Should You Buy CrowdStrike After the Security Outage?

CrowdStrike (NASDAQ: CRWD) stock has taken quite a tumble since its cybersecurity software caused a global computer outage on July 19. At their lowest point, shares had fallen nearly 40% in response to the incident, but they have since recovered and now sit only about 15% below their pre-outage price tag.

So, should you buy CrowdStrike while it appears to be on the mend?

CrowdStrike's software is still in high demand, even after its blunder

Prior to the outage, CrowdStrike was an undisputed leader in the cybersecurity space. Besides endpoint protection (which protects network access points like a laptop), it offers 28 modules that provide other defenses and capabilities on its Falcon platform. These products range from cloud security to identity protection, creating an all-encompassing cybersecurity product that is hard to switch away from once fully integrated.

Indeed, 65% of CrowdStrike's customer base used at least five modules as of the fiscal 2025 second quarter. This shows how integrated CrowdStrike's products have become with its client base, which is probably why the company didn't see a mass exodus of customers immediately following the outage. Furthermore, 48% of its largest clients (those with at least $100,000 in annual recurring revenue, or ARR) use eight or more modules.

The outage occurred in the final two weeks of CrowdStrike's fiscal second quarter (ended July 31), so its full effect on the business remains unclear. In June, management guided for $3.99 billion in total revenue (at the midpoint of its range) for fiscal 2025. After the outage, management decreased its outlook to $3.90 billion (also at the midpoint), just a 2.4% decrease.

This is a small change in the grand scheme of things, and management has a history of beating expectations and raising guidance.

Looking ahead, the next earnings report should shed more light on the fallout from the incident. If the backlash is still muted, CrowdStrike will have proved its resiliency and reinforced its position as an industry leader.

The stock is still expensive

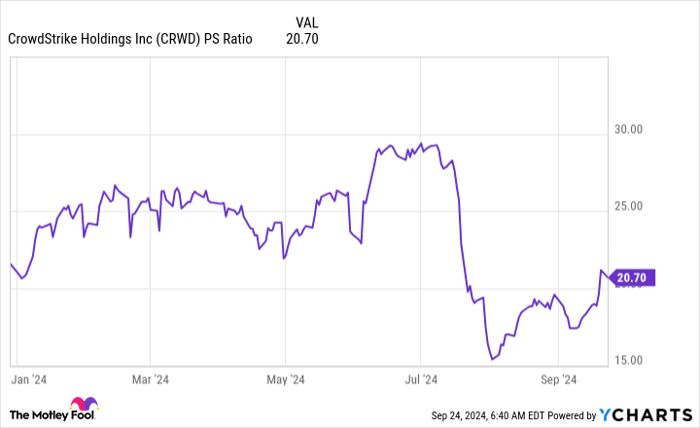

Because CrowdStrike has been a top cybersecurity stock for years, it commands a premium valuation. In fact, the stock was so expensive that even a 40% decline did little to make it a bargain -- its price-to-sales ratio never fell below 15.

Data by YCharts.

While the stock no longer trades for nearly 30 times sales, its current valuation is still expensive.

As far as investors can tell at this point, CrowdStrike is still growing quickly as its ARR rose 32% last quarter. Investors need to watch the fiscal third-quarter results to better understand the long-term implications the outage may have on CrowdStrike's business. However, don't be surprised if it continues to deliver strong results as demand for cybersecurity software has never been greater.

So, is CrowdStrike stock a buy here? It could be a good option for investors who don't have an existing position in a cybersecurity stock. CrowdStrike is still a top-tier choice in cybersecurity, and with massive tailwinds blowing in the industry's favor, it can still be a great long-term investment.

Should you invest $1,000 in CrowdStrike right now?

Before you buy stock in CrowdStrike, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CrowdStrike wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $743,952!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Keithen Drury has positions in CrowdStrike. The Motley Fool has positions in and recommends CrowdStrike. The Motley Fool has a disclosure policy.