Casino Stocks Were the Big Winners This Week

Shares of casino stocks with exposure to Macao had a great week this week after China announced economic stimulus plans.

According to data provided by S&P Global Market Intelligence, shares of Melco Resorts & Entertainment (NASDAQ: MLCO) jumped as much as 31.5%, Las Vegas Sands (NYSE: LVS) was up 22.2%, and Wynn Resorts (NASDAQ: WYNN) rose 21.9% this week. The three stocks were up 30.3%, 21.7%, and 21.3% respectively as of 2 p.m. ET on Friday.

Image source: Getty Images.

China's stimulus plans

The Chinese government said this week it would implement "necessary fiscal spending" to get the country's economy on track to meet a 5% GDP growth goal. The plan is to reduce reserves banks must hold, cut interest rates, and provide loans for investors to buy stocks.

In total, the package could be over $300 billion, but economists don't think it will move the needle much for the Chinese economy.

Macao overlooks questions about stimulus

Economists may not think the stimulus is enough to drive change, but that didn't stop investors this week who were looking for any way to get exposure to China's potential growth. Macao clearly offers that.

Macao has seen steady growth over the past two years and stocks have been relatively undervalued. So far this year, gambling revenue in Macao is up 33.4% and has grown double digits every single month.

Macao's value stocks

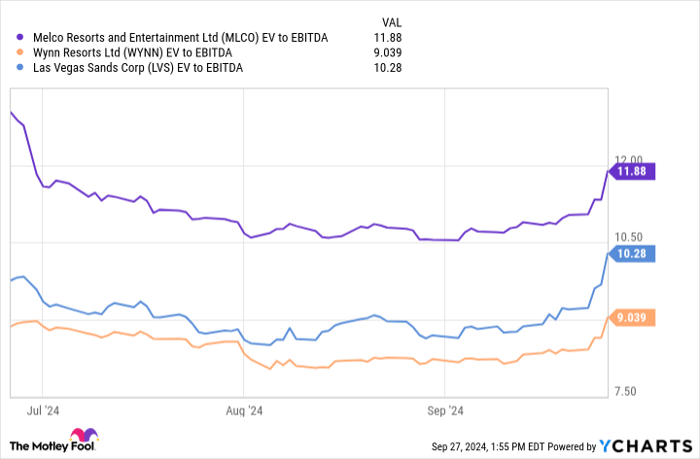

Before this week's pop, each of these three stocks was trading at a very attractive enterprise-value-to-EBITDA multiple at or around 10x and that hasn't priced in all of the recent growth in Macao. It's likely the market saw these stocks as values if China's economy grows and gamblers have more money to spend in Macao.

MLCO EV to EBITDA data by YCharts

While China doesn't drive all of Macao's visitation, as a special administrative region of China with 2.4 billion people within a five-hour flight of the gambling hotspot, it relies heavily on China for business.

When China's travel was shut down amid COVID-19 concerns, Macao suffered, and this could be a continued reversal of that downtrend.

What's real and what's not?

It'll take many months for any stimulus to flow through China and make its way to Macao. The biggest short-term impact would be some profit-taking on stocks that are up this week and taking a short trip to Macao to celebrate. But those numbers will be small.

I think the long-term focus should be on the value these stocks traded at and what management is doing with those funds. There aren't many new opportunities to grow in Macao or other parts of Asia, so companies like Las Vegas Sands and Wynn Resorts have reduced debt and bought back stock with excess cash. Melco Resorts has done less of those buybacks but is also looking to return cash to shareholders.

If the bounce in revenue comes, that would be great for stocks, but I think this week's move will end up being noise long-term. The more important numbers will come next month when investors learn what earnings look like and assess how management is using its cash in the current market.

Should you invest $1,000 in Wynn Resorts right now?

Before you buy stock in Wynn Resorts, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Wynn Resorts wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Travis Hoium has positions in Melco Resorts & Entertainment and Wynn Resorts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.