Should You Buy W.P. Carey While It's Below $65?

It is not a good start to a year when one of the first things you hand investors is a dividend cut. That's exactly how W.P. Carey (NYSE: WPC) began 2024, with a 20% dividend cut. But there's an interesting thing about that 20% number and what came after it. Here's why you might want to buy this dividend-cutter while its shares are below $65 and the dividend yield is above 5.5%.

The bad news was announced in 2023 by W.P. Carey

In late 2023 W.P. Carey, a real estate investment trust (REIT), said that it would exit the office sector in one swift move. It was basically ripping the Band Aid off after years of letting its exposure to office assets shrink as a percentage of the overall portfolio. But offices still made up about 16% of rents when it made the decision. That's too much rental income to jettison at once without cutting the dividend.

Image source: Getty Images.

On top of that, the REIT's largest tenant had decided to exercise its right to buy the properties it was leasing. Before that sale, U-Haul made up 2.6% of W.P. Carey's rents. Add 2.6% to 16% and you get around 18.6%, which is just about the 20% dividend cut that W.P. Carey made. That's back-of-the-envelope math, of course, but there's a correlation here.

It is pretty clear that these transactions resulted in some near-term pain for shareholders that had come to rely on the dividend. And now that the company has pretty much taken care of the change in direction, it has to earn back investor trust.

Dividend increases are back on track at W.P. Carey

To management's credit, it started on that project right away by raising the dividend the next quarter after the cut. It has now increased the dividend three quarters in a row, which shows that it has quickly returned to the quarterly dividend increase cadence before the cut. That's a statement to investors that this was a reset, not a sign of long-term weakness.

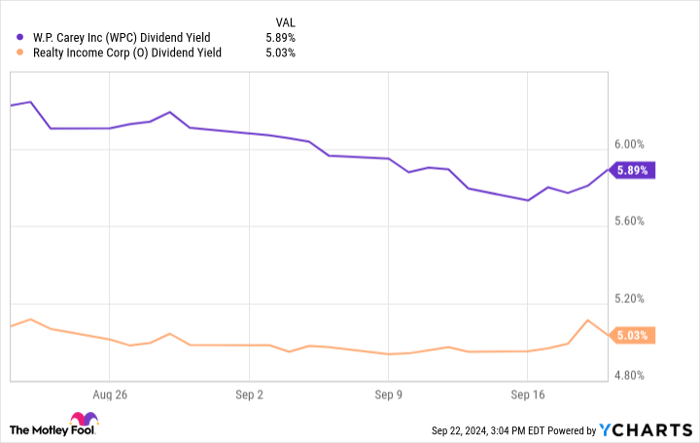

WPC Dividend Yield data by YCharts

Meanwhile, all of those asset sales have left W.P. Carey sitting on a lot of cash. At the end of the second quarter, cash stood at a little more than $1 billion. On top of that, the REIT had $2 billion available on its undrawn revolving credit facility. Total liquidity was $3.2 billion, an all-time high for W.P. Carey. Management is now going to shift from shrinking the property portfolio to expanding it, which should lead to more dividend growth in the future -- and, perhaps, a higher valuation once investors start to trust the REIT again.

There's a new tailwind here as well, thanks to the Federal Reserve, which appears to have shifted from a restrictive monetary stance to a more accommodating one. Lower interest rates, such as the sizable 50 basis point (0.5%) cut earlier this month, make debt less costly. That, in turn, should make it easier for W.P. Carey to profitably invest its cash and expand its business.

Wall Street isn't quite ready to forgive W.P. Carey

Realty Income is the largest net lease REIT (net lease tenants bear most of a property's maintenance costs and taxes) and it has a dividend yield of about 5%. W.P. Carey is the second-largest net lease REIT, has many similarities to Realty Income (including geographic and property type diversification), and its yield is 5.5% because its stock is less richly valued than Realty Income's. However, as W.P. Carey starts to rebuild its portfolio there's a good chance that discount will shrink as investors start to trust the REIT again.

Should you invest $1,000 in W.P. Carey right now?

Before you buy stock in W.P. Carey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and W.P. Carey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.