2 Stocks Down 40% and 16% to Buy Right Now

With Halloween on the horizon, kids are choosing their creepy costumes and horror film fans are revisiting their favorite creature features. One area where there is little fear to be found, though, is the S&P 500, which has risen 20% since the start of the year. The S&P 500's climb reflects the overwhelming enthusiasm of bulls who seem to be far from afraid that the market will fall in the near future.

Some stocks, however, have failed to capture the attention of optimistic investors. Lithium production specialist Albemarle (NYSE: ALB) and logistics powerhouse GXO Logistics (NYSE: GXO) have experienced notable downturns in 2024.

Despite the declines in these stocks, two Fool.com contributors think that shares of Albemarle and GXO Logistics stocks can bounce back and deliver strong returns for investors in the days ahead.

Lithium stalwart Albemarle is down for the year, but it'd be unwise to count it out

Scott Levine (Albemarle): Lithium prices have fallen precipitously from the highs they reached when exuberance for electric vehicles (EVs) was pervading the markets a couple of years ago. Albemarle, a leader in lithium mining, has seen its stock similarly struggle, falling 40% year to date. But while some stock declines reflect valid concerns that a company has entered perilous territory, this is hardly the case with Albemarle. Consequently, investors have a great opportunity to pick up a tried-and-true dividend stock at an attractive price.

Take a cursory glance at Albemarle's financials, and it's understandable why some investors have decided to click the sell button this year. In the second quarter of 2024, for example, Albemarle reported net sales of $1.43 billion, a 40 year-over-year decline, and diluted earnings per share (EPS) of negative $1.96, a far cry from the diluted EPS of $5.52 that the company reported for Q2 2023.

Experienced investors, however, recognize that the decline in the price of lithium was expected as the sky-high prices were hardly sustainable. Like the situation with any commodity, when lithium prices rise sharply, they're bound to fall sharply as well.

But the long-term story for lithium remains strong -- despite some near-term volatility in the pricing of the metal. Albemarle, for example, projects that demand for lithium carbonate (the form of lithium used in battery production) equivalent will rise at a 15% to 20% compound annual growth rate from an estimated 1.3 million metric tons in 2024 to 3.3 million metric tons in 2030.

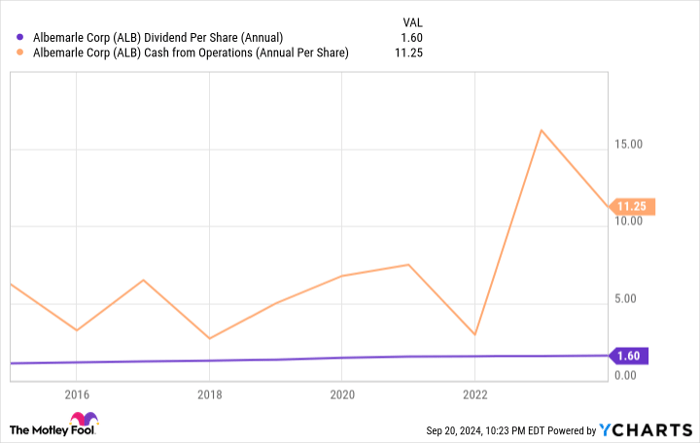

With a history stretching back to 1887, Albemarle has seen its share of upticks and downturns in lithium prices, and it has continued to thrive. In fact, the company has hiked its dividend for the past 30 consecutive years -- no small feat for any company. And despite its recent challenges, it continues to generate strong operational cash flow to support its dividend.

ALB Dividend Per Share (Annual) data by YCharts.

For those comfortable with riding out some near-term volatility -- and eager to procure some passive income while they do it -- Albemarle stock (and its 1.9% forward yield) provides a great opportunity right now.

Long-term trends remain favorable for GXO

Lee Samaha (GXO Logistics): Outsourcing contract logistics is a long-term growth market that's going through a temporary lull, and the 16% dip in GXO's share price this year is a buying opportunity. The company specializes in solving its customers' increasingly complex supply chain requirements so they can focus on their core business.

Given the long-term growth of e-commerce, it's an increasingly important service. In addition, significant advances in warehouse technology (automation, robotics, smart AI-powered facilities, etc.) are only increasing the value of outsourcing it to specialists like GXO.

That's the long-term growth story, and it's a compelling one. Still, GXO continues to work through a temporary weakness. Organic revenue increased by just 2% in the recent second-quarter report. The slowdown is due to a unique set of circumstances that's unlikely to repeat anytime soon.

In a nutshell, the distortions caused by the COVID-19-related lockdowns caused a surge in investment in e-commerce facilities, which is being corrected now as companies' capability can meet demand. In addition, the supply chain issues (mainly due to the lockdowns) caused extended product lead times (meaning it took longer to deliver products to distributors/manufacturers), resulting in distributors/manufacturers building up inventory to ensure they had enough on hand to meet demand.

However, with a slower economy in 2023 and 2024, customers are focused on running down their inventory. Following the previous boom in spending, they haven't been in a hurry to invest in e-commerce warehousing.

That's starting to change now. GXO management noted it signed $270 million in business wins in the second quarter and that its pipeline grew to $2.3 billion, a new 12-month high. "And we're on track to sign a record amount of new business this year," management said.

As such, it could be a great time to pick up some stock in GXO Logistics.

Is today a good day to buy Albemarle and GXO Logistics?

Without the aid of a crystal ball, we have no idea when shares of both Albemarle and GXO Logistics will head back north, but hopeful signs exist for both stocks. For those seeking EV exposure -- and who are interested in generating some passive income -- Albemarle is a powerful choice with its dominant market position. Those interested in a compelling logistics choice, on the other hand, will want to dig deeper into GXO Logistics -- especially with the strong increase in its pipeline, suggesting that growth is around the corner.

Should you invest $1,000 in Albemarle right now?

Before you buy stock in Albemarle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Albemarle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool recommends GXO Logistics. The Motley Fool has a disclosure policy.