February PCE Report——Stagflation Signals Flash as Rate Cuts Delayed

TradingKey – March 28,The February PCE data, released pre-market, aligned with expectations on headline metrics but revealed underlying risks:

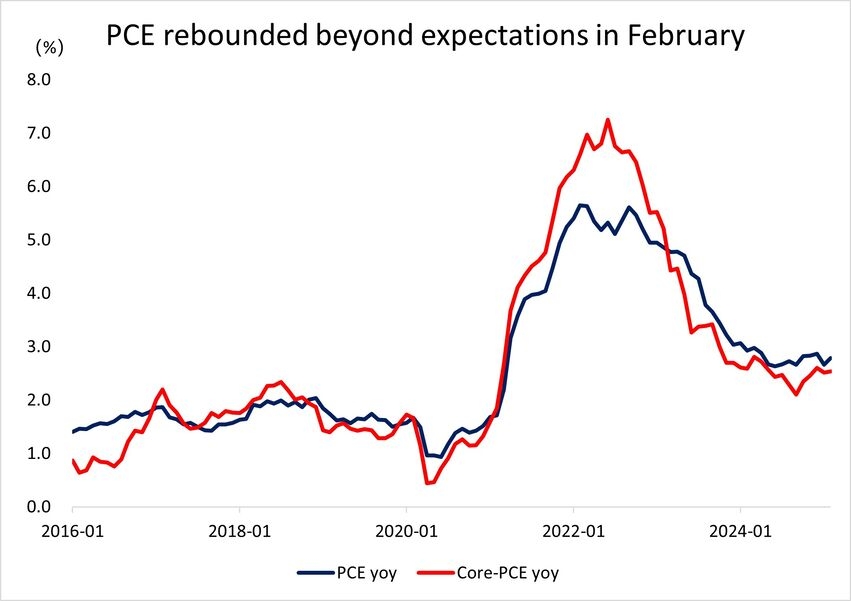

· Headline PCE: +2.5% YoY (consensus +2.5%), +0.3% MoM (consensus +0.3%)

· Core PCE: +2.8% YoY (vs. +2.7% expected), +0.4% MoM (vs. +0.3% expected)

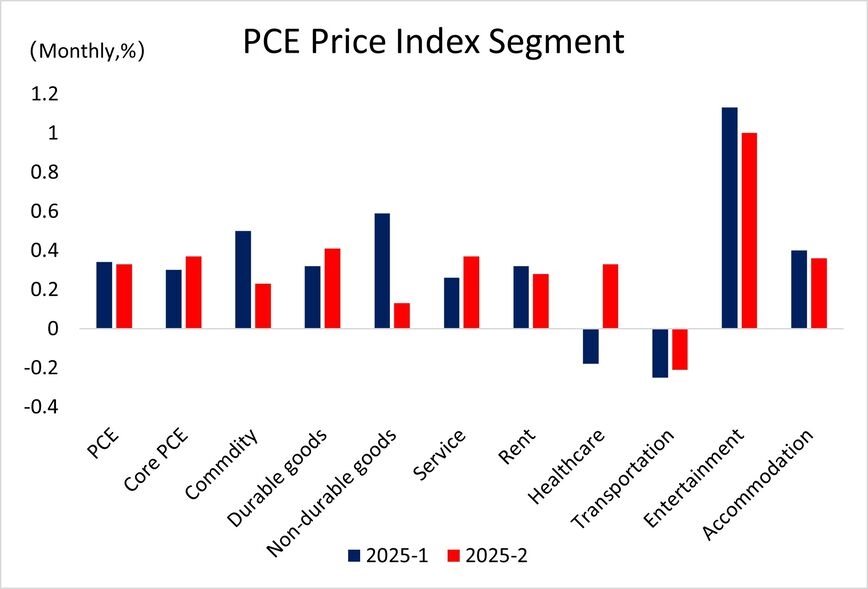

The core inflation overshoot has reignited reflation concerns, with early signs of stagflation emerging in the U.S. economy. On a granular leve, as predicted in our prior analysis, durable goods prices (+0.41% MoM) and healthcare services (+0.33% MoM, reversing January’s contraction) drove the monthly surge, consistent with our PCE preview(《February PCE Inflation Preview: Short-Term Concerns Overblown, Tariffs Remain the Focus》)published last week.

Data Sources: Reuters, TradingKey As of: March 31, 2025

Simultaneously released consumption data showed:

· Consumer spending: +0.4% MoM (below +0.5% consensus)

· Disposable income: +0.8% MoM (prev. +0.6%)

Despite stable income growth, the University of Michigan’s Consumer Sentiment Index plummeted to 52.6—near June 2022 lows—reflecting heightened anxiety over tariffs and inflation. This divergence underscores a shift toward precautionary saving, with households tightening belts despite rising earnings.

Fed’s Dilemma: Rate Cuts Face Mounting Challenges

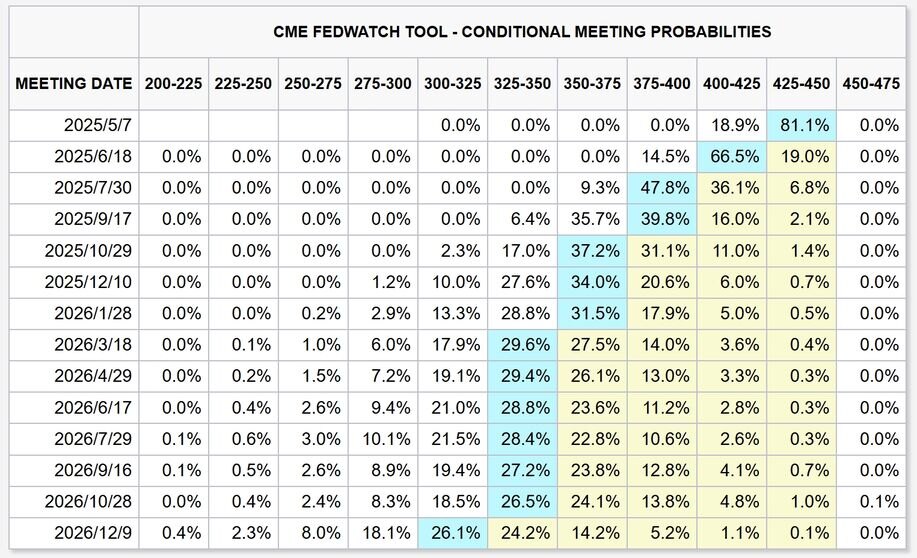

Post-PCE, CME FedWatch shows rising odds of a May pause and reduced expectations for June rate cuts. The market consensus now leans towards three rate cuts this year. San Francisco Fed President Mary Daly noted that the current inflation trajectory does not warrant any rate cuts, and the February inflation data has even diminished her confidence in the "reasonable" forecast of two rate cuts this year. While Trump’s tariff proposals and Musk’s layoff plans have yet to materially impact the economy, their psychological spillover is already dampening consumer sentiment.

Data Sources: CME FedWatch, TradingKey As of: March 31, 2025

Looking ahead, if Trump maintains his aggressive trade stance or embraces isolationism post-April, the Fed’s policy flexibility will face unprecedented constraints: either tolerate reflation risks to sustain economic stability via rate cuts or resort to debt issuance and balance sheet expansion amid elevated rates. Neither path offers a clear resolution.

Looking ahead, if Trump maintains his assertive stance on diplomacy and trade, or even embraces isolationism, the Fed’s policy flexibility and monetary operation space will face unprecedented constraints: either tolerate reflation risks to sustain economic stability via rate cuts or resort to debt issuance and balance sheet expansion amid elevated rates. Neither path offers a clear resolution.

Divergence from the Reagan Era: Fragile Household Balance Sheets

Though parallels are drawn between Trump’s "MAGA" agenda and Reagan’s policies (tax cuts, deregulation, small government), today’s macroeconomic landscape is fundamentally distinct. Reagan tamed inflation via "expansionary fiscal policy coupled with tight monetary policy" (tax cuts + rate hikes), whereas Trump confronts fiscal constraints and limited rate-cut optionality. Reviving U.S. manufacturing under MAGA would force a near-term trade-off between inflation containment and growth preservation.

Crucially, household balance sheets today are far more exposed to asset prices than in the 1980s. During Reagan’s tenure, financial assets comprised only 25% of household wealth, insulating families from market downturns. Today, fueled by decades of equity gains and pandemic-era stimulus, U.S. households hold over 40% of assets in equities—a historic high. Post-PCE in Friday, the S&P 500 and Nasdaq have slid over 10% from February peaks. If asset prices are allowed to "free fall", it could severely damage the balance sheets of most households, significantly suppress consumer spending, and potentially trigger an economic "hard landing" due to falling market prices.

Market Focus: April Tariff Implementation

The core tension remains between Trump’s protectionist agenda and the Fed’s monetary policy:

- Trump insists on announcing reciprocal tariffs by April 2 before negotiating.

- The Fed maintains a wait-and-see stance, holding rates steady.

Near-term market dynamics will hinge on tariff implementation specifics. However, given Trump’s carrot-and-stick negotiation style, initial maximalist posturing may eventually yield to pragmatic compromises.