1 Incredibly Cheap Tech Stock That Could Soar 50% Thanks to Apple's Generative AI Move

Apple (NASDAQ: AAPL) recently jumped into the fast-growing market for smartphones capable of running generative artificial intelligence (AI) applications. Even though the latest iPhone models won't get the company's Apple Intelligence suite of features until October, the demand for its latest devices seems to be good.

JPMorgan analysts point out that the delivery time delays of Apple's new iPhones are expanding, which is a sign of healthy demand for these smartphones. Meanwhile, Dan Ives of Wedbush Securities said he believes that Apple could sell 90 million units of its new smartphones in 2024. That's up 8 million to 10 million units when compared to last year's release.

T-Mobile CEO Mike Sievert goes a step further, saying that the demand for iPhone 16 models is better than it was last year. All of this indicates that Apple could strike gold with its latest smartphones, and that won't be surprising as the market for generative AI smartphones is forecast to clock a compound annual growth rate (CAGR) of 78% through 2028, according to IDC.

Additionally, there is a huge installed base of 300 million iPhones that have not been upgraded in at least four years, according to Wedbush, and that could trigger a huge upgrade cycle as customers move to generative AI smartphones.

One way investors can take advantage of the robust sales of the iPhone 16 is by buying Apple stock. However, another company could ride Apple's coattails and deliver handsome gains thanks to the iPhone 16. Let's take a closer look at it.

This Apple supplier could get a nice boost to its bottom line

Qorvo (NASDAQ: QRVO) is a well-known supplier of radio frequency (RF) chips used in Apple's devices such as iPhones and iPads. The chipmaker is trying to diversify its customer base and supply chips to leading Android smartphone OEMs (original equipment manufacturers), but it still got 46% of its total revenue from Apple in the previous fiscal year.

As Qorvo's fortunes appear to be intertwined with Apple's, the sunny sales prospects of the latest iPhones bode well. Even better, Qorvo could be supplying more chip content for the new iPhones and thus making more money on each unit that Apple builds.

On its fiscal 2025 first-quarter earnings conference call a couple of months ago, Qorvo management remarked that the company is investing in several long-term programs with its largest customer to increase its content and grow its business further. What's more, a report by the Chinese newspaper Economic Daily News in April this year pointed out that Apple has changed the design of the antenna module for its latest iPhone generation, thereby incorporating more chips from Qorvo.

Not surprisingly, Qorvo's fiscal first-quarter results (for the three months ended June 29) impressed many. The company's Q1 revenue increased 36% year over year to $887 million. Non-GAAP earnings came in at $0.87 per share as compared to $0.34 per share last year. Qorvo completed the acquisition of Anokiwave in the fourth quarter of fiscal 2024, and that seems to have given the chipmaker's financial performance a nice boost. Investors should note that Apple is reportedly using Anokiwave's offerings in its latest iPhones to improve signal reception.

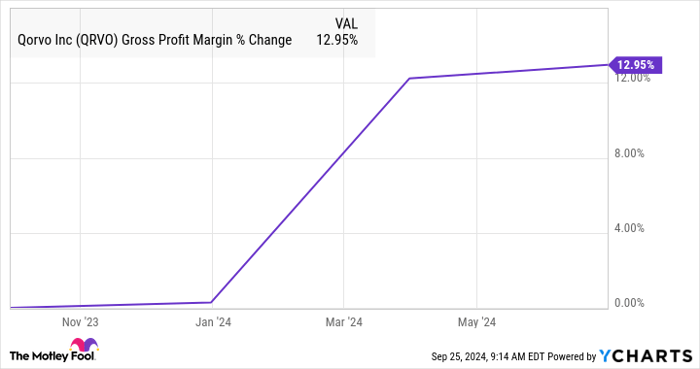

Qorvo, therefore, could benefit from a combination of stronger volume shipments and more revenue per unit from the new iPhone models. As a result, the margin improvement that Qorvo is seeing of late is likely to continue.

QRVO Gross Profit Margin data by YCharts

This improvement in the company's margin profile is expected to lead to healthy growth in the company's earnings over the next couple of years.

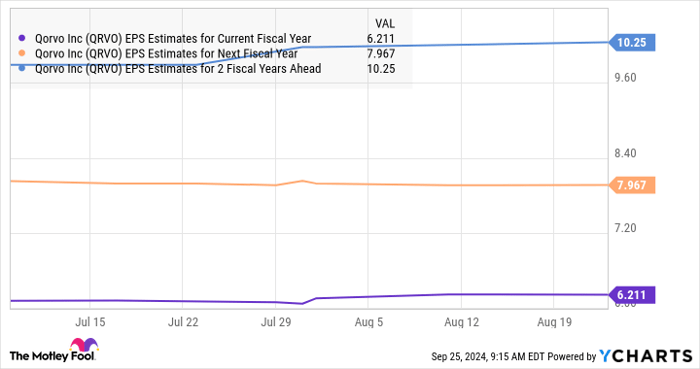

QRVO EPS Estimates for Current Fiscal Year data by YCharts

Investors can expect Qorvo stock to deliver solid gains

The chart above indicates that Qorvo's bottom line could increase at an annual rate of 28% in the next two fiscal years. Assuming Qorvo's earnings indeed jump to $10.25 per share after three years and it trades at 15 times forward earnings at that time (in line with its five-year average forward earnings multiple), its stock price could increase to $154. That would be a jump of nearly 50% from current levels.

Interestingly, Qorvo currently trades at 15 times forward earnings, a discount to the U.S. technology sector's average earnings multiple of 45. That's why investors should consider buying this undervalued semiconductor stock hand over fist, as the strong sales of Apple's iPhones are set to improve Qorvo's earnings power and could send its shares soaring over the long run.

Should you invest $1,000 in Qorvo right now?

Before you buy stock in Qorvo, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qorvo wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and JPMorgan Chase. The Motley Fool recommends Qorvo and T-Mobile US. The Motley Fool has a disclosure policy.