U.S. March PCE Preview: PCE Set to Reverse Stock Market Decline

TradingKey - The PCE is projected to fall below consensus market expectations, likely prompting the Federal Reserve to resume its rate-cutting cycle with larger-than-anticipated reductions, which would be bullish for U.S. equities.

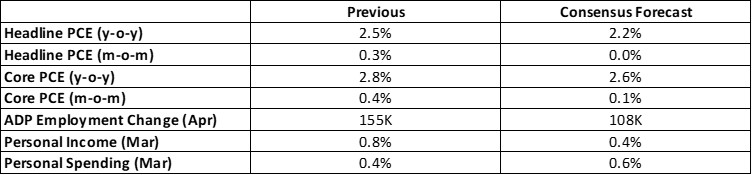

On 30 April 2025, the U.S. will release its March Personal Consumption Expenditure (PCE) data. Market consensus forecasts year-over-year headline PCE growth at 2.2% and core PCE at 2.6%, down from February’s 2.5% and 2.8%, respectively (Figure 1). However, we project March PCE will fall below these expectations for three primary reasons:

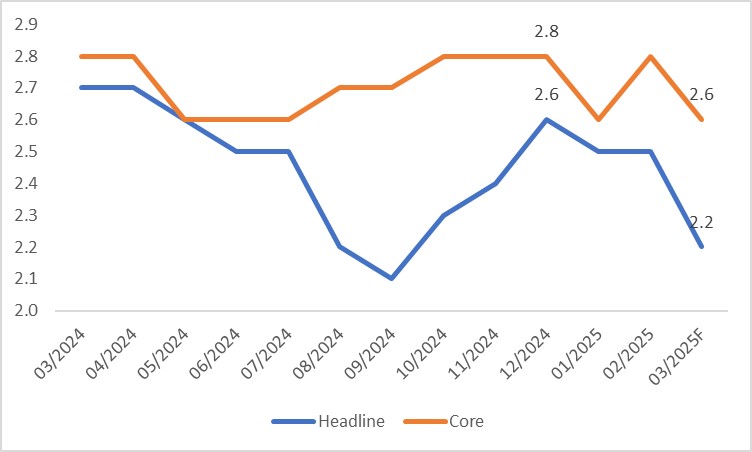

- Persistent Downward Trend in Headline PCE: Since early 2025, headline PCE has been on a consistent decline. As a high-frequency economic indicator, PCE exhibits strong momentum, and the slide from December’s peak of 2.6% is unlikely to reverse in the near term (Figure 2).

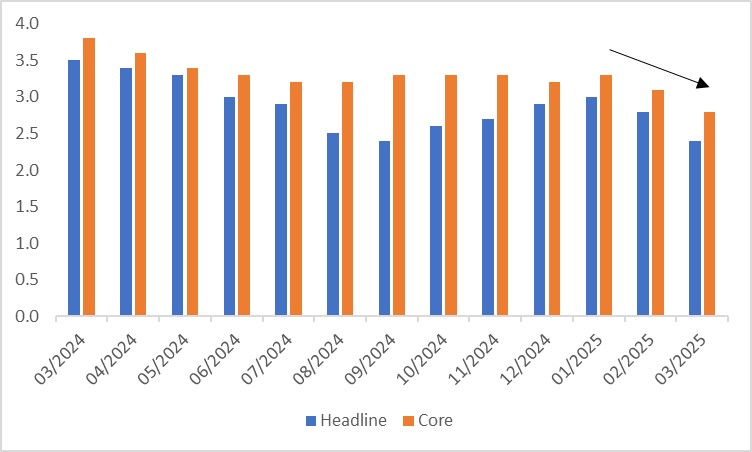

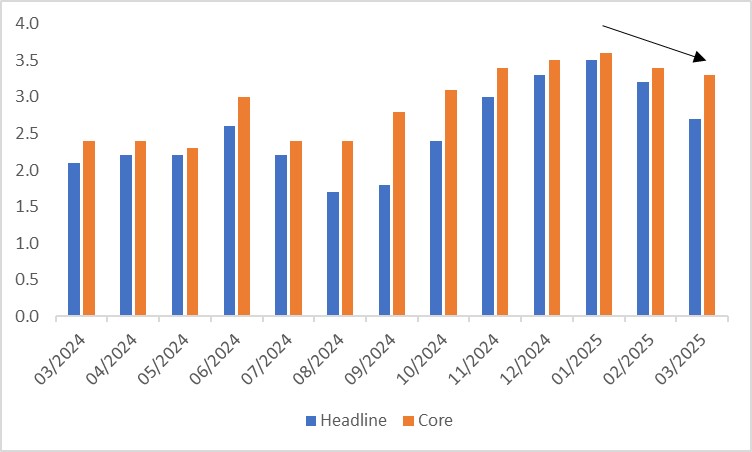

- Correlation with Inflation Metrics: PCE, CPI, and PPI, as measures of inflation, are closely linked. Recent declines in CPI and PPI are expected to further depress March PCE (Figures 3 and 4).

- Economic Softness: Ongoing weakness in the U.S. economy will remain a key driver of PCE’s downward trajectory.

Figure 1: Consensus Forecast

Source: Refinitiv, Tradingkey.com

Figure 2: PCE (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Figure 3: CPI (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Figure 4: PPI (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Looking forward, tariffs are poised to become a dominant factor influencing PCE. Tariffs exert two opposing forces on inflation. Higher tariffs raise imported goods’ prices, potentially increasing inflation. Conversely, tariffs can slow economic growth, curbing inflation by reducing demand. We believe the latter effect will prevail, leading PCE to trend toward the 2% target in the short to medium term.

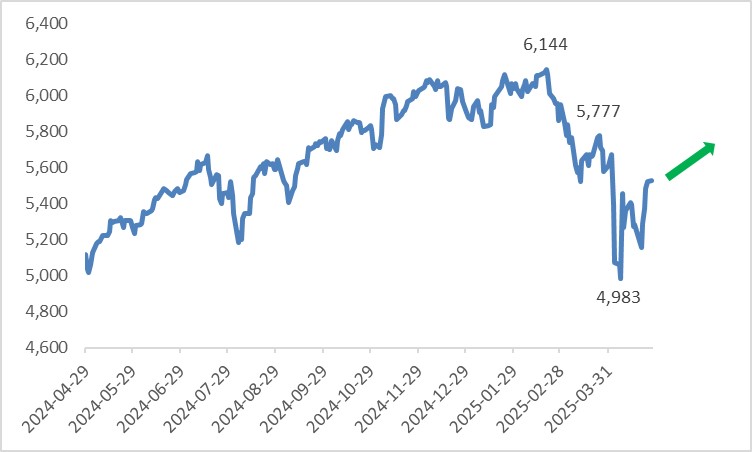

Declining inflation, coupled with a subdued economic outlook, is likely to prompt the Federal Reserve to resume its rate-cutting cycle, with reductions potentially exceeding current market expectations. This would be bullish for U.S. stocks (Figure 5) while bearish for the U.S. dollar index and Treasury yields.

Figure 5: S&P 500 Index

Source: Refinitiv, Tradingkey.com