Better Rising Biotech: Viking Therapeutics vs. Summit Therapeutics

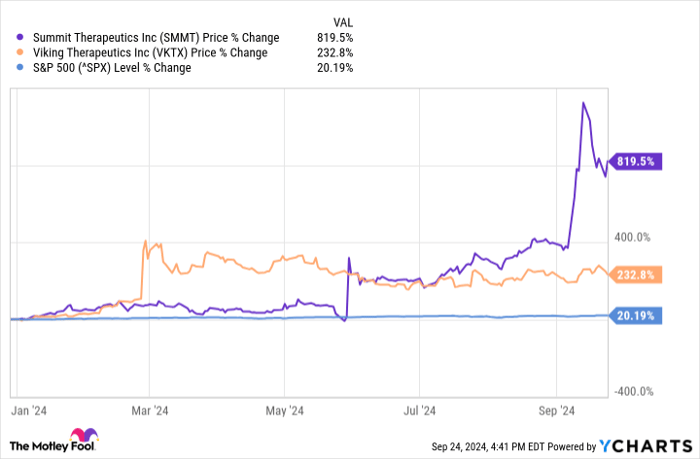

The market could potentially see the emergence of new biotech industry leaders. Since the year started, Viking Therapeutics (NASDAQ: VKTX) and Summit Therapeutics (NASDAQ: SMMT), two clinical-stage drugmakers, have seen their shares skyrocket. The reason? Both companies announced promising clinical progress for their leading pipeline candidates.

While there's still some way to go before launching their products, it's hard to argue with the results both Viking and Summit have already achieved. And if they can get that far, they could deliver excellent returns in the long run. But which one looks more attractive?

SMMT data by YCharts.

The case for Viking Therapeutics

Viking Therapeutics' leading pipeline candidate, VK2735, is a potential dual GLP-1/GIP medicine. Both classes of drugs help control satiety but with different mechanisms. Only one approved therapy combines these two categories: Eli Lilly's obesity medicine Zepbound, whose sales are growing at a dizzying pace. Could VK2735 be nearly as successful? In a phase 2 study, the medicine led to a 13.1% placebo-adjusted mean weight loss at the highest dose level in 13 weeks.

Though it still has to undergo a phase 3 clinical trial, VK2735's results were impressive enough to send Viking Therapeutics' shares through the roof. Some analysts have also predicted potential mouthwatering sales for the medicine. William Blair's Andy Hsieh projects potential peak sales of $21.6 billion, with roughly two-thirds of that total coming from the U.S. market. Yet it's important to keep in mind that the likelihood of medicines reaching annual sales of $20 billion is incredibly low.

Viking Therapeutics has other programs as well. The company is working on an oral version of VK2735 that also produced promising phase 1 results. Elsewhere, the company's VK2809 is a potential therapy for metabolic dysfunction-associated steatohepatitis. VK2809 passed phase 2 studies and is now moving forward. Viking Therapeutics should be running a pair of phase 3 studies within the next year.

If they are successful, and if its leading candidates go on to earn approval, expect Viking Therapeutics' shares to skyrocket even more.

The case for Summit Therapeutics

Summit Therapeutics is an oncology specialist with a potential jewel on its hands. The company's ivonescimab could become a multibillion-dollar cancer drug. In 2023, Summit Therapeutics signed a licensing agreement with ivonescimab's original developer, China-based Akeso Biopharma. Per their agreement, Akeso retains the rights to market ivonescimab in China, but Summit now owns licensing rights in the U.S., Europe, Canada, the Middle East, Japan, South America, Central America, the Caribbean, and Africa.

Summit dished out $474.9 million in cash and 10 million of its shares for the rights to ivonescimab in these regions. Summit will also pay Akeso development-related milestones and royalties.

It is worth noting that the medicine has already been granted approval in China. And it recently posted some impressive phase 3 clinical trial results. As Summit Therapeutics reported, an Akeso-led late-stage study of ivonescimab in China decreased the risk of disease progression or death by 49% compared to Merck's Keytruda in patients with non-small cell lung cancer (NSCLC) that express the PD-L1 protein. Keytruda is the leader in this market and the best-selling drug in the world. It generated $25 billion in sales last year.

Ivonescimab is the first cancer medicine to beat Keytruda in a head-to-head phase 3 clinical trial in NSCLC. Summit Therapeutics is planning phase 3 studies in the U.S. to support ivonescimab's approval in the regions where it owns the medicine's rights. Ivonescimab is also being developed across a range of other indications beyond NSCLC. Summit Therapeutics' future looks bright if everything evolves without a hitch.

The verdict

Viking Therapeutics and Summit Therapeutics have no products on the market, generate no revenue, and are unprofitable. It can be challenging for biotech companies with this profile to generate funding, but considering their recent clinical progress, it won't be a problem for either of these drugmakers. So, in my view, funding won't be much of an obstacle for Viking or Summit, at least for the foreseeable future. One way to decide which stock is the better option is their valuations. Viking Therapeutics' market cap is $6.86 billion.

Summit Therapeutics' is more than twice that at $17.39 billion. Summit is worth more partly because its leading candidate has already received regulatory approval in one country and has passed another phase 3 study. That said, at current levels, Viking Therapeutics likely has more upside potential, so more aggressive investors should consider that option. However, it also carries more risk. Summit Therapeutics is a safer bet, considering ivonescimab's already extensive existing clinical data.

Nevertheless, both stocks could fall off a cliff if there are setbacks to their leading programs. Invest accordingly.

Should you invest $1,000 in Viking Therapeutics right now?

Before you buy stock in Viking Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Viking Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Summit Therapeutics. The Motley Fool has a disclosure policy.