Enterprise Products Partners Stock: Buy, Sell, or Hold?

Some investments are great for a specific type of investor, but they won't be a great fit for many others. That's exactly the situation that exists with Enterprise Products Partners (NYSE: EPD) today.

If you are looking at this midstream master limited partnership (MLP) here are some reasons why you might want to buy it, sell it, or hold it for the long term.

Reasons to sell Enterprise Products Partners

The list of reasons to sell, or never buy, Enterprise Products Partners is actually pretty easy to identify. And it will be fairly obvious what types of investors will want to take a pass on this high-yield option. With a hefty 7.1% distribution yield, investors who are focused on growth will probably not find Enterprise interesting at all. In fact, the distribution is likely to make up the lion's share of returns here. Distribution increases have only been in the low- to mid-single digits over the past decade or so, which speaks to the MLP's prospects for growth.

Image source: Getty Images.

There's another wrinkle here since Enterprise Products Partners is an MLP, a pass-through business structure that is specifically meant to create tax-advantaged income for unitholders. But MLPs have unique tax considerations, including the fact that they don't play nicely with tax-advantaged retirement accounts and that they require investors to deal with a K-1 form at tax time. Investors who prefer simple investments will probably be better off elsewhere despite the attractive yield on offer from Enterprise.

Lastly, Enterprise is not for you if you believe that renewable power is the future and simply don't want to touch anything involved in carbon fuels. Its entire business is dedicated to owning the energy infrastructure that helps to move oil and natural gas around the world.

Reasons to buy Enterprise Products Partners

While growth investors won't like Enterprise, income investors probably will. The first indication of that is the hefty 7.1% distribution yield. The second is that MLPs often create income that is tax-advantaged because a portion of the payment may be classified as a return of capital (this lowers your cost basis). And the distribution has been increased annually for 26 consecutive years, which is a very strong track record for an income investment.

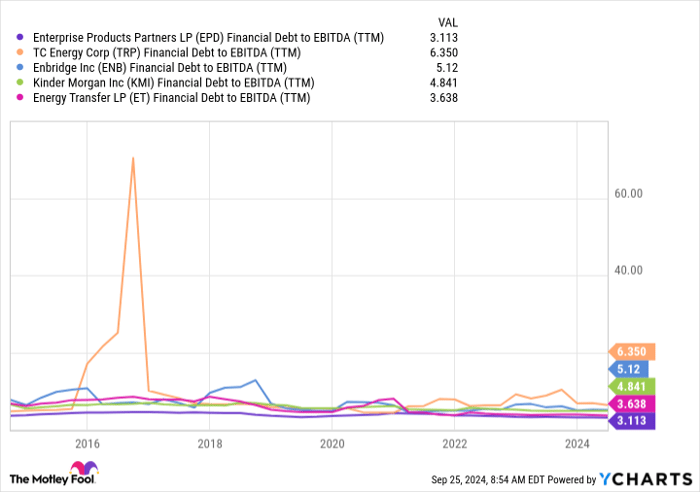

EPD Financial Debt to EBITDA (TTM) data by YCharts

But the good news doesn't stop there. Backing the income stream Enterprise Products Partners creates is an investment-grade rated balance sheet. The MLP's distributable cash flow covers its distribution by a very strong 1.7 times, suggesting that there is a great deal of leeway for adversity before a cut would be in order. On top of that, Enterprise has always tried to operate with a very low amount of leverage compared to its closest peers, so it is one of the strongest options, financially speaking, in the midstream sector.

If you like reliable, secure income, Enterprise Products Partners is probably going to be a good option for your portfolio.

Reasons to hold Enterprise Products Partners

As with most situations, the hold and the buy logic will be roughly similar. But there's one important thing here that needs to be highlighted: Enterprise Products Partners' business model. It is a midstream provider, which means it owns energy infrastructure like pipeline, storage, transportation, and processing assets. These are expensive items to build and acquire, but they generally throw off consistent cash flows. The key is that Enterprise charges customers for the use of its assets, acting as a toll taker.

That's not exciting, but the energy sector can't operate without the infrastructure that Enterprise owns. So long as oil and natural gas remain important to the world, Enterprise will have happy and willing customers. Note that, despite the energy transition taking place, oil and natural gas are expected to remain important for decades to come. And since Enterprise charges fees for the use of its assets, the price of oil and natural gas aren't really that important to its performance. If you like boring investments, Enterprise is the kind of holding you buy and hold for the long term.

Enterprise is a great option for income

Growth investors will dislike Enterprise Products Partners. Value investors, who haven't been addressed yet, will probably be mildly interested noting that the distribution yield is a touch above its 10-year average (but the MLP very clearly isn't on the discount rack right now). Dividend investors will be the group that is most attracted to this high-yield stock for the long list of reasons noted above. But most of all because Enterprise is reliable and financially strong.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has positions in Enbridge. The Motley Fool has positions in and recommends Enbridge and Kinder Morgan. The Motley Fool recommends Enterprise Products Partners and Tc Energy. The Motley Fool has a disclosure policy.