Warren Buffett's $9 Billion Warning to Wall Street Has Become Deafening

There's arguably not an investor on the planet who garners as much attention on Wall Street as Warren Buffett, CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B). The reason investors cling to the aptly named "Oracle of Omaha's" every word is because he's crushed the broad-based S&P 500 over a span of almost six decades.

Since ascending to the role of CEO at Berkshire Hathaway in the mid-1960s, Buffett has overseen a cumulative return in his company's Class A shares (BRK.A) that comfortably tops 5,400,000%. By comparison, the S&P 500 has returned around 38,000%, including dividends paid, over the same time frame. While this is a very respectable return in its own right, it doesn't hold a candle to Buffett's investing mastery.

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

Every quarter, investors eagerly await the filing of Berkshire Hathaway's Form 13F with the Securities and Exchange Commission (SEC). This is a required filing for institutions and large-scale investors with at least $100 million in assets under management that provides a snapshot of which stocks were purchased and sold in the latest quarter. A 13F allows investors to effectively mirror Buffett's buying and selling activity (after the fact).

While investors are predominantly seeking out Berkshire Hathaway's 13Fs and SEC filings for ideas on which stocks to buy, Warren Buffett's now-obvious warning to Wall Street has become absolutely deafening.

One of Wall Street's most optimistic investors is a decisive seller of equities

Whether it's been written in his annual letter to shareholders or stated during Berkshire Hathaway's annual shareholder meetings, Warren Buffett's message to the investment community has consistently been one of positivity and patience. He's frequently opined that investors should never bet against America, which is precisely why you won't see him or his investing lieutenants, Ted Weschler and Todd Combs, short-selling stocks or buying put options.

However, Buffett's optimism isn't blind. Although he fully understands that economic cycles aren't linear and the U.S. economy spends a disproportionate amount of time expanding, relative to contracting, he's not willing to chase stocks higher if he doesn't see value or can't locate plain-as-day bargains.

Over the previous seven quarters (Oct. 1, 2022 to June 30, 2024), Buffett has been a decisive net seller of equities to the tune of $131.6 billion. Although Berkshire won't file its 13F with the SEC for the September-ended quarter until Nov. 14, SEC Form 4 filings provide strong evidence that this net selling activity is set to continue for an eighth straight quarter.

On Sept. 24, Buffett's company filed a Form 4 showing that roughly 21.56 million shares of Bank of America (NYSE: BAC), worth about $862.7 million, were sold.

However, this sale of Berkshire Hathaway's third-largest holding by market value wasn't an isolated incident. Since July 17, Buffett has sold shares of Bank of America during 33 separate trading sessions, with the cumulative market value of these sales nearing $9 billion. A position that once stood at more than 1.03 billion shares owned has been whittled down to 814.35 million shares, as of Sept. 24.

It is possible that simple profit-taking is the motive behind this 21% reduction in Berkshire's stake in Bank of America over the last 10 weeks. Buffett offered his opinion during Berkshire's annual shareholder meeting in early May that corporate tax rates were likely going up in the future. Therefore, locking in sizable unrealized gains now is something investors can look back on and appreciate years down the road.

But there may be something far more menacing behind Buffett's aggregate $9 billion in sales of BofA stock.

Image source: Getty Images.

Stocks are exceptionally pricey and unattractive amid Wall Street's "casino-like behavior"

Let me preface what I'm about to say by reminding you that Warren Buffett is an unabashed long-term optimist. He strongly believes in the U.S. economy and realizes that bull markets on Wall Street last considerably longer than bear markets. It's why he's constantly on the lookout for price dislocations in time-tested businesses with well-defined competitive advantages.

In spite of this unwavering long-term optimism for the U.S. economy and the stock market, what Buffett does with Berkshire Hathaway's cash over shorter timelines isn't always going to perfectly align with what he preaches. As Buffett himself said, "Price is what you pay. Value is what you get."

As a deeply rooted value investor, the Oracle of Omaha won't overpay for equities. He'll simply sit on his proverbial hands and wait for the next emotion-driven event to create price dislocations he can take advantage of.

At the moment, the stock market is at one of its priciest valuations in history!

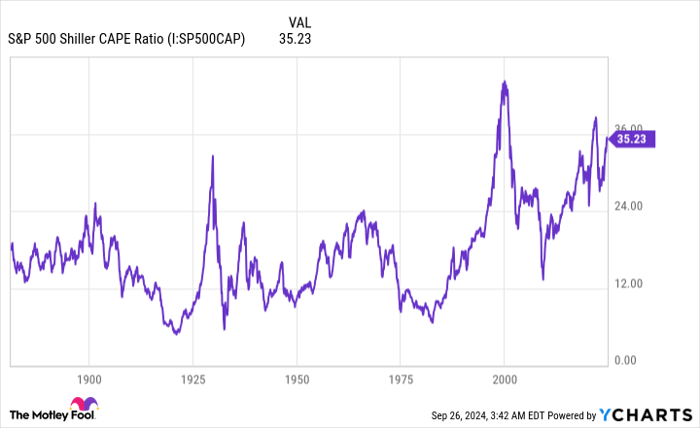

While there are a number of measures of "value," and value is ultimately a subjective term, the S&P 500's Shiller price-to-earnings (P/E) ratio does a particularly good job of illustrating just how outsized the current valuation is for stocks. The Shiller P/E ratio is also known as the cyclically adjusted price-to-earnings ratio, or CAPE ratio.

S&P 500 Shiller CAPE Ratio data by YCharts.

The Shiller P/E, which is based on average inflation-adjusted earnings over the prior 10 years, ended Sept. 24 at nearly 37. This is the third-highest reading during a continuous bull market dating back to January 1871, and is more than double its average reading dating back more than 150 years.

Over the last 153 years, there have only been six occasions, including the present, where the S&P 500's Shiller P/E surpassed 30 during a bull market rally. Following the previous five instances, the S&P 500 and/or Dow Jones Industrial Average eventually lost between 20% and 89% of their value. Although timing when the music will stop is impossible for investors to do, the lesson history offers is that stock valuations don't remain extended indefinitely.

Emotion-driven investing isn't helping, either. In Buffett's latest annual letter to Berkshire Hathaway's shareholders, he cautioned of the "casino-like behavior" that's now prevalent on Wall Street. Years of historically low interest rates, coupled with ease of access to information, has encouraged some retail investors to seek out volatility. This certainly clashes with Buffett's long-term ethos, which he promotes by purchasing an exorbitant amount of his own company's stock.

While Buffett won't sit on the sidelines forever, he's steadfast in his desire to get perceived value from his investments. Until such time as price dislocations become too tempting to ignore, we're liable to see the Oracle of Omaha paring down key positions, such as Bank of America, and building up Berkshire's $277 billion war chest.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.