JPMorgan Chase Just Hiked Its Payout by 9%. Is This a Great Dividend Stock?

JPMorgan Chase (NYSE: JPM), the country's largest bank by assets, recently declared a third-quarter dividend of $1.25, a roughly 9% hike. Banks are generally known as good dividend-paying stocks, and JPMorgan Chase is one of the most profitable large banks. It has grown its payout significantly over the last decade.

Is this a great dividend stock? Let's take a look.

A growing dividend

JPMorgan's $1.25 quarterly dividend equates to an annual total of $5. Based on the share price as of Sept. 23, which was near all-time highs, that results in a 2.37% dividend yield.

That's certainly not bad, but generally, I would like to see a 3% yield or higher to call it a good dividend stock. That said, JPMorgan is highly profitable and has been growing its dividend significantly, so it's certainly possible that it could get to a 3% yield in the not too distant future.

Since JPMorgan Chase was formed in 2000, it has paid a dividend every year, although it was cut significantly in 2009 and 2010. This was common for banks following the Great Recession. Since bottoming in 2010 at $0.20, JPMorgan has grown its annual dividend to a projected $5.

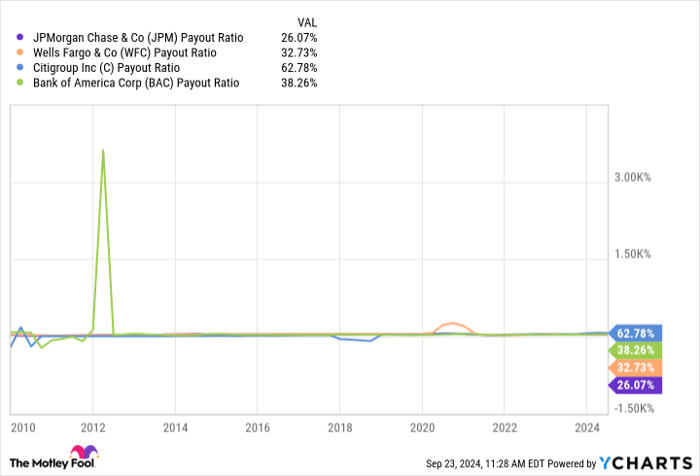

The payout ratio is a good place to start when looking at a bank's ability to grow its dividend. As you can see below, JPMorgan has the lowest payout ratio among its peers at 26%. Banks will typically pay in the 30% to 40% range.

JPM payout ratio; data by YCharts.

When evaluating a dividend, other good places to look are a bank's earnings and excess capital, which it needs for capital distributions. When looking at analyst earning projections in Visible Alpha, a financial analysis software platform, the consensus as of Sept. 23 was that diluted operating earnings per share will come down about 8 cents next year and then move significantly higher in 2026 and 2027.

As for excess capital, JPMorgan had a common equity tier 1 (CET1) capital ratio of 15.3%. The CET1 looks at a bank's ratio of core capital to risk-weighted assets such as loans. Banks use excess capital as a reserve for loans (so they need it to grow) and to pay dividends and make share repurchases.

Regulators set annual CET1 requirements for the largest banks in the U.S. JPMorgan's requirement for 2025 is 12.3%. So the bank has roughly $53 billion of excess capital based on risk-weighted assets at the end of the second quarter.

With a $1.25 quarterly dividend, JPMorgan will pay out roughly $3.6 billion in dividends per quarter, or nearly $14.5 billion a year. But keep in mind this is coming out of the $45 billion to $55 billion in earnings it is going to have each year, so the bank won't have to touch any excess capital. But even if it somehow did, it has enough to cover the annual dividend for at least four years.

It should grow into a good dividend

I suspect JPMorgan Chase will continue to grow its dividend and that it will eventually surpass a 3% yield. The bank has plenty of excess capital and strong earnings. The other thing to consider is that the stock is expensive right now, which makes share repurchases less appealing.

JPMorgan Chase will want to get its payout ratio into that 30% to 40% range to be more in line with peers, I believe. Ultimately, I think it is a good dividend stock. It's not the highest yield you'll find, but the company can easily pay its dividend and has plenty of room to keep growing it.

Should you invest $1,000 in JPMorgan Chase right now?

Before you buy stock in JPMorgan Chase, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Chase wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $756,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Citigroup is an advertising partner of The Ascent, a Motley Fool company. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and JPMorgan Chase. The Motley Fool has a disclosure policy.