In With the New: Is Nike Stock a Buy After CEO Change?

It's been a tough stretch for sporting apparel and shoe giant Nike (NYSE: NKE). The company, famous for its Swoosh logo, has lost its growth momentum after an excellent couple of years following the onset of the pandemic. Today, investors question the company's competitive moat as emerging competitors like Deckers Brands, which sells Hoka sneakers, have enjoyed solid success.

Nike has grown concerned enough that it ousted CEO John Donahoe to bring back former executive Elliott Hill to lead the company's turnaround.The stock bounced on the news, but remains 50% below its former high and a severe laggard to the broader stock market.

Should investors buy the turnaround? Or are Nike's best days behind it?

What went wrong at Nike?

Retail is highly competitive, but when you're the top brand, like Nike is in sneakers, you get the best shelf space in the store. Nike's ability to hog shelf space has been a competitive moat for decades. However, once former CEO John Donahoe assumed the helm in early 2020, the company focused on building its direct-to-consumer selling model.

At face value, a direct-to-consumer model isn't a terrible idea. Nike can increase its profit margins and have more control over how it markets its products. But Nike didn't foresee the strategy's drawbacks before leaning too hard in that direction.

For example, wholesalers take a lot of logistical headaches off the manufacturer's plate. That was left to Nike to figure out. And that coveted shelf space? Nike gave much of that to competitors by pulling back from retailers, even ceasing business with some of them.

Simply put, Nike put so much emphasis on its direct strategy that it opened the door for competition in retail. Nike admitted this over the past few quarters before Donahoe stepped down. Elliott Hill, who retired from Nike in 2020, will return as CEO on Oct. 14. He previously headed companywide commercial and marketing operations for the Nike and Jordan brands.

No, Nike isn't dead

The great thing about dominant companies is that a few years of lousy management usually isn't enough to ruin the business. I've seen sentiment turn sour to the point that people believe Nike is toast. I would say that's highly unlikely (I could be wrong, of course). It boils down to some simple facts.

Nike is still the behemoth that rules the sporting world:

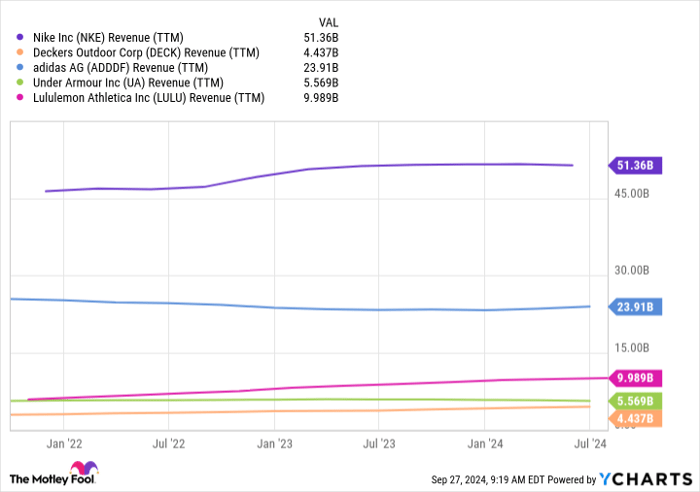

NKE Revenue (TTM) data by YCharts

Sure, there is competition, but Nike is still bigger than most of its primary competitors combined. It still has the deepest pockets, the largest advertising budget, and a list of top-tier sponsorships, including Michael Jordan, LeBron James, Caitlin Clark, and dozens more. Nike is the de facto leading Olympic apparel brand and owns licensing deals with the NFL, NBA, and MLB.

You could argue that Nike may have lost some positioning in niche categories, such as running or athleisure. Competitors like Hoka and Lululemon Athletica have excelled here. Yet Nike's sales have only slightly declined after a tremendous growth spurt. It seems premature to say that Nike's in trouble. If anything, investors should applaud the company for taking drastic action before sales declined enough to really spell trouble.

But is the stock a buy?

Nike's iconic brand, steady top- and bottom-line growth, and remarkable long-term stock performance have routinely commanded a premium over the years. For the past decade, Nike has traded at an average price-to-earnings ratio (P/E) of 37. The problem with a sustained premium like Nike's is that it can get messy if something happens and the market no longer wants to pay that price. Investors have seen that, with Nike still down 50% from its all-time highs.

What matters now is where the Swoosh goes from here.

Analysts expect Nike to take a big step back this year. Full-year earnings estimates of $3.03 per share are nearly a buck lower than last year's $3.95. So, the stock becomes more expensive when you value it on forward earnings. The stock trades at 30 times its estimated 2024 earnings, about 20% below its long-term average.

At the same time, analysts believe Nike will grow earnings by an average of 12% annually over the next three to five years. In other words, 2024 is a reset year for Nike before double-digit earnings growth returns. If that's how it plays out, today's drop looks like a solid buying opportunity for long-term investors.

Unfortunately, blue chip stocks rarely come cheap. It often takes a market crash or some bumps and bruises to get shares to fall. Nike must deliver on its expectations, but that's the risk you take to buy shares for less. The company's solid fundamentals and long-standing brand power point to the Swoosh being OK in the long run.

Should you invest $1,000 in Nike right now?

Before you buy stock in Nike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 30, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lululemon Athletica and Nike. The Motley Fool recommends Under Armour. The Motley Fool has a disclosure policy.