ChargePoint: Buy, Sell, or Hold?

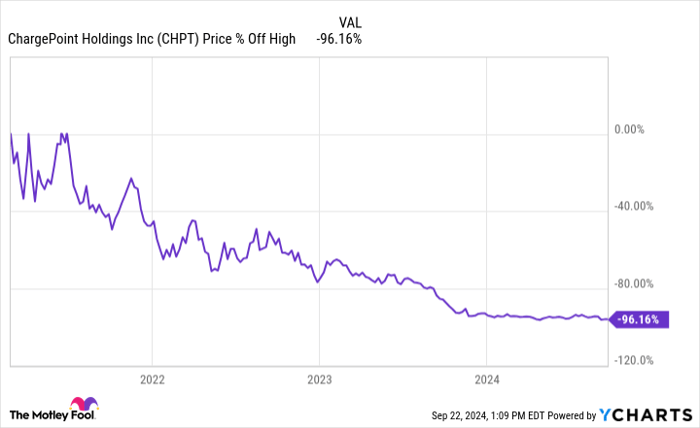

Wall Street loves a good story. However, sometimes, the story is better than the company, so you have to be careful when you invest in story stocks. ChargePoint Holdings (NYSE: CHPT) had a great story when it joined the public market in March 2021 via a reverse merger with a special purpose acquisition company (SPAC), and the stock posted some strong gains in the months that followed. Since then, though, it has fallen by more than 95% from its highs. Is this company a buy, sell, or hold today?

The buy case for ChargePoint

ChargePoint sells products and services that allow for the charging of electric vehicles (EVs). There's no question that infrastructure of the type it provides will be necessary to support the widespread adoption of EVs as the world shifts away from dirtier and carbon-emitting energy sources like gasoline. That's the big-picture narrative backing the company's long-term story.

CHPT data by YCharts.

To the company's credit, it has created a large business. Its reach spans across Canada, the United States, and Mexico, and it also has operations in 16 European countries. ChargePoint claims to have over 300,000 activated ports, and offers its users access to over 700,000 more via roaming through its deals with partners. That's a pretty big network of assets given the current level of EV adoption.

In fact, EV adoption is an important part of the long-term story here, too. According to the International Energy Agency, almost 14 million EVs were sold globally in 2023, up 35% from 2022. There are now around 40 million EVs on the street. More than 250,000 EVs are registered each week, more than the total number that were registered in all of 2013. Clearly, ChargePoint is tapping into a growing market. That's one reason you might want to buy the stock, even after its steep price decline -- or perhaps because of that decline.

The sell case for ChargePoint

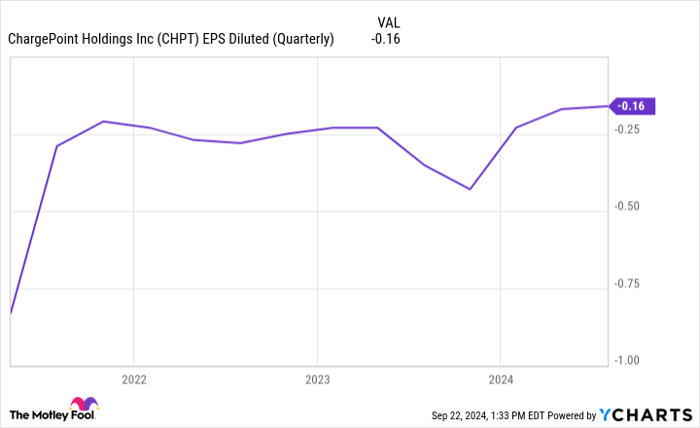

Although ChargePoint clearly serves a growing market, the investments required to build out charging infrastructure are huge. There's no quick, easy, or cheap way to get it done. Simply put, it's going to be a slow and steady grind. This makes sense, but there's a problem: ChargePoint is incurring large losses.

CHPT EPS Diluted (Quarterly) data by YCharts.

That's unlikely to change anytime soon. ChargePoint's gross profit in the second quarter was $25.5 million, but it spent $36.5 million on research and development. That's spending it really can't afford to cut. On top of those expenses, the company's selling general and administrative costs tallied up to nearly $52 million. The company has $240 million worth of cash on its balance sheet, but that's only going to last so long.

If that makes the stock sound like a bit of a risky proposition to you, well, you'd be correct. ChargePoint would not be an appropriate pick for conservative investors, nor for those with weak constitutions.

The hold case for ChargePoint

Most investors are likely to fall firmly into either the buy or sell camp at today's share price. However, if you bought the stock when it was trading at much higher prices, you have some serious thinking to do. You could harvest your losses in it now to offset taxable gains you've booked elsewhere in your portfolio this year. That's a big-picture portfolio-level decision. From a company-specific point of view, you need to consider how long you think it will take before you could get back in the black on your investment. It could be years. Selling would allow you to put money to work in investments with stronger profit profiles instead.

On the other hand, you may be down so far on paper that selling the stock and locking in those losses wouldn't be worth it. How much further could the stock fall, anyway? The answer is all the way to zero, but maybe you still believe that ChargePoint will eventually deliver on its thesis profitably and turn its stock into a long-term winner from here. There's no harm in sticking it out, so long as you understand that the financial results here are hard to read, and likely won't get much better anytime soon.

ChargePoint is a risky investment even after a big price decline

If there's anything an investor should take away from this review, it's that ChargePoint stock is risky. The company is not doing well financially, and even the huge growth opportunity it possesses in the EV charging space may not be enough to turn its stock around. Only the most aggressive investors should buy it or hold it.

Should you invest $1,000 in ChargePoint right now?

Before you buy stock in ChargePoint, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ChargePoint wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.