Bank of Canada March Interest Rate Decision Preview: Trump's High Tariffs Pose Limited Threat

On 12 March 2025, the Bank of Canada (BoC) will announce its interest rate decision for March. The market widely anticipates a 25-basis-point rate cut, bringing the policy rate down to 2.75%. We concur with this consensus forecast.

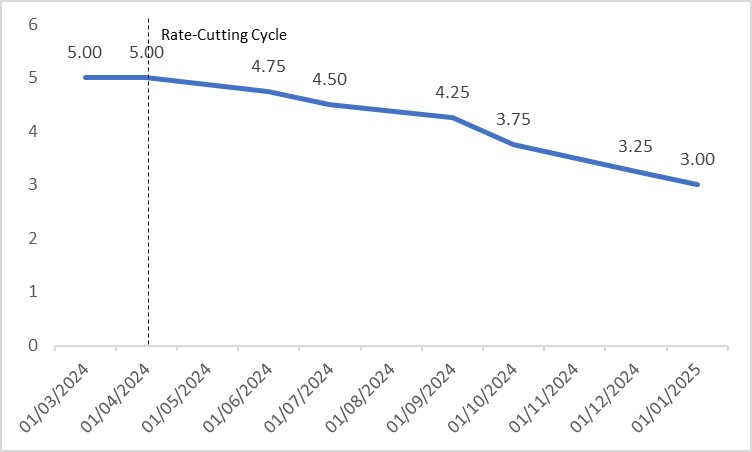

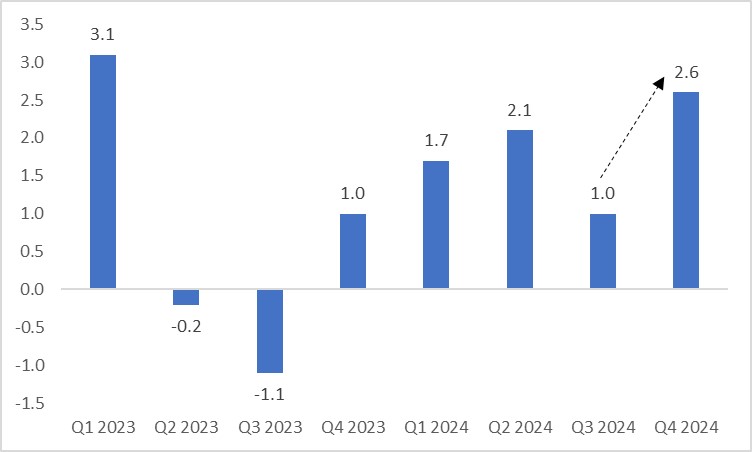

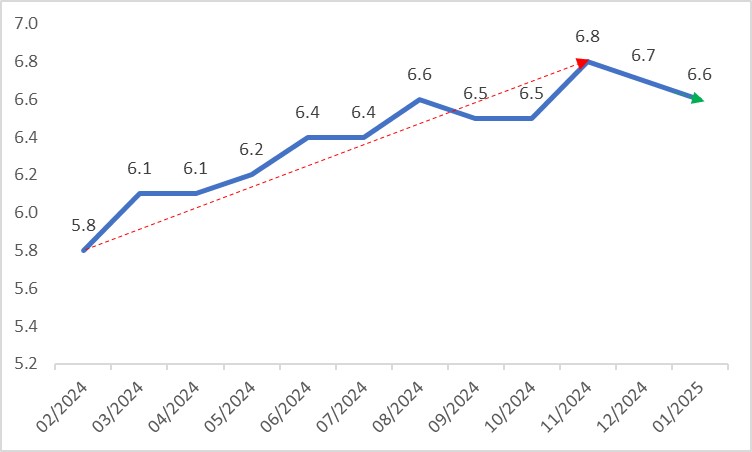

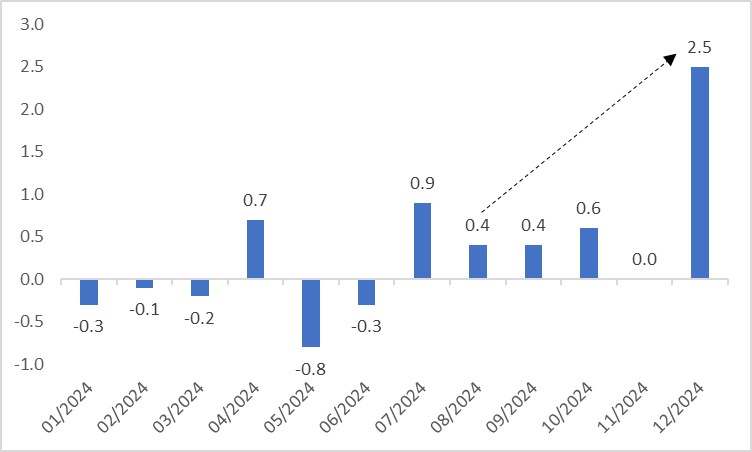

Since mid-last year, the BoC has been in a rate-cutting cycle, reducing rates by a cumulative 200 basis points to date (Figure 1). A rebound in real GDP growth in the fourth quarter of last year (Figure 2), bolstered by an improving labour market (Figure 3), fuelled household spending and drove a 2.5% month-over-month surge in December retail sales (Figure 4). This temporarily tempered expectations for further BoC rate cuts.

Figure 1: BoC policy rate (%)

Source: Refinitiv, Tradingkey.com

Figure 2: Canada's real GDP growth (annualized, %)

Source: Refinitiv, Tradingkey.com

Figure 3: Canada's unemployment rate (%)

Source: Refinitiv, Tradingkey.com

Figure 4: Canada retail sales (m-o-m, %)

Source: Refinitiv, Tradingkey.com

However, on 4 March 2025, the U.S. imposed an additional 25% tariff on Canadian imports, citing Canada’s failure to curb illegal immigration and fentanyl inflows. This will primarily impact the Canadian economy through trade channels:

- Oil Sector: As the world’s fourth-largest oil producer, Canada exports 80% of its output, with the U.S. as its primary buyer. Tariffs on oil imports will significantly reduce Canada’s energy exports, weighing on GDP growth.

- Other Goods: An additional 25% tariff on non-energy exports will dampen U.S. demand, though Canada could mitigate some of the impact by rerouting exports through third countries, softening the blow to its export markets.

If high tariffs persist over an extended period, they could severely undermine Canada’s economic growth, prompting the BoC to implement more aggressive rate cuts. Thus, following this month’s rate reduction, the BoC’s future rate path will heavily depend on the trajectory of Trump’s foreign policy.

Nevertheless, we believe the U.S. is likely to reach an agreement with Canada in the near future, potentially removing or delaying the high tariffs (On 5 March, the U.S. decision to delay imposing new tariffs on Canadian automobiles may just be the beginning). Should this occur, the BoC’s rate cuts may be less aggressive than currently anticipated. Even so, given the inherent softness in Canada’s economy, the Canadian dollar and government bond yields are expected to decline, while the stock market is likely to experience continued volatility, even in a scenario where tariffs are eased.