Dogecoin Price Prediction: Retail traders panic as DOGE plunges to lowest level since Trump’s re-election

- Dogecoin price declined 12.4% on Friday, trading below $0.19 for the first time since November 2024.

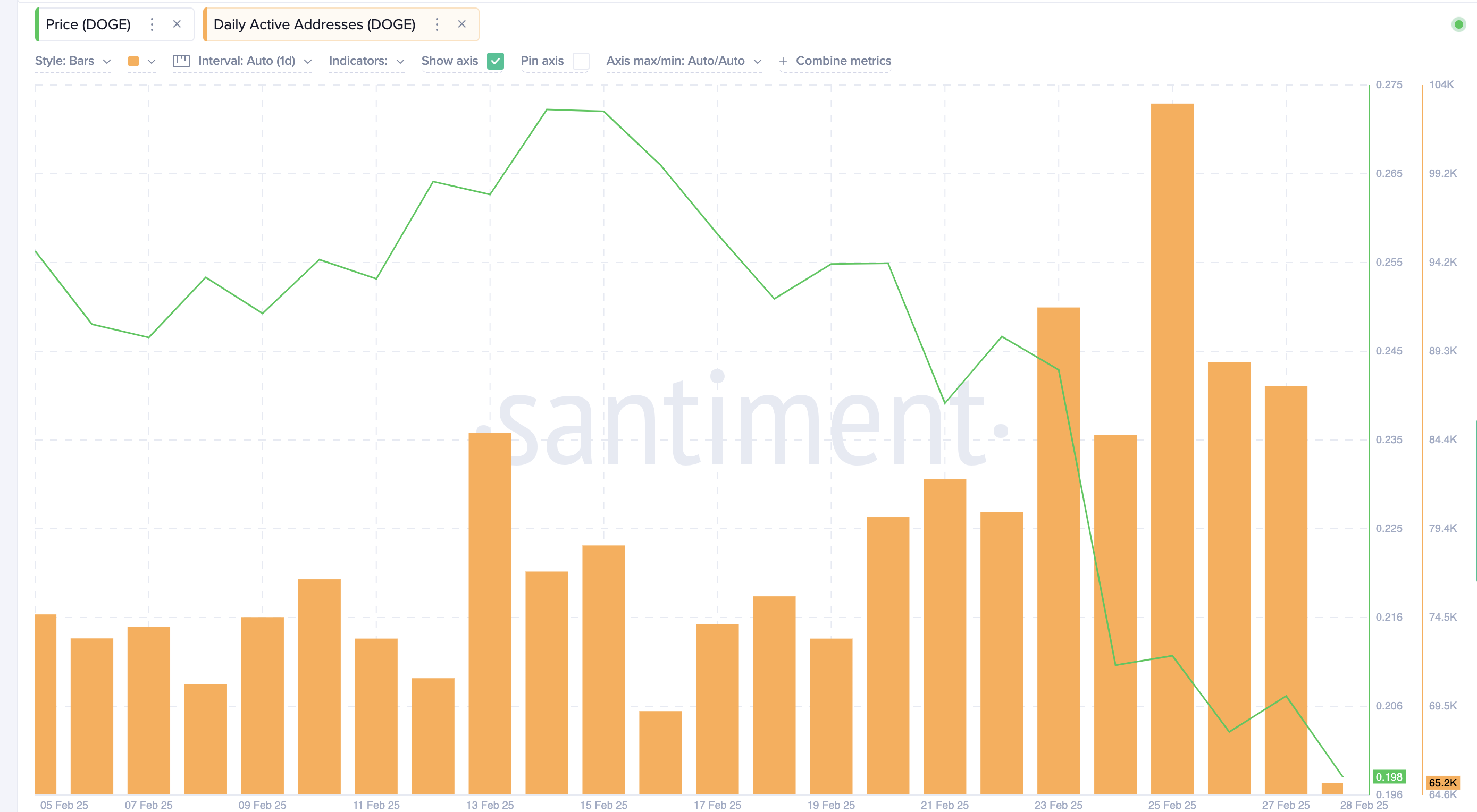

- DOGE’s latest downturn coincided with spikes in daily active addresses, signaling active sell pressure from retail traders.

- Despite trending in oversold territories, the DOGE Relative Strength Index indicator continues to slope further downward.

Dogecoin's price declined 12.4% on Friday, trading below $0.19 for the first time since November 2024. On-chain data trends suggest retail traders' panic selling is behind the latest DOGE price downturn.

Dogecoin (DOGE) price plunges to lowest since November 2024

In the last quarter of 2024, Dogecoin (DOGE) emerged as a top-performing crypto asset, driven by the United States (US) elections.

Elon Musk's collaboration with the Donald Trump campaign bolstered Dogecoin's momentum as Trump secured re-election.

After delivering triple-digit growth in Q4 2024, DOGE has faced intense sell pressure, with the crypto market entering a retracement phase following Trump's inauguration on January 20.

Dogecoin Price Action | DOGEUSDT

Dogecoin Price Action | DOGEUSDT

As of Friday, Dogecoin's price has declined by up to 12.4%, trading below $0.19 for the first time since November 2024.

Having opened at $0.31 on February 1, DOGE has now dropped 46% this month, standing at $0.19 at press time.

Why is Dogecoin price going down?

Beyond a "sell-the-news" reaction post-inauguration, February introduced new bearish catalysts:

1. Trump's tariffs on Mexico and Canada:

President Donald Trump announced a 25% tariff on imports from Mexico and Canada, effective March 4, aiming to combat drug trafficking, particularly fentanyl.

This policy has led investors to withdraw from volatile assets like memecoins, including Dogecoin.

2. Elon Musk's controversial government role:

Appointed to oversee the Department of Government Efficiency (DOGE), Musk has clashed with agencies such as USAID, the US Treasury, and the Securities and Exchange Commission (SEC).

These disputes have unsettled financial markets, and Musk's known ties to the Dogecoin community have amplified bearish sentiment toward the cryptocurrency, contributing to its 46% decline in February.

3. Retail traders panic as DOGE loses $0.20 support

While Dogecoin's price mirrored the broader market downturn this week, on-chain data reveals that DOGE's 46% loss surpasses those of BTC and ETH, primarily due to increased selling pressure from retail traders.

According to Sentiment's Daily Active Addresses chart, DOGE reached a February peak of 103,500 active addresses when its price fell below $0.25 following Trump's tariff announcement on Monday.

Since then, active addresses have remained above 88,000, with 87,414 observed as of Thursday.

Dogecoin Active Addresses vs. DOGE Price | Source: Santiment

The heightened number of active addresses during a price dip suggests that many retail traders are actively selling, exerting downward pressure on Dogecoin's price.

In summary, Dogecoin's recent decline below $0.19, influenced by geopolitical events and internal controversies, has prompted panic selling among retail traders.

Without a significant uptick in positive catalysts or institutional support, DOGE's price may face further downward pressure in the near term.

Dogecoin Price Prediction: Death cross indicator signals further declines ahead

Dogecoin price forecast remains cautiously bearish as the meme coin slips below $0.20, triggering concerns of extended losses.

The daily DOGEUSDT chart below shows a pronounced death cross, with the 50-day moving average crossing below the 200-day moving average, a textbook signal of prolonged downside momentum.

This bearish crossover confirms the trend shift observed since late January, emphasizing the impact of negative headwinds from Trump’s Presidency.

Dogecoin Price Prediction | DOGEUSD

The Relative Strength Index (RSI) sits at 26.37, deep in oversold territory, suggesting that DOGE may be nearing a short-term bounce.

However, the persistent downward slope of the RSI indicates that selling pressure remains dominant.

A potential relief rally could emerge if buyers reclaim the $0.20 mark, but resistance at the 50-day MA near $0.29 could limit any recovery.

Conversely, failure to reclaim $0.20 may accelerate declines toward the next key support at $0.15.

Trading volume remains elevated, suggesting strong participation in the downtrend.

Without a bullish catalyst, Dogecoin risks further losses as technical indicators confirm a deteriorating market structure.