Canada CPI set to show easing price pressures, bolstering BoC to further ease policy

- The Canadian Consumer Price Index is seen losing further traction in July.

- The BoC could extend its easing cycle in the latter part of the year.

- The Canadian Dollar appears firm against its US counterpart so far in August.

Canada is poised to release the latest inflation figures on Tuesday, with Statistics Canada publishing the Consumer Price Index (CPI) data for July. Forecasts suggest the continuation of disinflationary trends in the headline CPI, while another uptick in the core reading, as it happened in June, could add some volatility to the release.

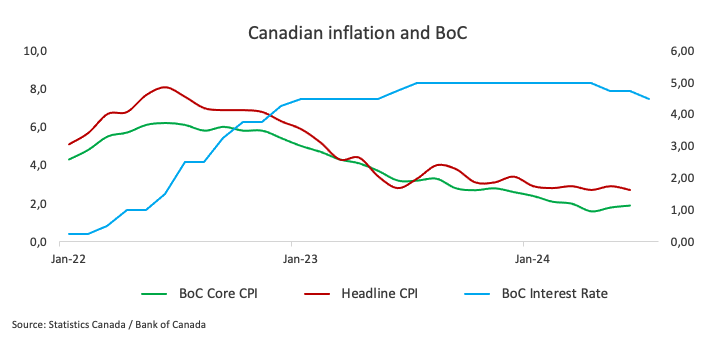

Alongside the CPI data, the Bank of Canada (BoC) will also unveil its core Consumer Price Index, which excludes volatile components like food and energy. In June, the BoC core CPI recorded a 0.1% drop against May’s reading and a 1.9% gain over the last twelve months, while the headline CPI climbed by 2.7% over the past year and contracted by 0.1% from the previous month.

These numbers are under close scrutiny, as they could impact the Canadian Dollar (CAD) in the short term and shape expectations for the Bank of Canada's monetary policy, particularly after the central bank cut its policy rate by an extra 25 basis points (bps) to 4.50% in July.

In the FX world, the Canadian Dollar gathered strong traction following year-to-date lows near 1.3950 against the Greenback on August 5. So far, the downside in USD/CAD remains well guarded by the key 200-day SMA near 1.3600 the figure.

What can we expect from Canada’s inflation rate?

Analysts anticipate that price pressures in Canada will maintain their downward bias in July, though they are likely to still remain above the central bank’s target. Consumer prices are expected to follow the recent trend observed in the US, where lower-than-expected CPI data have fuelled speculation about a 50 bps interest rate cut by the Federal Reserve (Fed) in September. Despite those expectations fizzling out afterwards, along with strong results on the US macro data, the Fed is largely predicted to trim its interest rates by 25 bps next month.

Should the upcoming data meet these expectations, investors may speculate that the Bank of Canada (BoC) could further ease its monetary policy with another quarter-point interest rate cut, potentially bringing the policy rate down to 4.25% at its September 4 meeting.

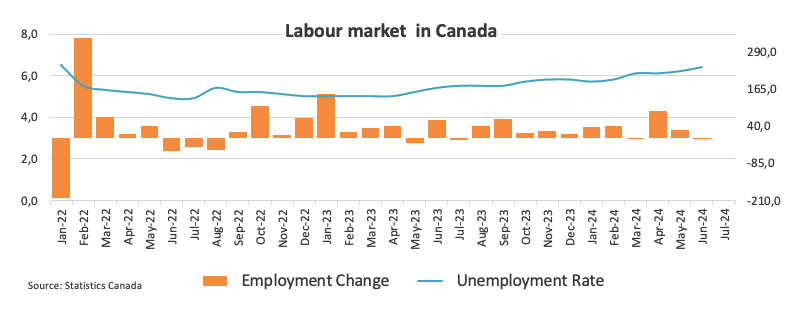

According to the Minutes of its July event, BoC governors expressed concerns about weaker consumer spending in 2025 and 2026 compared to expectations. Lower borrowing costs could boost spending, but households would still face debt-servicing burdens, hindering any recovery. Economic growth lags behind population growth, causing excess supply and labour market slack. This could weaken the labour market and dampen consumption, affecting growth and inflation.

Back to inflation, and following the interest rate cut last month, BoC’s Governor Tiff Macklem argued that the economy is experiencing excess supply, with slack in the labour market contributing to downward pressure on inflation. He noted that their assessment indicates sufficient excess supply already exists in the economy and emphasized that, rather than increasing excess supply, the focus should be on boosting growth and job creation to absorb this surplus and achieve a sustainable return to the 2% inflation target.”

Analysts at TD Securities commented that: “Markets will look to the July CPI for a final update on underlying price pressures ahead of the September BoC decision, with TD projecting a 0.2pp drop to 2.5% y/y, although stronger core inflation momentum should give a mixed tone to the report.”

When is the Canada CPI data due, and how could it affect USD/CAD?

On Tuesday at 12:30 GMT, Canada will release the Consumer Price Index (CPI) for July. The Canadian Dollar's response will largely hinge on any shifts in expectations regarding the Bank of Canada's (BoC) monetary policy. However, unless there are significant surprises in the data, the BoC is expected to maintain its current easing approach, somewhat mirroring the stance of other central banks like the Fed.

USD/CAD began the month trading with a strong bias and climbing to yearly highs around 1.3950. However, the Canadian currency managed to regain firm pace and dragged spot nearly three cents lower at the time of writing, pari passu with a strong corrective decline in the US Dollar (USD).

Pablo Piovano, Senior Analyst at FXStreet, suggests that USD/CAD appears well supported by the critical 200-day SMA around 1.3600. A breach of that level could spark further weakness to the next support of note at the March bottom of 1.3419 (March 8), prior to the weekly low of 1.3358 from January 31.

On the upside, Pablo adds, immediate resistance is found at the 2024 high of 1.3946 (August 5), ahead of the key milestone of 1.4000 (June 11).

Pablo also noted that significant increases in CAD volatility would likely depend on unexpected inflation data. If the CPI comes in below expectations, it could bolster the argument for another BoC interest rate cut at the upcoming meeting, leading to a rise in USD/CAD. On the other hand, if inflation exceeds expectations, the Canadian Dollar might see only modest support.

Economic Indicator

BoC Consumer Price Index Core (YoY)

The BoC Consumer Price Index Core, released by the Bank of Canada (BoC) on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. It is considered a measure of underlying inflation as it excludes eight of the most-volatile components: fruits, vegetables, gasoline, fuel oil, natural gas, mortgage interest, intercity transportation and tobacco products. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Last release: Tue Jul 16, 2024 12:30

Frequency: Monthly

Actual: 1.9%

Consensus: -

Previous: 1.8%

Source: Statistics Canada

Inflation FAQs

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.