U.S. March Nonfarm Payroll Commentary: Non-Farm and Tariffs Are Not the Concern, Inflation Takes Centre Stage

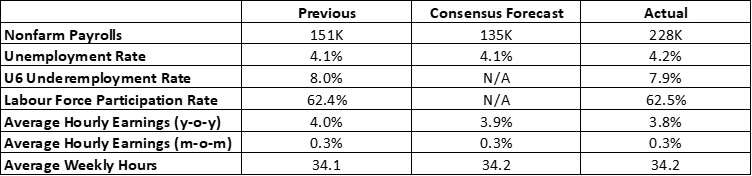

On 4 April 2025, the U.S. released its March non-farm payroll (NFP) data, reporting a increase of 228,000 jobs, significantly surpassing market expectations of 135,000 and the prior month’s 151,000 (Figure 1). Data also show that NFP has risen for two consecutive months (Figure 2). The services sector led the gains, adding 197,000 jobs, with the education and healthcare subsector contributing the most at 77,000 new jobs. The strong labour market pushed the Labor Force Participation Rate slightly higher, from 62.4% in February to 62.5% in March.

Figure 1: Latest U.S. labour market data

Source: Refinitiv, Tradingkey.com

Figure 2: Nonfarm Payrolls (000)

Source: Refinitiv, Tradingkey.com

Three key factors drove the March NFP strength. First, adverse weather in January and February had suppressed job growth, but as these disruptions faded in March, the data rebounded. Second, the resolution of strikes in industries such as healthcare and retail boosted employment. Third, the impact of government layoffs has not yet significantly appeared in the hard data.

Looking ahead, the "reciprocal tariff" policy announced by President Trump on 2 April, with the tariffs unexpectedly steep increases, could further strain an already weakening U.S. economy. Against a backdrop of slowing economic growth and recent high-frequency data underperforming expectations, we anticipate a softening U.S. labour market in the coming months.

However, from an equity market perspective, we believe neither the NFP data nor tariffs warrant significant concern. Instead, inflation should be the primary focus. Based on the Federal Reserve’s preferred metrics—Headline PCE and Core PCE—show no clear signs of accelerating inflation (Figure 3). If U.S. economic growth continues to decelerate, this could reduce demand-pull inflation pressures. Currently, the Fed’s policy rate stands at 4.25%-4.5%, well above historical lows, providing ample room for rate cuts if needed (Figure 4).

Figure 3: PCE (y-o-y, %)

Source: Refinitiv, Tradingkey.com

Figure 4: Fed policy rate (%)

Source: Refinitiv, Tradingkey.com

Moving forward, as long as inflation remains contained, the Fed has both the willingness and capacity to support economic growth through more aggressive rate reductions. Such cuts would also be supportive of equity markets. Given our view that a sharp surge in inflation is unlikely, we remain bullish on U.S. equities. Short-term market dips may present attractive buying opportunities (Figure 5).

Figure 5: S&P 500 Index

Source: Refinitiv, Tradingkey.com