Is Energy Transfer Still a Buy After Its Nearly 20% Rally?

Energy Transfer (NYSE: ET) has rallied nearly 20% this year. Add in the master limited partnership's (MLP) high-yielding distribution, and the total return is up to 25%. That has outperformed the S&P 500's total return of more than 20%.

While the MLP might not be as cheap as it was to begin the year, it should still have plenty of fuel to grow value for its unitholders in the future. Here's why it still looks like a compelling buy after its rally, especially for those who want to collect a lucrative and growing passive income stream.

What fueled Energy Transfer's surge?

Energy Transfer is having a strong year. Its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) increased 20% in the second quarter to almost $3.8 billion. Meanwhile, its distributable cash flow surged 32% to over $2 billion.

Several factors helped fuel its robust growth. The biggest catalyst has been acquisitions. Energy Transfer closed its $1.5 billion acquisition of Lotus Midstream last May and followed it up with its $7.1 billion merger with fellow MLP Crestwood Equity Partners in November. Those highly accretive deals helped fuel record volumes across several categories during Q2. The MLP also benefited from strong market conditions and recently completed organic expansion projects.

Energy Transfer's growing cash flow has enabled it to increase its distribution. Its payout is up more than 3% over the past year.

Meanwhile, its growing earnings and excess free cash flow have strengthened its financial profile. Energy Transfer's leverage ratio is now in the lower half of its 4.0 to 4.5 times target range.

That strong financial profile has enabled the company to continue expanding. It recently closed its highly accretive $3.1 billion acquisition of WTG Midstream. It also formed an accretive joint venture with affiliated MLP Sunoco LP to combine their crude oil and produced water assets in the Permian Basin. As a result, the MLP is on track to grow its adjusted EBITDA by more than 12% at the midpoint to over $15 billion this year.

Plenty of fuel to continue growing value

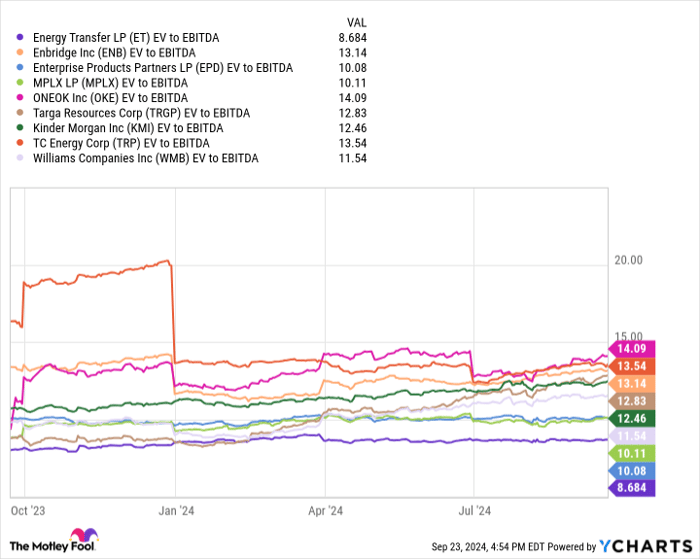

Despite its surging unit price, Energy Transfer still trades at a bottom-of-the-barrel valuation compared to its midstream sector rivals.

ET EV to EBITDA data by YCharts.

It's even cheaper when looking at its forward enterprise value (EV) to EBITDA multiple (less than 8.0 times compared to 9.5x-12x for its peer group). That low valuation is why it has such a high distribution yield (nearly 8%).

There's no reason for Energy Transfer to have such a low valuation. The MLP has significantly improved its financial profile in recent years, evidenced by a leverage ratio trending toward the low end of its target range. Meanwhile, its earnings are growing briskly, fueled by its consolidation strategy and organic expansion projects.

It has enhanced its growth profile by acquiring WTG Midstream and securing additional expansion projects. It expects to invest $3 billion to $3.2 billion on growth capital projects this year. That's up from less than $2 billion last year. It's also higher than its initial forecast for capital spending of between $2.4 billion and $2.6 billion (and above the high end of its $2 billion to $3 billion target long-term investment rate).

Energy Transfer's capital project backlog gives it growth visibility through 2026. Meanwhile, it has several additional expansion projects under development, including lower carbon energy opportunities like carbon capture and storage and blue ammonia. On top of organic growth, Energy Transfer has the financial flexibility to continue making accretive acquisitions.

The MLP's growth drivers will give it the fuel to continue increasing its high-yielding payout. It's aiming to boost its distribution by 3% to 5% per year. Given its current yield, it could deliver total returns above 10% annually if it grows its cash flow per share at that rate. Meanwhile, there's ample upside potential if it continues to grow at an elevated rate and its valuation rises closer to its peer group average.

The fuel to potentially produce high-octane total returns

Energy Transfer's unit price has surged this year, fueled by its accelerating growth rate. Despite that rally, it still looks like an attractive investment opportunity, given its low valuation, high yield, and growth profile. While the MLP sends its investors a Schedule K-1 Federal Tax Form each year (which can complicate tax filing), its income and upside potential can make it well worth the hassle.

Should you invest $1,000 in Energy Transfer right now?

Before you buy stock in Energy Transfer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Matt DiLallo has positions in Enbridge, Energy Transfer, Enterprise Products Partners, and Kinder Morgan. The Motley Fool has positions in and recommends Enbridge and Kinder Morgan. The Motley Fool recommends Enterprise Products Partners, Oneok, and Tc Energy. The Motley Fool has a disclosure policy.