U.S. March CPI Preview: Will "Reciprocal Tariffs" Drive Up Inflation? Not Necessarily!

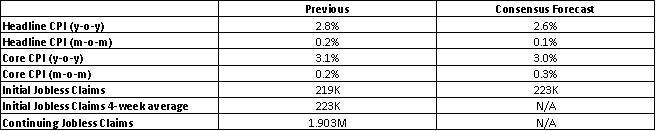

TradingKey - On 10 April 2025, the United States will release its Consumer Price Index (CPI) data for March. Market consensus forecasts suggest that the year-over-year (YoY) increases for headline CPI and core CPI will reach 2.6% and 3.0%, respectively, down from the prior readings of 2.8% and 3.1% (Figure 1). We align with this market expectation.

Figure 1: U.S. inflation forecasts

Source: Refinitiv, Tradingkey.com

We anticipate a decline in core CPI for March relative to February, driven by three key factors:

· High Base Effect: Last year’s March core CPI was elevated. Against this higher base, this year’s March figure is likely to reflect a slowdown.

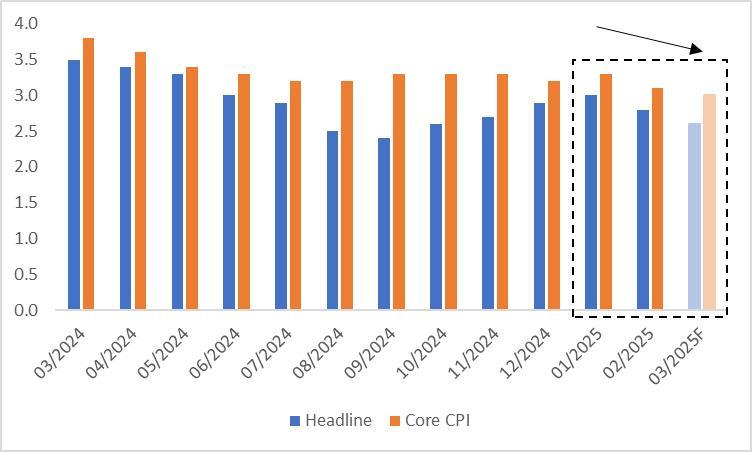

· Inflation Momentum: Like other economic indicators, inflation exhibits inertia. Since the end of 2024, core CPI has trended downward, a pattern we expect to persist into March (Figure 2).

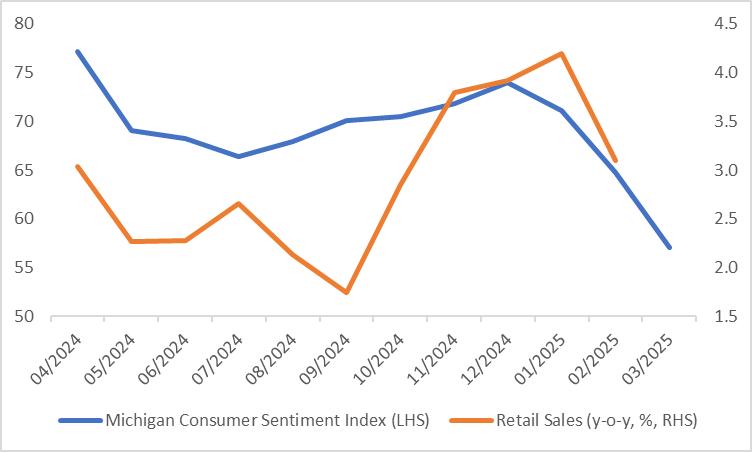

· Weakening Demand: Softer demand is easing inflationary pressure. The recent decline in the Michigan Consumer Sentiment Index has led to a slowdown in retail sales growth (Figure 3).

Figure 2: CPI (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Figure 3: Consumer Sentiment and Retail Sales

Source: Refinitiv, Tradingkey.com

Compared to February, we project core CPI to fall by 0.1 percentage points in March. Headline CPI, however, is expected to decline more significantly—by about 0.2 percentage points. This larger drop stems from factors shared with core CPI (base effect, momentum and weak demand) plus two additional drivers:

· Seasonal Energy Price Retreat: Energy prices are expected to ease in March due to seasonal factors.

· Reduced Food Price Pressure: Food inflation is likely to moderate further.

Since headline CPI includes volatile energy and food prices, its YoY decline is projected to outpace that of core CPI.

If March inflation comes in below market expectations, it could bolster the Federal Reserve’s willingness to cut rates and potentially increase the magnitude of such cuts. Post-release, this scenario would likely pressure the U.S. dollar and Treasury yields downward while lifting U.S. equities. The reverse would hold if inflation exceeds forecasts.

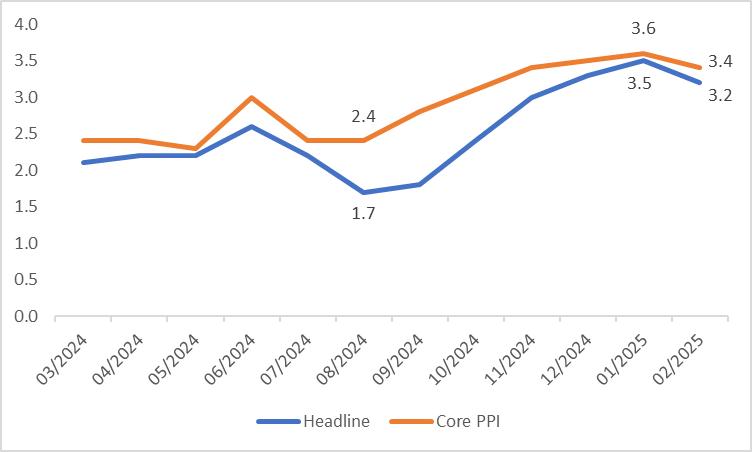

Tariffs imposed earlier this year on Canada, Mexico and China have yet to significantly impact CPI but have already driven up the Producer Price Index (PPI). Despite a slight pullback in February, the broader upward trend in both headline and core PPI remains intact (Figure 4). Looking forward, should producers pass these rising costs onto consumers, CPI could face upward pressure in the coming months.

Figure 4: PPI (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Additionally, the 2 April announcement of “reciprocal tariffs” and their subsequent implementation will meaningfully affect the U.S. economy. A static analysis suggests that sharply higher tariffs, combined with retaliatory measures from trade partners, could slow U.S. economic growth while fuelling inflation—raising the spectre of stagflation. However, a dynamic perspective offers a counterpoint: slower growth may restrain elevated inflation. Over the next few months, while inflation may fluctuate, the overarching trend toward the Fed’s 2% target is likely to persist.

In summary, while tariffs pose an inflationary risk, their full impact on CPI remains uncertain. For now, March’s expected decline suggests inflation is cooling—though the trajectory ahead hinges on both policy and economic dynamics.