1 Growth Stock Down 59% to Buy Right Now

Do you like buying good stocks at discounted prices? Most investors do. After all, why pay more for a stock worth owning when you can pay less? The key, of course, is figuring out which stocks are worth buying and holding when they go on sale.

To this end, while it's not necessarily a great fit for everyone's portfolio, risk-tolerant growth investors may want to consider stepping into a stake in computing technology name IonQ (NYSE: IONQ) while shares are still trading 59% below last September's peak.

The stock seems to be testing the waters of a recovery and doing so for all the right reasons.

A whole new (and better) kind of computing

Never heard of it? Don't sweat it. Most investors haven't. The company's only been around since 2015 and has only been publicly traded since 2021. Its modest $2 billion market capitalization doesn't exactly turn many heads either. Never even mind its lack of profitability.

Give it some time though. IonQ is already at where its industry is going. It's called quantum computing. In contrast with the billions of digital ones and zeros that modern-day, silicon-based computers routinely handle, quantum computers use quantum particles -- subatomic components of an atom -- as the basis for handling complex digital tasks.

This approach utilizes the unique physical attributes of the particles in question, allowing (in oversimplified contrast with conventional computers) a quantum computer's processor to calculate thousands of variables simultaneously. In turn, these platforms can process data many millions of times faster than your typical household computer can.

This sort of computing power could prove revolutionary for industries like drug development, cybersecurity, and a wide range of artificial intelligence (AI) applications. And it's not just a theoretical idea, for the record. IonQ is already commercializing such systems even as it continues to refine its technology.

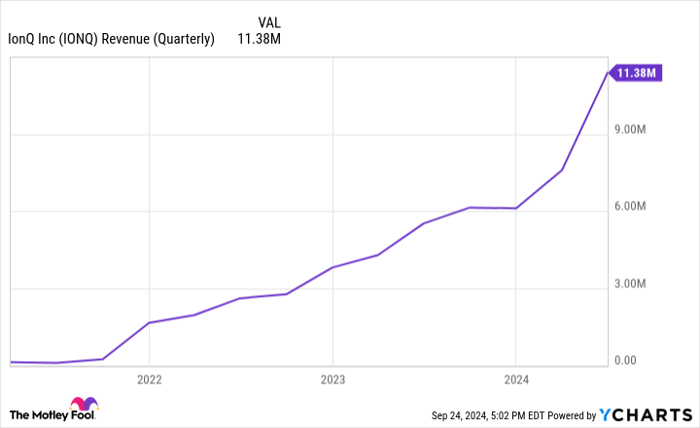

The company did $11.4 million worth of business during the second quarter of 2024, up 106% year over year as institutions wade deeper into nascent quantum computing waters. IonQ also upped its full-year, top-line outlook to around $40 million versus last year's total sales of $22 million.

IONQ Revenue (Quarterly) data by YCharts

IonQ is leading the charge

This still only scratches the surface of what awaits, however.

Don't hold your breath waiting for an at-home quantum computer. Not only are they impractical for everyday tasks like surfing the web or playing a video game, at several million bucks apiece, most of them are also too expensive for the average person to own.

But for institutions with higher-level needs and multimillion-dollar budgets, prices for IonQ systems -- or at least access to its technology -- are now reasonably affordable. Most investors underappreciate this affordability, just as they underappreciate how far along the company is in terms of commercial development.

For instance, when unveiled back in 2020, IonQ's 32-qubit (meaning 32 different quantum particles are simultaneously processing data) platform easily made it the world's most powerful but practical quantum computer commercially available at the time -- a lead the company arguably hasn't relinquished since then. IonQ also still believes it's on track to debut a usable commercial 64-qubit system sometime in 2025, which again will be game-changing for the industry.

And these aren't weak quantum particle systems simply slapped together for the sake of boasting higher qubit numbers. These systems have been and are expected to continue achieving 99.999% fidelity. In layman's terms, fidelity can be thought of as a lack of computing errors within quantum computing systems that aren't built around something as finitely binary as ones and zeros.

Fidelity in excess of 99% is generally considered strong enough for such work, since this relatively small number of errors can be identified and then corrected by the system itself. The last bit of fidelity IonQ is achieving that others aren't, however, is a bigger leap than it seems. It pushes its systems to the near-perfection that its paying customers would like to see for and from their complex processing work.

And there's certainly a growing number of paying customers and partners. The University of Maryland recently made a $9 million investment in IonQ in exchange for expanded access to its tech via the National Quantum Lab at Maryland. In August, the company announced it will be designing a new system for the federal government's Applied Research Laboratory for Intelligence and Security (or ARLIS).

The kicker: IonQ is the only true "pure play" investment within the quantum computing space.

IonQ stock may not be down much longer

It begs the question: If IonQ is so game-changing, why is the stock struggling? Not only is it down 59% for the past year, but shares are 77% below their late-2021 peak.

The answer is, most investors remain unfamiliar with quantum computing, just as they remain unfamiliar with the company leading this nascent market. Its lack of profits isn't helping much either.

That's ok though. In fact, it's arguably better for you. It means you're able to step in at what may be a bargain price before other people start connecting the dots and begin bidding this stock higher. In fact, the shares are acting as if they could possibly be ready to break out of the funk that dragged them down to last month's new 52-week low.

If so, investors may be seeing what market research outfit Precedence Research has been predicting for some time now. That's a quantum computing market set to grow at an annualized pace of 31% through 2034, turning a $1 billion market now into more than a $16 billion market at the end of the 10-year stretch. This outlook jibes with forecasts from McKinsey as well as SkyQuest. Given just how powerful these computing systems already are, that's a plausible growth outlook.

Of course, be sure you're ready for the above-average risk and above-average volatility this ticker brings to the table along with its above-average potential.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.