Luminar Technologies Surged Today on Potential Trade Protections

Shares of Luminar Technologies (NASDAQ: LAZR) jumped as much as 17.9% in trading on Tuesday after news broke that the Biden administration proposed new restrictions on Russian and Chinese vehicle software. Shares are up 15.4% near the close of the trading day.

New protections in the auto business

The U.S. Department of Commerce has proposed banning vehicle software that comes from China or Russia, as well as the hardware that could enable autonomous driving. This could put protections around not only the U.S. auto industry, but also the software that enables autonomous driving.

There's an arms race going on in autonomous driving, and Chinese companies, in particular, are aggressively improving their capabilities. But security and economic concerns have caused the U.S., Canada, and Europe to all implement hefty tariffs on Chinese vehicles, and that may now extend to software.

Will Luminar Technologies be saved?

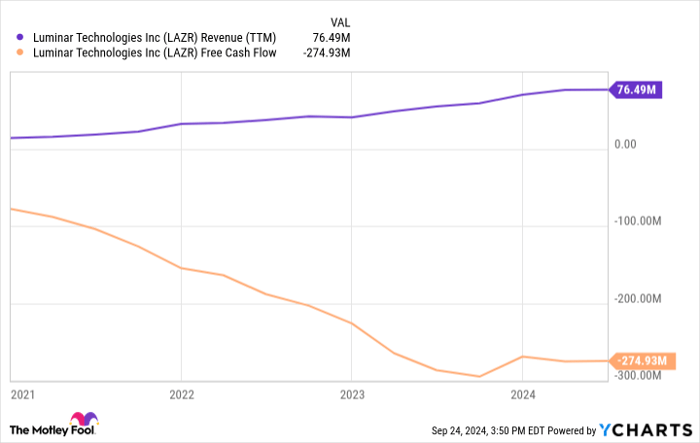

While this could potentially be good for U.S. self-driving companies, it's not clear if Luminar will be one of them. The company is not generating significant revenue, and losses are piling up for the company.

LAZR Revenue (TTM) data by YCharts

Investors hoped that a boom in autonomous driving could turn around the company's financials, but falling costs for LiDAR and an uncertain addressable market as new technologies develop may lead to less revenue and profit than previously expected.

While a ban on foreign technology would be an incremental positive, it would also likely reduce the total addressable market for Luminar's products, and with these weak financials, that's not good news for the stock long term.

Should you invest $1,000 in Luminar Technologies right now?

Before you buy stock in Luminar Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Luminar Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $712,454!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.