Here's How the Fed's Big Rate Cut Could Affect These 2 Artificial Intelligence (AI) Stocks

Go big or go home. That seemed to be the Federal Reserve's mantra as it sliced the benchmark rate by 0.5%, the largest since the pandemic started and more than the 0.25% many anticipated. It expects to continue cutting the rate this year and in 2025. This has major implications for the economy and stocks. Lower rates give companies easier access to capital and generally increase the value of stocks. When Wall Street values companies' future earnings (called discounted cash flow analysis), lower rates increase valuations.

All of this has implications for artificial intelligence (AI) companies. Here are a few examples.

Is SoundHound AI a buy now?

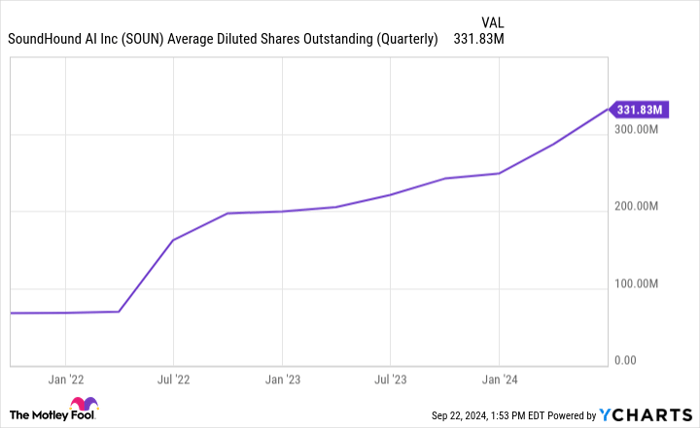

It's hard to overstate the positive effect that low rates can have on small, cash-strapped companies like SoundHound AI (NASDAQ: SOUN). SoundHound financed its recent growth primarily by issuing stock, which dilutes existing shareholders. As shown below, the share count exploded during the past couple of years.

SOUN Average Diluted Shares Outstanding (Quarterly) data by YCharts

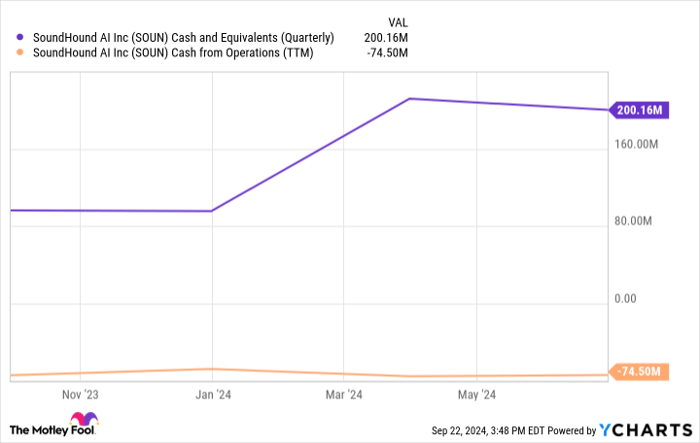

The conversion and sale of shares allowed SoundHound to build a war chest of $200 million as of the second quarter; however, as you can see below, the company burns a lot of cash from operations.

SOUN Cash and Equivalents (Quarterly) data by YCharts

The cash burn is normal for a small, fast-growing company, so easier access to capital through lower interest rates is crucial.

Many fast-food and fast-casual restaurants are moving toward AI-powered voice recognition and conversational software to automate ordering. Automotive companies are also implementing cutting-edge conversational intelligence in vehicles, and many brands, such as White Castle, Jersey Mike's, Hyundai Motor, and Honda Motor, use SoundHound's software.

SoundHound reported $13.5 million in revenue in Q2, a 54% gain from a year earlier. The company forecast $80 million in revenue for 2024 and has a market cap of $1.8 billion, or 24 times estimated sales. The stock is not cheap, considering that SoundHound is unprofitable; however, the market potential is gigantic. SoundHound pegs its addressable market at more than $140 billion and expects sales to hit $150 million in 2025. This huge growth potential has many investors salivating, making SoundHound a buy for speculative investors.

Is Palantir stock overvalued?

Many companies and defense departments turn to Palantir (NYSE: PLTR) when considering tabulating, visualizing, and using data to make informed decisions. Palantir's latest product is its new AI platform, AIP. It harnesses generative AI to help customers optimize decision-making with a conversational interface. Palantir relies to a great extent on government contracts but it is focused on expanding its commercial business. Lower interest rates can help.

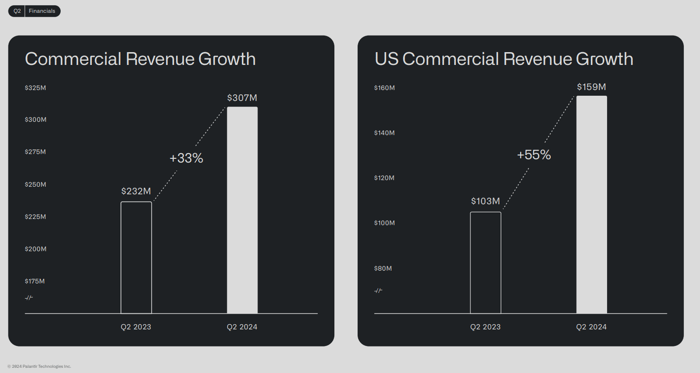

Lower rates can spur companies to invest in products from businesses like Palantir since credit is less expensive, and low rates accelerate economic activity. This can further Palantir's already robust commercial growth. In Q2, commercial growth was stellar, while U.S. commercial growth was even better, as you can see below.

Image source: Palantir.

The rate cuts are another tailwind here.

Palantir has silenced doubters in other ways recently, especially by swinging to profitability. It hit $678 million in sales last quarter and was profitable for the seventh straight quarter with $134 million in net income (its highest ever). These results and enthusiasm for AI pushed the stock near all-time highs. But has it gone too far?

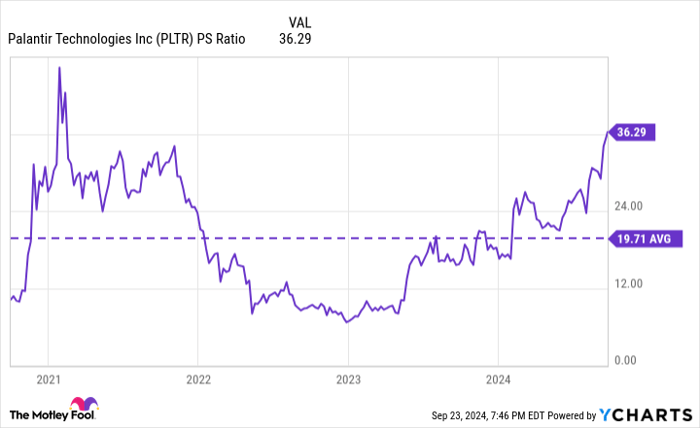

The stock trades at 36 times sales, which, as shown below, is well above its historical average and approaching the bubble valuation of 2021.

PLTR PS Ratio data by YCharts

The valuation drops to 31 times sales on a forward basis, but this is still very rich. Palantir is a terrific company with a tremendous future (and rate cuts should help), but the valuation is too high for my money right now.

Should you invest $1,000 in SoundHound AI right now?

Before you buy stock in SoundHound AI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoundHound AI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Bradley Guichard has the following options: long January 2025 $2 calls on SoundHound AI. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.