Everyone Is Talking About Nike Stock. But Here's Why I Believe Another Shoe Stock Is a Better Buy

It's perhaps the most well-known athletic apparel brand in the world, and one of the biggest shoe brands, so almost everyone already knows about Nike (NYSE: NKE). But even though everybody knows about it, it seems like everyone is suddenly talking about it.

Nike is grabbing headlines because it suddenly and surprisingly made a change at the CEO position. After he led the company through the pandemic, Nike decided it was time for John Donahoe to go into retirement. In his place, Nike is bringing former executive Elliott Hill out of his retirement.

Nike has also been in the news due to an investment from billionaire Bill Ackman. The known value investor has a hedge fund called Pershing Square, which only had investment positions in seven companies earlier this year. But Ackman started a position in an eighth company by investing about $275 million in Nike.

Nike might be the talk of the town. But I prefer investing in shares of a different shoe stock today: Crocs (NASDAQ: CROX). Here's why.

Why I like Crocs stock better than Nike stock

Crocs is a shoe company comprised of its namesake brand and another brand called HeyDude. It doesn't necessarily have much growth right now -- net sales in the first half of 2024 were only up 5% from the first half of 2023. But it does beat Nike when it comes to its profit margin and the valuation of the investment.

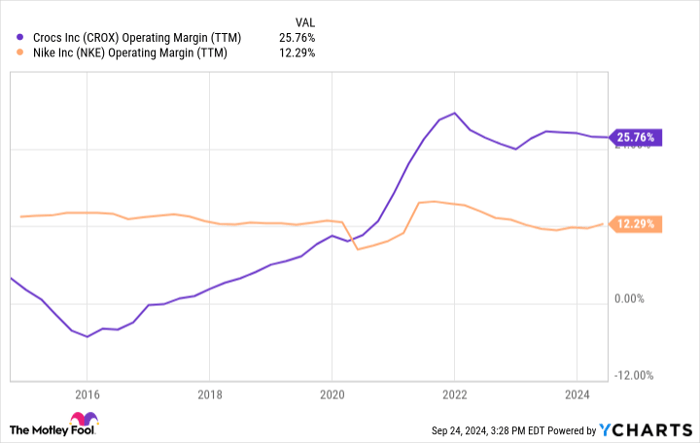

Nike's operating margin is currently about 12%, and there's nothing wrong with that. But this is about what investors should expect -- not much has changed in over a decade. In contrast, Crocs' operating margin has improved steadily since CEO Andrew Rees took over in 2017. It's presently holding steady at north of 25%, which is double the margin for Nike.

CROX Operating Margin (TTM) data by YCharts.

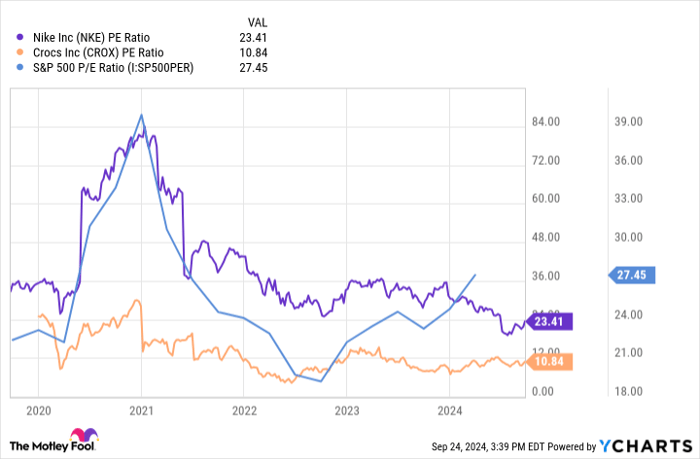

When it comes to valuation, there's been a lot said about how cheap Nike stock is relative to times past. And it's true: At 23 times its earnings, Nike stock has rarely been cheaper during the past decade. This valuation could partly explain why Ackman bought shares.

However, Nike stock doesn't represent a meaningfully lower value than the average for the S&P 500, as seen in the chart below. In contrast, Crocs stock does represent a significant value compared to the market average, since it trades at less than 11 times its earnings.

NKE PE Ratio data by YCharts.

My investment thesis for preferring Crocs stock over Nike stock is off to a good start. Crocs has better margins, and the valuation is cheaper.

Driving the point home

Some might point out that Nike is a special situation. After all, it just hired a new CEO who is very familiar with the industry and the brand. This could catalyze sales for Nike and send the stock soaring.

It's a fair point. But that positive outcome isn't guaranteed for Nike. Moreover, Crocs has its own special situation that many investors overlook.

Crocs acquired HeyDude in early 2022 for $2.5 billion. Things started well, but sales for HeyDude have dropped recently. Crocs is still growing as a whole, despite this headwind. But management believes it made some missteps that have only affected sales in the near term. According to management, growth for HeyDude will resume before the end of the year.

Rees recently said: "We're as confident and as enthusiastic about the brand as we were when we bought it." Therefore, while Nike has a potential catalyst for sales growth, Crocs has one too with HeyDude.

There is one more thing for investors to consider. I mentioned the valuations for Nike stock and Crocs stock for a reason. Both companies will likely be profitable in the long term. But it's fair to believe growth will be modest. This makes share repurchases a bigger part of the equation for shareholders.

In short, Crocs can repurchase more shares relative to Nike because its shares are cheaper. Assuming its impressive operating margin isn't a fluke, Crocs' management can more efficiently use profits to boost shareholder value with these buybacks.

The difference won't be noticed over just a quarter or two. But over years, this can make a big difference. All of these things contribute to my preference of Crocs stock over Nike stock today.

Should you invest $1,000 in Crocs right now?

Before you buy stock in Crocs, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Crocs wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Jon Quast has positions in Crocs. The Motley Fool has positions in and recommends Nike. The Motley Fool recommends Crocs. The Motley Fool has a disclosure policy.