Where Will Amazon Stock Be in 3 Years?

Shares of Amazon (NASDAQ: AMZN) are up 12% in the last three years, recently surpassing their all-time high, set in 2021. But did you know that the stock has materially underperformed the S&P 500 index over that time span? That's right: The broad market index is up 34% in the last three years, handily beating the returns of the e-commerce and cloud computing company.

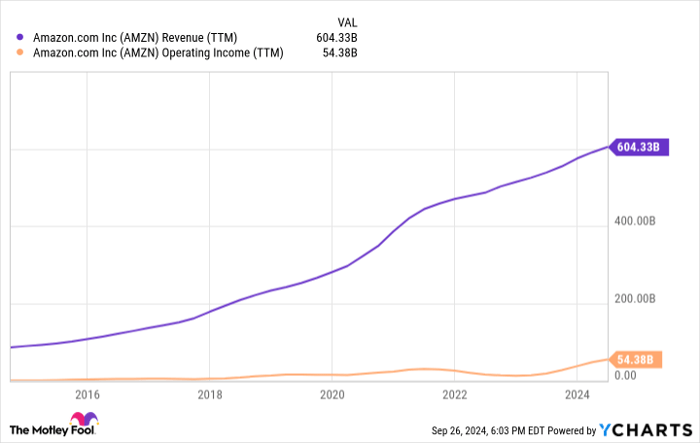

This is one of the longest stretches of underperformance in Amazon's history. Yet, if we look at the underlying financials, the company is doing phenomenally well. Revenue is growing by double digits, with profit margins inflecting higher. If this continues, where does that put Amazon's stock three years from now?

Let's analyze further and find out.

Big drivers of revenue growth

Last quarter, Amazon's revenue grew by 10% year over year to $148 billion. It is one of the largest sales generators in the world due to its dominance in e-commerce in the United States and a few other markets worldwide.

And let's not forget the cloud computing division, Amazon Web Services (AWS). It generates around $100 billion in revenue every year and grew sales by 19% year over year last quarter.

Investors should expect continued growth from both of these divisions due to the tailwinds for each one. E-commerce is still just roughly 16% of overall retail sales in the United States. While every transaction is not going online, the trend has been up and to the right for multiple decades now and shows no signs of slowing down. Amazon will benefit as overall retail spending grows in the United States and e-commerce eats up more of this pie.

For cloud computing, the situation is similar. It remains a small percentage of overall IT spending, with analysts projecting annual total sector growth of 19.4% from 2024 to 2028. This is another tailwind for the company.

Add everything together, and I believe it's possible for Amazon to grow its overall revenue by 10% per year for the next three years, if not longer.

Continued margin expansion

Combined with revenue growth, Amazon is seeing nice margin expansion as both its e-commerce and cloud computing divisions scale up. Operating margin over the last 12 months has hit 9%, which is an all-time high.

Three key segments are driving this margin expansion with their high profitability. We already talked about one: AWS. It has operating margins of 30%-plus, and they are growing faster than overall sales. The other two segments are third-party seller services (growing 13% year over year) and advertising (up 20%).

All three of these segments come with better profit margins than the traditional e-commerce business. If these three segments keep growing faster than overall sales, Amazon's operating margin will keep expanding in the next three years.

Besides fast growth at its high-margin segments, Amazon has trimmed its workforce. Various divisions have had layoffs in 2023 and 2024, which should lead to even more profit growth.

AMZN revenue (TTM); data by YCharts. TTM = trailing 12 months.

A three-year profit inflection

In Amazon, we have a double driver of earnings growth: sales and operating margin expansion. Over the next three years, I would expect consolidated revenue to grow by at least 10% annually. Profit margins should expand to at least 15% from 9% today.

Over the last 12 months, revenue was $604 billion. With compound annual revenue growth of 10% for three years, the company will generate $804 billion in sales in 2027. Apply a 15% profit margin to that figure and you have $120 billion in annual operating income. Over the last 12 months, Amazon generated around $50 billion in operating income. So, earnings will more than double in three years.

We can't precisely predict what the stock price will do over the next three years. But if the company more than doubles its operating earnings -- which I think is very possible given the above estimates -- shareholders will likely be happy buying and holding Amazon for an extended time period.

As this profit inflection occurs, watch its share price climb higher and higher for the rest of this decade.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Brett Schafer has positions in Amazon. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.