Is This New S&P 500 Stock a Sell After Soaring 161%?

It has been a year to remember for shareholders of data analytics and artificial intelligence (AI) software company Palantir Technologies (NYSE: PLTR). The stock has surged by more than 160% over the past year, and the committee that picks which companies merit membership in the S&P 500 added it to the benchmark large-cap index this month. Index inclusion is a badge of honor that acknowledges a company's strong performance and raises awareness of it among investors.

Palantir's products, especially its AIP platform, are driving accelerating revenue growth and strong profitability. However, the share price has grown faster than the underlying business. Should shareholders consider selling while they're ahead, or does Palantir have more room to run?

The stock has outrun the business

I'm not here to pick on Palantir's business. There is a lot to be excited about.

The company has emerged as arguably the leading AI software play on Wall Street. It debuted the AIP platform last year as a tool for companies to develop and deploy bespoke AI applications, and its revenue growth has steadily accelerated since then. Technology advisory company Forrester Research recently recognized AIP as the market's top AI and machine learning platform.

And yes, its inclusion into the S&P 500 has likely generated some buying momentum for the stock. Funds that track the S&P 500 must add Palantir shares to reflect the index, and many investors gravitate to S&P 500 companies because they must meet strict standards to get into the index.

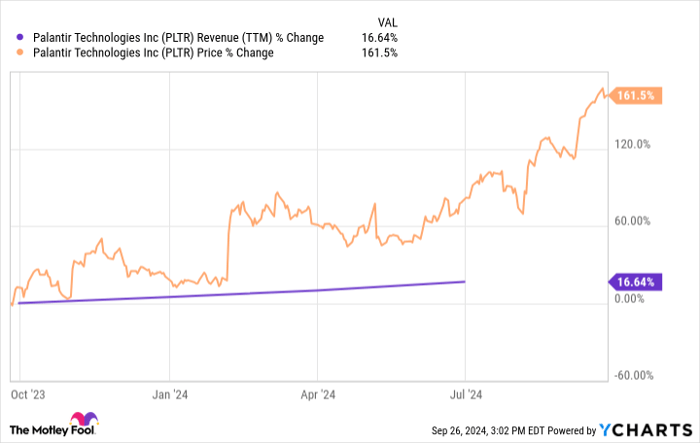

The problem is that the stock price gains have dramatically outrun the growth of the business. Palantir's trailing-12-month revenue has grown by a total of around 16%. The stock's appreciation has outpaced that by a factor of almost 10.

PLTR Revenue (TTM) data by YCharts.

Just how expensive is Palantir?

In reality, stock prices at any given time are heavily reflective of the market's level of enthusiasm for that stock. Part of investing is recognizing when the market is too excited or pessimistic.

Right now, the market's sentiment toward Palanir is borderline frenzied.

Remember the "everything bubble" of 2020-2021, when zero-percent interest rates and loose-money fiscal policies put in place to keep the economy stable during the pandemic crisis fed into a speculative bubble across growth stocks, cryptocurrencies, and other assets? Though the broad market indexes are now setting new all-time highs again, many growth stocks still trade at fractions of the valuations they reached at the peak of that bubble.

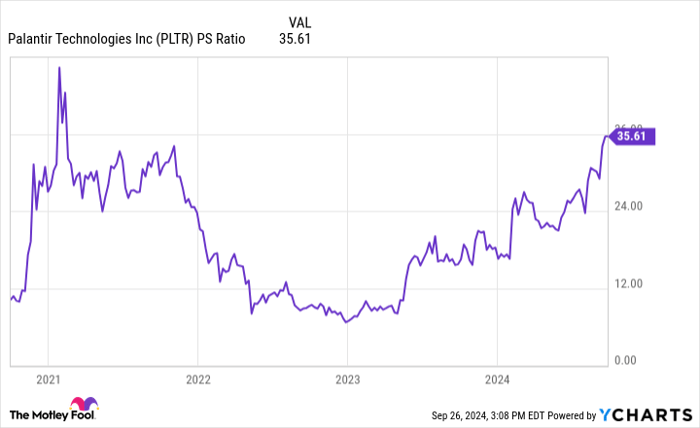

Yet on a price-to-sales (P/S) basis, Palantir is approaching the highest valuations it carried during the bubble.

PLTR PS Ratio data by YCharts.

Analysts believe the company will generate $2.76 billion in revenue in 2024 and $3.32 billion in 2025. The stock trades at a forward P/S of 25 based on next year's revenue estimates. If the stock eventually settles down to a long-term P/S ratio somewhere in the middle of this wide range -- say, 15 times revenue -- its chart could go flat or decline for years while the business grows enough to catch up to the stock price.

Should investors sell Palantir?

Palantir's valuation has arguably entered bubble territory, and a number of factors could lead to that bubble bursting. There is political uncertainty as the U.S. election approaches. Geopolitical tensions are flaring in Europe and the Middle East. Now that U.S. inflation has largely been put back in check, the Federal Reserve has begun cutting interest rates, which should stimulate the economy. But when such stimulus is needed, it's sometimes because the country is heading toward a recession.

Stock bubbles can also pop themselves. Remember, high valuations create high expectations. Palantir stock could keep rising until the company inevitably falls short of the impossibly high standards the market has baked into the share price. Once this happens, the resulting correction could be fierce.

In other words, stock bubbles are like a game of musical chairs. They always end eventually.

For investors, selling winners while they are still winning is difficult, and anyone who bought Palantir as recently as within the past few months is likely sitting on fantastic gains and feeling good. But selling some shares to lock in your gains might be wise. Otherwise, you may regret it when the music stops.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.