U.S. Money-Supply Growth Is Accelerating, and It Could Signal a Big Change Is Coming in the Stock Market

Despite a few hiccups, the S&P 500 bull market isn't slowing down. The stock index most often used to reference the U.S. large-cap stock market has climbed over 20% through 2024 as of this writing.

But not every company has participated equally in the current market rally. Just a handful of the largest companies in the market have driven the vast majority of returns for the S&P 500. As a result, the index has become increasingly concentrated with the bulk of the value in just a few stocks.

Over 20% of the 500-company index's value comes from just three stocks -- Apple, Microsoft, and Nvidia. The top-10 stocks account for around 35% of the index, the most since the 1960s.

While the biggest companies are getting bigger faster than the rest of the market, it's worth noting that rising market concentration is unsustainable. At some point, the megacap stocks driving the market today will take a back seat to smaller companies. And one market indicator suggests a big change is coming.

Image source: Getty Images.

U.S. money supply is accelerating

U.S. money supply can have far-reaching impacts on business and investor behavior. When a business has easier access to low-cost capital, it can grow a lot faster. But when money supply is tight, smaller companies struggle to grow and take advantage of business opportunities. Meanwhile, larger, deep-pocketed companies can seize those opportunities while facing less competition.

According to data gathered by J.P. Morgan's European Quantitative Strategy head, Khuram Chaudhry, there is a correlation between a decrease in money supply growth and a rise in stock market concentration. The opposite is also true. When money-supply growth accelerates, smaller companies can outperform, leading to less concentration in the market.

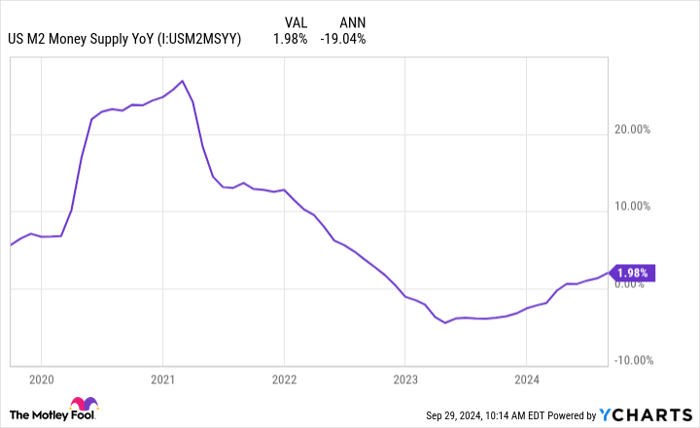

After several years of slowing growth, even some declines, U.S. money-supply growth is accelerating. The trend is expected to continue. Here's how we got here.

Amid the onset of the COVID-19 pandemic in 2020, the Federal Reserve set the low end of its target federal funds rate to 0%. Meanwhile, the government sent out stimulus checks to households in order to prop up the economy. The result was a surge in a measure of the U.S. money supply called M2 money supply. M2 includes cash in circulation, deposit accounts, money market accounts, and certificates of deposit. Basically, if you can easily access the funds to pay for goods and services, it's included in M2.

US M2 Money Supply YoY data by YCharts.

Money supply grew extremely quickly in 2020, and it continued to grow quickly in 2021, although it couldn't possibly keep up the torrid pace from multiple stimulus checks and a sudden slash in interest rates. Inflation was starting to become a challenge for many households, and it eventually became clear the Fed needed to tighten the screws on the money supply.

Amid tightening policies from the Fed in 2022, M2 money-supply growth started to slow quickly. By the end of the year, growth went into negative territory as the Fed continued to raise interest rates. Supply shrank throughout all of 2023 and into the first quarter of 2024 even after the Fed halted its interest rate hikes.

But M2 money supply is finally growing again. Not only that, but growth is accelerating quickly. In April, M2 money supply increased about 0.6% year over year. That climbed to 1.3% in June, and it reached 2% in its most-recent reading for August. While M2 remains below the peak money-supply levels of 2022, we're starting to see greater liquidity in the market.

As mentioned, money supply should continue growing quickly moving forward. The Federal Reserve just instituted its first interest rate cut since 2020, a 0.5 percentage point cut. Two more cuts could come by the end of the year, and we could see rates drop more than 1 percentage point next year as well.

That will make it less expensive to borrow, increasing the total amount of capital available to smaller companies. As a result, smaller stocks could lead the next leg up in the current bull market.

The best way to invest as money-supply growth accelerates

The most straightforward way to invest in stocks when you expect market concentration to reverse is to buy an equal-weight index fund. The Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) is one of the best in the industry, charging an annual-expense ratio of just 0.2%.

With an equal-weight index fund, the fund manager invests the same amount of money in each of the components of the index. So, they'll put just as much money in Apple, Microsoft, and Nvidia as stocks number 498, 499, and 500. That way, if the larger companies underperform, it doesn't weigh down the index as much as the traditional cap-weighted S&P 500.

Of course, the opposite is also true. If the megacaps continue to outperform, the equal-weight index will underperform. That's been the case for some time now. However, the equal-weight index historically produces very strong and prolonged periods of outperformance once concentration finally peaks. And we may be nearing another peak.

Another option is to invest in small-cap stocks. These stocks aren't represented in the S&P 500, but they face the same challenges as the stocks you'll find at the bottom of the popular index. In fact, small-caps may have seen an even bigger impact from high-interest rates, as many rely on floating-rate debt instead of long-term fixed-rate bonds.

My preferred index for small-cap stocks is the S&P 600, which tracks 600 of the smallest companies in the U.S. market. The SPDR Portfolio S&P 600 Small Cap ETF (NYSEMKT: SPSM) has an expense ratio of just 0.03%.

Just like the S&P 500, the index has a profitability requirement for inclusion. As a result, the S&P 600 tends to tilt toward value stocks. The profitability requirement can reduce the risk of investing in small-cap stocks. And profitable businesses with greater access to capital tend to become more profitable over time instead of burning through cash.

Despite the potential growth for small-cap stocks going forward, there's a big valuation discrepancy. The S&P 600 trades for just 15.3 times forward earnings, versus a forward PE of 21.2 for the S&P 500. The big valuation gap between the indexes suggests the market doesn't appreciate the potential for profitable small caps to accelerate earnings growth as money-supply growth accelerates.

Should you invest $1,000 in Invesco S&P 500 Equal Weight ETF right now?

Before you buy stock in Invesco S&P 500 Equal Weight ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Adam Levy has positions in Apple and Meta Platforms. The Motley Fool has positions in and recommends Apple, JPMorgan Chase, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.