The Ultimate Growth Stock to Buy With $1,000 Right Now

The stock market has been kind to growth investors for about two years now. It's a welcome change of pace from the inflation crisis in 2022. The tech-heavy Nasdaq Composite (NASDAQINDEX: ^IXIC) index is up by 67% in 24 months, or 70% in terms of dividend-boosted total returns.

There's a downside to a surging bull market, though. There are fewer slam-dunk buys available these days, as many of yesteryear's bargains are soaring again.

But "fewer" doesn't mean "zero." If you have $1,000 of investable funds on hand (or any other amount, really), I highly recommend grabbing a few shares of Fiverr International (NYSE: FVRR).

This high-octane growth stock never got the memo about a broad market rebound, and the stock is down 18% in two years instead.

That makes Fiverr a no-brainer buy today. Let me show you why.

Rumors of Fiverr's death have been greatly exaggerated

Many investors expected Fiverr to shrivel up and fade away after the coronavirus pandemic. The company helps freelancers connect with clients and the other way around. That idea was hot amid the lockdowns of 2020, and then people got back to regular nine-to-five work again.

That's the theory behind Fiverr's slumping stock chart, anyway. Fiverr's time in the limelight was surely over as soon as the first COVID-19 vaccines were widely available.

Fiverr's gig economy growth

But the company never stopped growing.

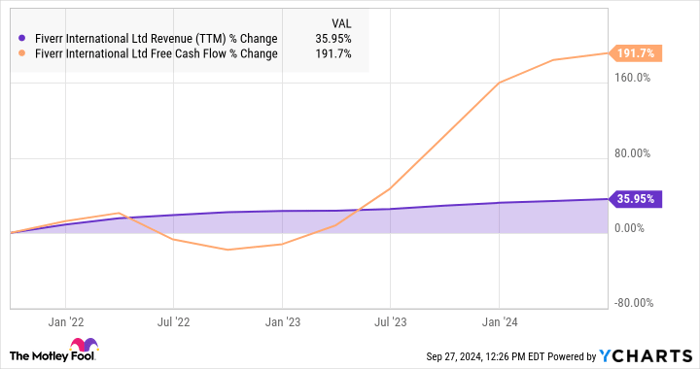

As it turns out, plenty of the people who got their first taste of the gig economy four years ago liked what they saw. Fiverr's trailing twelve-month sales have increased by 36% in three years while free cash flows nearly tripled:

FVRR Revenue (TTM) data by YCharts

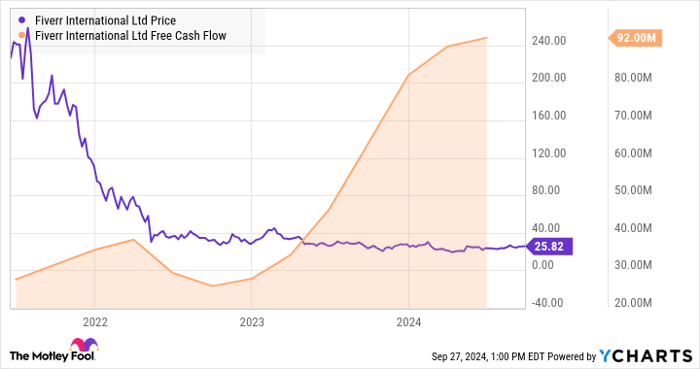

Sure, there was a slowdown in the inflation crisis. Equipped with a robust balance sheet and solid cash profits, Fiverr survived that challenge and thrived on the other side. Yet, market makers continued to assume the worst and drove the stock price 86% lower over the same period. I don't know about you, but I don't think that these conflicting chart lines belong in the same graph:

FVRR data by YCharts

New services and strategic initiatives

On top of these impressive results, Fiverr isn't sitting still.

The company has launched a plethora of new services this year. Recent additions include two dozen new service categories in the financial sector and an ad campaign featuring Martha Stewart. Some investors see artificial intelligence (AI) as a threat to Fiverr's business model -- but those digital brains still need human input and editing, and Fiverr in making a mint selling those services today.

Stellar growth and low share prices -- what's not to love?

I can't promise that the stock will soar in the near future. After all, investors have ignored the company's strong financials and enormous long-term business prospects for years, and sometimes I wonder what it will take to end that disconnect.

But it will almost certainly end someday, and Fiverr's stock simply looks undervalued until that day comes. Shares are changing hands at the modest valuation of 2.5 times trailing sales and 10 times free cash flows. You've seen the company's generous top-line growth and even stronger cash flow gains. Fiverr hopes to reshape concepts like "work" and "careers" on a global level and it plays a leading role in a long-term shift toward contractors, freelancers, and short-term gigs.

So you should see Fiverr's price drop as a buying opportunity. This tremendous growth stock deserves a second look, and it is one of my favorite places to invest $1,000 right now.

Should you invest $1,000 in Fiverr International right now?

Before you buy stock in Fiverr International, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Fiverr International wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Anders Bylund has positions in Fiverr International. The Motley Fool has positions in and recommends Fiverr International. The Motley Fool has a disclosure policy.