Is Polestar Automotive Stock a Buy?

Polestar Automotive (NASDAQ: PSNY), like all companies, wants to put its best foot forward when it reports earnings, which is why the lead headline in the second quarter of 2024 was an 82% sequential increase in deliveries. That sounds great, but if deliveries jumped 82% in just one quarter there's got to be a bigger story going on. The bigger story isn't great. Here's some key facts you need to know before you buy this electric vehicle (EV) stock.

1. Polestar is back in compliance

In mid-August, a Polestar press release said that it had "filed its Annual Report on Form 20-F for the fiscal year ended 31 December 2023 with the U.S. Securities and Exchange Commission. As a result, the Company has regained reporting compliance, meeting the requirements of Nasdaq Listing Rule 5250(c)(1)."

Being out of compliance means that a company is, for some reason, not living up to the exchange's expectations. In this case, the shortfall was obviously a failure to provide regulators with required financial statements. Polestar has also recently received a notice about its stock price falling below $1 per share, which is troubling, as well.

Image source: Getty Images.

The question is, why did the company delay its 20-F filing? (It's pretty obvious why it received a notice about its stock trading below $1.) According to a Securities and Exchange Commission filing by the company, it had to delay because it needed additional time for the "evaluation and quantification of certain errors in historical 2021 and 2022 annual and interim financial statements." These things happen, but when they happen to stocks that are trading near $1 a share you need to be extra careful.

2. Polestar revamped its leadership team

While the EV company has worked through its compliance issues, with both the SEC and the Nasdaq exchange, it also decided to turn over its top leadership, highlighting in the second-quarter earnings release that it hired a new CEO, head of design, and head of global communications. More recently the company brought in a new CFO. When a company massively overhauls its top brass, particularly when there have been accounting issues (see point No. 1), conservative investors should probably start looking elsewhere.

3. Polestar's quarterly results weren't great

After getting past the bullet points at the top of the second-quarter earnings report, which were largely positive highlights, investors got to see the financial statements. The story wasn't very good. Revenues were down 17% year over year in the quarter. The company explained that this was "mainly due to lower global vehicle sales and higher discounts." So it cut selling prices and still couldn't sell as many cars? That's a bad sign.

Gross profit fell from $900,000 to negative $2.4 million, which means the company is paying more to build its cars than it is generating from selling them. That is not a sustainable business model. So far, it looks like Polestar is a company that is struggling, even as it highlighted a large sequential increase in deliveries.

Meanwhile, research and development spending dropped a huge 76%. The company explained that the decline was because of changes in the capitalization and amortization of this expense as it began selling a new model. But, given the other issues going on, a glass-half-empty read here could be that the company is pulling back extra hard as it looks to save money and/or make the earnings picture look a little brighter. Time will tell on that front, but it is important to remember that R&D is something that you don't want to skimp on in the highly competitive auto industry. Which brings up point No. 4.

4. Polestar is still losing money

Polestar lost $242.3 million in the second quarter, a 12% improvement over the loss in the second quarter of 2023. That's good on the one hand, but a more realistic view would be that it is really just less bad.

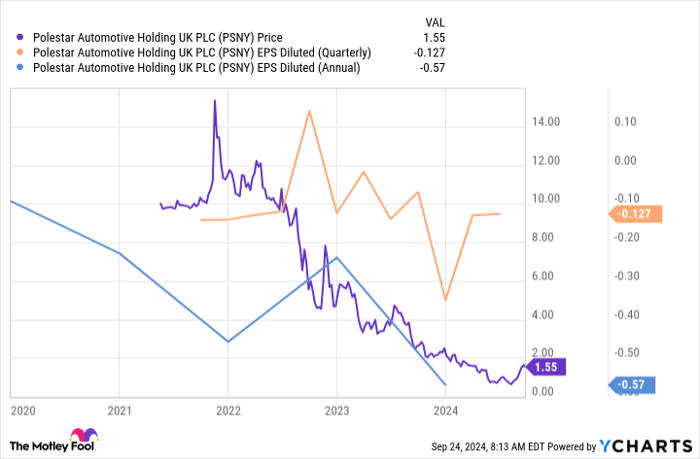

PSNY data by YCharts

Looking further back, meanwhile, Polestar has never had a profitable year. It is an upstart company, so that's not surprising. But when you add in accounting issues and massive management turnover, the company's story isn't a pretty one. Only a very aggressive investor will want to own these shares.

Polestar is a very risky stock

Polestar is one of a handful of upstart EV makers that is trying to break into the auto industry with all-electric vehicles. So far, the only company that has really managed to do that is Tesla. As the chart above highlights, investors were excited by Polestar's prospects early on, perhaps believing it could be the next Tesla. But given the ongoing negative news, Wall Street has soured on the shares, pushing them down roughly 90% from their high-water mark. Only the most aggressive investors should be considering Polestar today.

Should you invest $1,000 in Polestar Automotive Uk Plc right now?

Before you buy stock in Polestar Automotive Uk Plc, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Polestar Automotive Uk Plc wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.