2 Excellent Dividend Stocks to Buy With Less Than $200

Investing in dividend stocks is one of the best and easiest ways to generate excellent returns over the long run, particularly if you pick those with reliable histories of payout hikes.

Companies that can regularly boost their payouts over the long term generally have solid underlying businesses. Moreover, reinvesting your dividends can significantly boost your total returns over time. Despite these benefits, some outstanding dividend stocks can still be had for reasonable prices. Two of the more impressive ones that are currently trading for less than $200 per share are Abbott Laboratories (NYSE: ABT) and Johnson & Johnson (NYSE: JNJ).

Abbott Laboratories: $114 per share

Abbott Laboratories is a healthcare giant with products that span an array of therapeutic areas, from nutrition and diagnostics to cardiovascular health and diabetes care. Some of the company's brands are the leading names in their respective fields -- its infant formula Similac, for example, and its MitraClip, which helps treat mitral valve regurgitation (a heart-related condition).

In recent years, its FreeStyle Libre franchise of continuous glucose monitoring (CGM) systems -- which help diabetics keep track of their blood glucose levels -- has become a leader in its niche, and the company's main growth driver.

Abbott Laboratories recently expanded its CGM franchise with an over-the-counter option, and another one aimed at people who wish to monitor their blood glucose for other health reasons, but do not have diabetes. The point is that Abbott is an incredibly innovative company. It has been developing novel devices for decades, has a broad footprint in the healthcare industry, is a brand that physicians and consumers tend to trust, and has generally delivered reliable financial results. That's no guarantee that Abbott will perform well in the future, but the fundamentals of its business haven't changed.

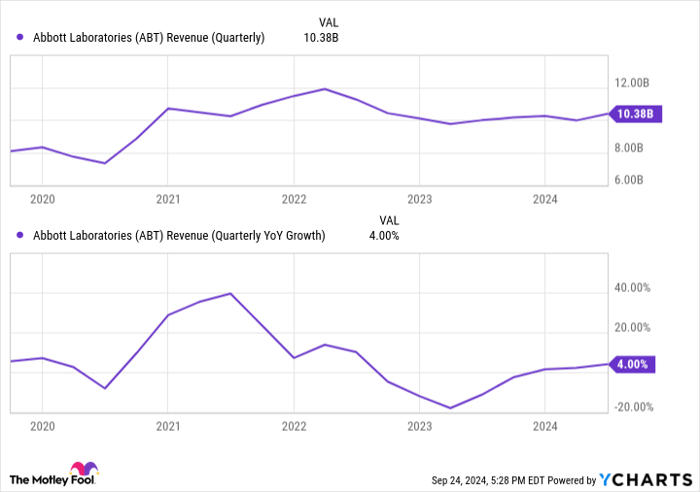

Abbott's top line has admittedly been somewhat inconsistent in the past few years as revenue from its COVID-19 diagnostic products rose and fell. But despite the impact of those shifts, the company has generally posted decent performance.

ABT Revenue (Quarterly) data by YCharts.

Further, this volatility won't affect Abbott forever. It's also worth noting that the healthcare giant has plenty of growth opportunities, particularly in diabetes care. The CGM market is severely underpenetrated -- Abbott estimates that just 1% of adults with diabetes in the world have access to CGM technology.

When it comes to dividends, Abbott has increased its payouts for 52 consecutive years, making it a Dividend King.

Unless something catastrophic delivers a huge blow to the company (and a pandemic wasn't enough), the company should maintain this streak.

Johnson & Johnson: $163 per share

Johnson & Johnson's legal and regulatory problems have somewhat overshadowed its business results during the past few years. On the legal front, it is still dealing with thousands of lawsuits from people who allege that its talc-based products caused their cancers. On the regulatory side, the Inflation Reduction Act has, for the first time, allowed Medicare to negotiate with pharmaceutical companies over the prices it will pay for some widely used drugs; this will lead to Johnson & Johnson receiving less revenue for a few of its products.

Those hurdles aside, though, the company has made important changes to its business. It spun off its consumer health segment, which was a drag on revenue growth. It also strengthened its medical devices segment through the $16.6 billion acquisition of Abiomed, which focuses on developing products for heart and lung-related issues.

Though not spectacular, Johnson & Johnson's financial results have remained solid. In the second quarter, its revenue increased by 4.3% year over year to $22.4 billion, while its adjusted earnings per share rose by 10.2% to $2.82. Though headwinds might affect its results in the short run, the company should be able to find ways to navigate through them.

Johnson & Johnson has been developing new drugs for a long time and has dealt with many different legal and regulatory landscapes. Its current pipeline features 101 programs. It routinely earns new drug approvals and label expansions for those it already has on the market, and it had a couple of such wins during the second quarter. It also made a trio of regulatory submissions. Johnson & Johnson's ability to continue developing new products is one of the most critical reasons its long-term prospects look strong.

Meanwhile, its dividend record is impressive. Johnson & Johnson is another Dividend King with a streak of 62 consecutive payout increases. The company should continue rewarding shareholders with dividend hikes for a long time.

Should you invest $1,000 in Abbott Laboratories right now?

Before you buy stock in Abbott Laboratories, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Abbott Laboratories wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Prosper Junior Bakiny has positions in Johnson & Johnson. The Motley Fool has positions in and recommends Abbott Laboratories. The Motley Fool recommends Johnson & Johnson. The Motley Fool has a disclosure policy.