Worried About a Stock Market Pullback? Buy This Vanguard ETF.

The S&P 500 just set another all-time high on its way to another strong year. The benchmark large-cap index has bested virtually every Wall Street forecast from the beginning of the year, and it's now up 20% year to date.

However, there is reason to wonder whether the rally can continue. Some investors are concerned that artificial intelligence (AI) stocks are already overvalued, and there's also evidence that the S&P 500's valuation is getting stretched.

For example, the Vanguard S&P 500 ETF, which tracks the S&P 500, trades at a price-to-earnings (P/E) ratio of 28.7. That's the highest it's been since the pandemic's height, and well above its historical average. In fact, the only times the index has been more expensive than it is now -- during the dot-com bubble, the Great Recession, and the pandemic -- a bear market has followed.

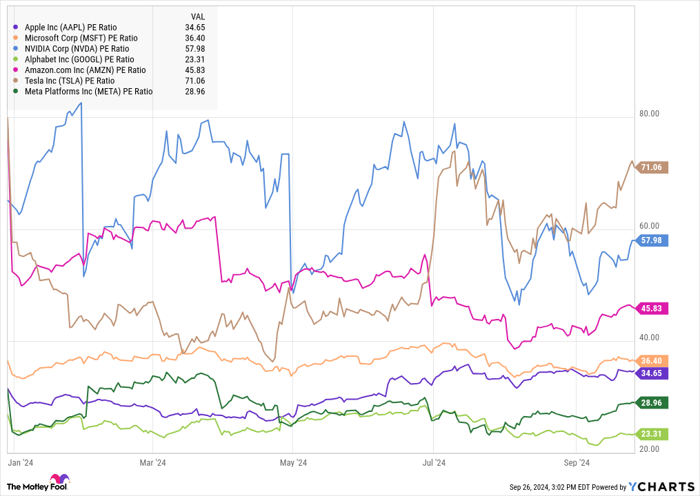

Looking at the biggest stocks in the S&P 500, you might also get the sense that the index is overvalued. The chart below shows the valuations of the "Magnificent Seven" stocks. As you can see, all but two are above 30, showing how pricey the most popular stocks are.

AAPL PE Ratio data by YCharts

The valuations of all these stocks have expanded significantly, pushing into well above 30. That's a ratio that typically reflects smaller growth stocks. While large-cap stocks have outperformed, leaving smaller companies behind, that could soon change.

Image source: Getty Images.

It's time for a rotation

This bull market isn't unique. It's typical for large caps to lead the early stages of a new rally, but bull markets tend to broaden over time as investors move into mid-caps and small-caps.

Considering valuations in the large-cap sector and the effect of falling interest rates, the rally in the Magnificent Seven stocks may have peaked. Most of them are trading below their 52-week highs, even as the S&P 500 just set another all-time high.

In order for stocks to continue to moving higher at this point, the rally needs to broaden. Expanding into small-caps, which have thus far lagged, would be the normal way for that to happen. That means the Vanguard Russell 2000 ETF (NASDAQ: VTWO) should be a winner as investors rotate out of large-cap stocks.

Why the Vanguard Russell 2000 ETF is a buy

Small-cap stocks have lagged behind their large-cap peers in the current bull market because they aren't as directly exposed to the AI boom. Concerns have lingered about a potential recession due to elevated interest rates, high inflation, and a rising -- but still small -- unemployment rate.

However, the Vanguard Russell 2000 ETF is much cheaper than the S&P 500 index funds. It trades at a P/E ratio of 17, or a roughly 40% discount from the S&P 500. That's too much of a discount for the market to continue to ignore it.

Furthermore, the Federal Reserve has begun a new interest rate cutting cycle, lowering the Fed Funds rate by 50 basis points last week. Lower interest rates tend to favor small-cap stocks because smaller companies tend to be more dependent on borrowing money and more at risk of going bankrupt. Therefore, they benefit more from lower interest rates than their more-established large-cap peers.

What's next for the Vanguard small-cap fund

Small-caps have historically traded at a premium to their large-cap peers, at least over the last 20 years. During that period, the S&P Small-Cap 600 has traded at a P/E ratio of 1.32 times the S&P 500, according to research from RBC Wealth Management.

While the AI boom may offer one explanation for why that relationship is currently reversed, investors should expect the ratio to eventually revert to the mean over time. That means small-cap stocks will go up, large-caps will come down, or both.

In order for the Vanguard small-cap index to trade at 1.3 times the valuation of the S&P 500, it would have to double in price, at least without any change in its earnings. That's unlikely to happen in the short term, but the math is favorable for small-cap investors over the coming years.

As interest rates go down, small-caps should narrow the historically large gap with the S&P 500, and that will make the Vanguard small-cap ETF a winner.

Should you invest $1,000 in Vanguard Russell 2000 ETF right now?

Before you buy stock in Vanguard Russell 2000 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Russell 2000 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.