Mantra shares buyback and 300M token burn details as CEO commits personal holdings

- Mantro CEO John Patrick Mullin pledges to burn all personal OM tokens amid controversy surrounding the native OM token.

- Mantra proposes a DAO vote to burn 300M team-allocated tokens, alongside launching a buyback program.

- The OM token crashed 90% on April 13, with the team attributing the decline to forced liquidations and market manipulation concerns.

Mantra intensifies recovery efforts following a 90% price crash this week. CEO John Patrick Mullin commits personal holdings to the upcoming burn.

Mantra CEO Mullin confirms buyback details post-crash

Mantra’s CEO John Patrick Mullin said on Friday that the company is finalizing details of a token burn program designed to stabilize the OM token after a steep 90% collapse that erased nearly $5 billion in market capitalization.

“The burn program details are in the final stages and will be shared in the near future, Buyback program also well underway. We are working around the clock for the Sherpas/OMies,” Mullin posted on X.

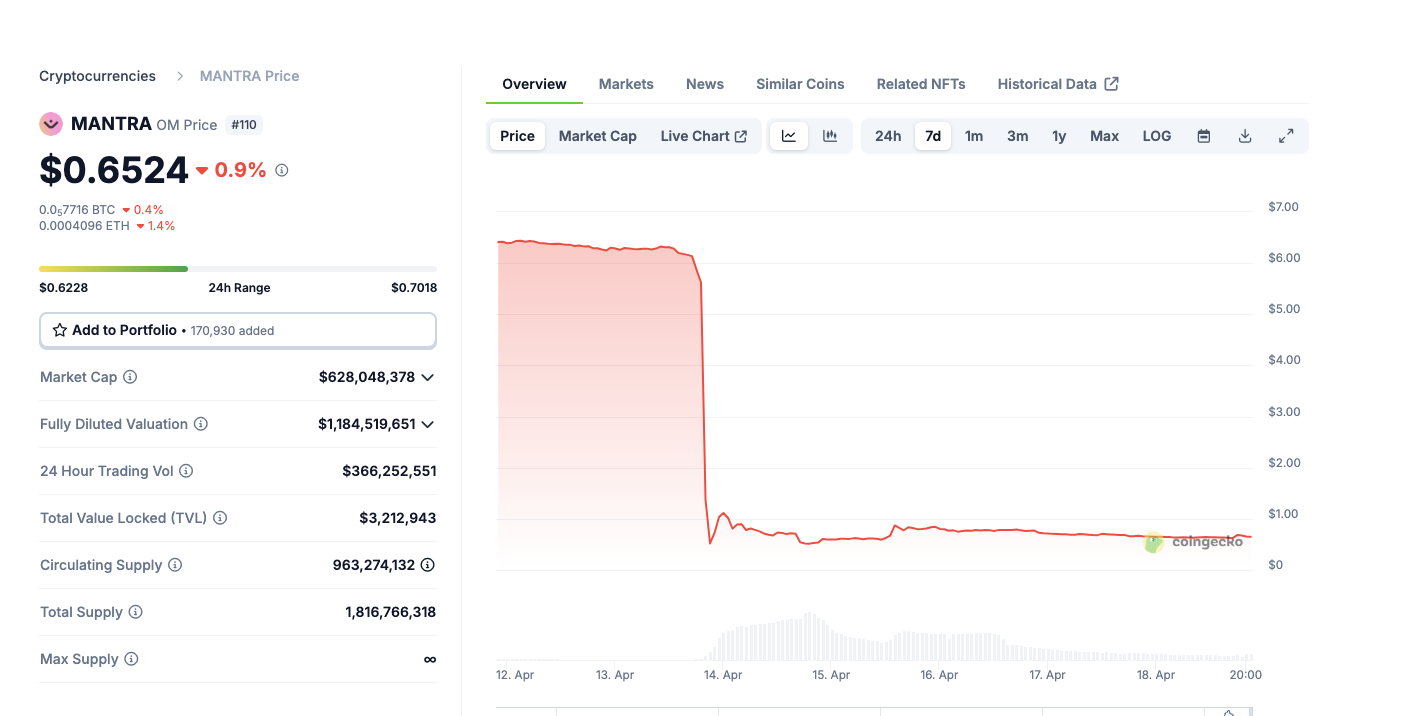

Following the announcement, Mantra token price remained muted at $0.65 at press time.

According to Coingecko data, OM’s price crash from $6 has seen the token fall out of the top 100 ranked cryptocurrencies, currently trending at 110, at the time of writing.

Mantra (OM) Token Price Action | Source: Coingecko

Notably, the Mantra CEO insists the price drop was not caused by insider selling, but forced liquidations during low-liquidity periods.

“There were no team sales during this event,” Mullin reiterated. “It was a result of reckless leverage and poor liquidity management on CEXs.”

A formal statement released on Wednesday also confirmed internal findings that the liquidation of OM-collateralized positions during low-volume trading hours caused the disruption. The token briefly recovered above $1 before settling around $0.65,still down over 88% from its pre-crash peak.

Governance vote, tokenomics dashboard aim to restore confidence

Mantra is pursuing multiple strategies to restore investor trust, including new transparency tools, financial commitment from its leadership, and community-driven governance votes.

First, the team plans to launch a real-time tokenomics dashboard, enabling the public to monitor OM’s circulating and locked supply. This comes after Mullin committed to burning his personal OM allocation as part of the recovery effort, a move intended to signal leadership accountability.

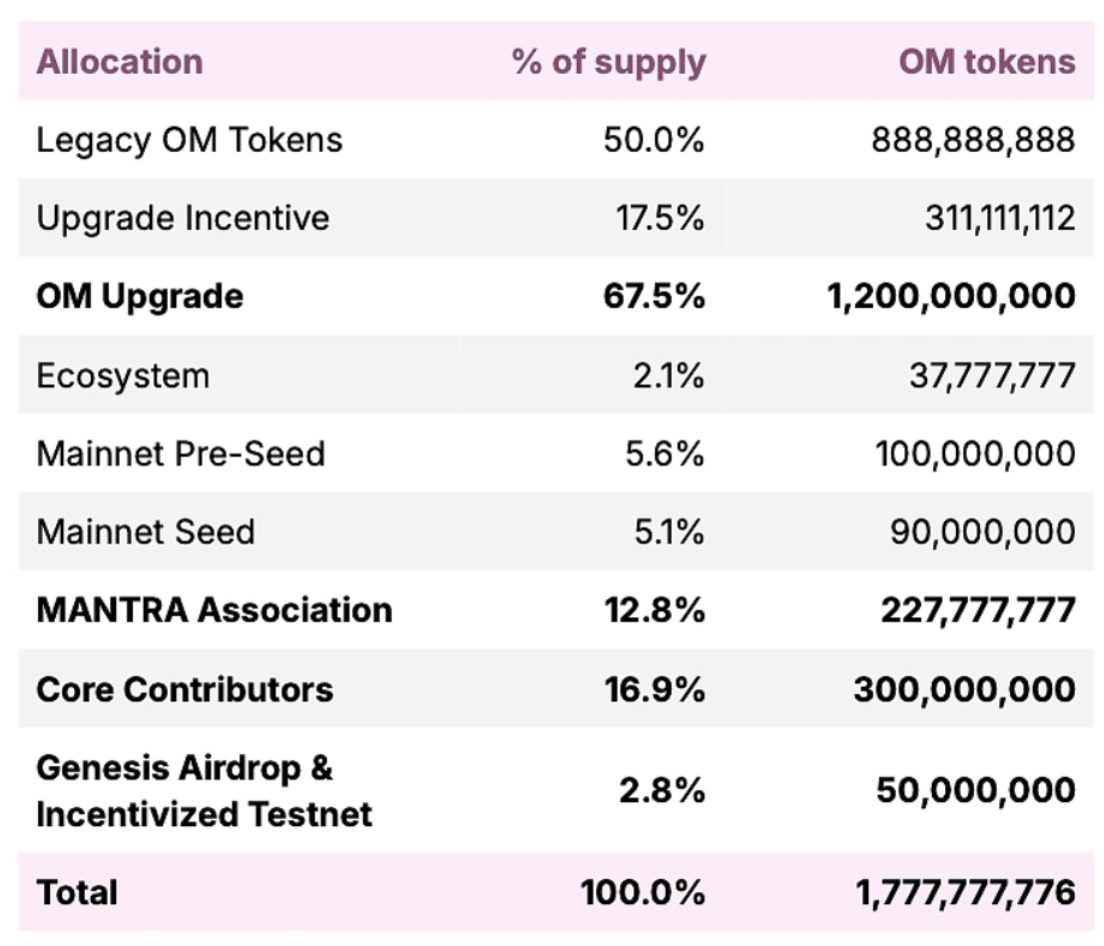

Mantra (OM) Tokenomics | source: https://docs.mantrachain.io/mainnet-om-information/chain-features

One of the most contentious proposals involves a DAO vote to determine whether the community will support burning 300 million OM tokens allocated to core contributors and team members. These tokens—representing about 17% of OM’s total supply—are currently locked and set for gradual release between April 2027 and October 2029.

“Some have voiced concerns about burning too many tokens allocated for team incentives,” Mullin said. “We’ll leave it to the community to decide via decentralized governance.”

The value of this team allocation has dropped from nearly $1.8 billion pre-crash to about $200 million as of Friday.