this problem might now be getting fixed. In the second quarter of 2024, PayPal grew its transaction margin dollars -- a fintech metric similar to gross profit -- by 8% year over year, which was its best growth in this metric since 2021. Granted, it still trailed revenue growth but it's hopefully a first step in the right direction.

Finally, there are some things to look forward to with PayPal as well, such as advertising. When it comes to the company's recent focus on building an advertising business, many investors likely have the wrong idea. For those thinking they'll have to watch an ad to make a payment, that's not really what's happening.

In reality, PayPal has millions of merchants that use it services. The company can offer these merchants consumer data so that they can better target new customers, as well as incentivize purchases with special pricing. It helps merchants improve sales conversions, which will hopefully grow its business overall.

What it all means for investors today

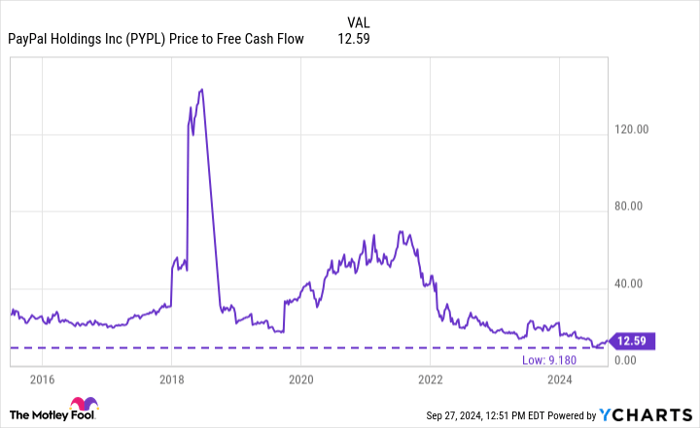

There are real positive developments underway with PayPal's business. That's why the stock is suddenly soaring. But could it go up even more? Here's something to keep in mind: Even with its recent struggles, PayPal was a big, profitable business. But its valuation had dropped to an all-time low, from a price-to-free-cash-flow perspective.

PYPL Price to Free Cash Flow data by YCharts

Even after bouncing off of its lows, PayPal stock is still cheap at less than 13 times its free cash flow. And when a stock trades this cheaply, investors are essentially giving the business very little credit. Without saying it, investors are saying that they don't believe that PayPal will grow its free cash flow or make good use of it over the long haul.

In this case, it's starting to look like investors might be wrong. Key PayPal metrics are improving and the business does have potential drivers for long-term growth. Moreover, it's using its free cash flow to buy back stock, which boosts shareholder value.

In other words, PayPal stock could indeed have further upside if its turnaround continues in the right direction.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 774% — a market-crushing outperformance compared to 169% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and PayPal made the list -- but there are 9 other stocks you may be overlooking.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon and PayPal. The Motley Fool recommends the following options: short September 2024 $62.50 calls on PayPal. The Motley Fool has a disclosure policy.