Ethereum Price Forecast: ETH sees rejection at $1,800 despite buying pressure from whales and institutional investors

Ethereum price today: $1,760

- Ethereum whales boosted their collective balance by over 149,000 ETH last week.

- Institutional investors added to the buy-side pressure, with US spot Ether ETFs posting weekly net inflows of $157.1 million.

- Despite the price rise, ETH realized profits/losses remained modest, indicating a leaning toward bullish expectations.

- ETH is on the verge of marking six days of consecutive rejection at $1,800 as bears mount pressure near the 50-day SMA.

Ethereum (ETH) dropped 2% on Monday, tapering gains from its impressive rise last week. On-chain activity shows the price growth was fueled by rising whale optimism and institutional buying pressure.

Ethereum whales and institutional investors turn bullish following recent price growth

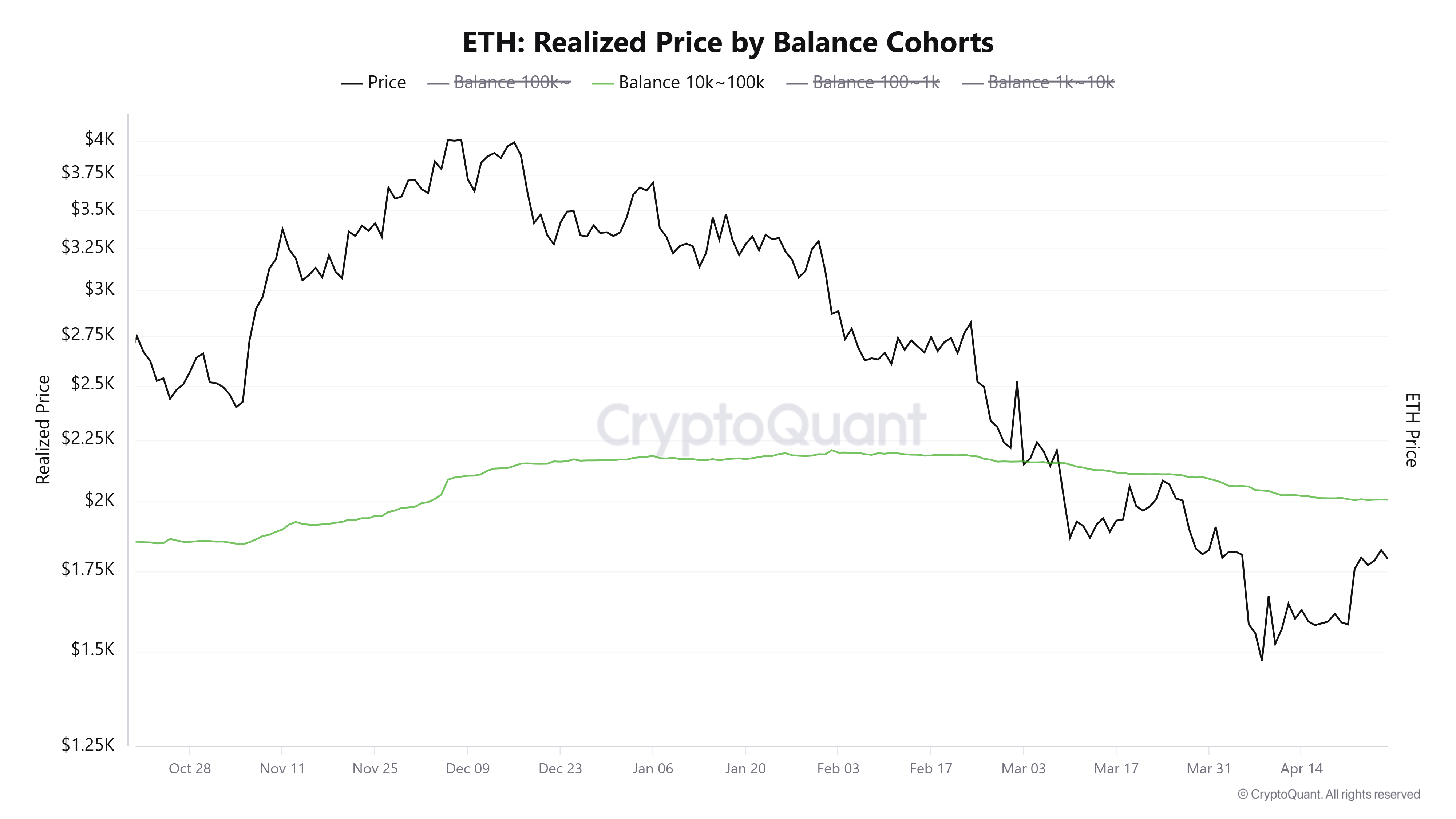

Ethereum whales — specifically addresses holding between 10K-100K ETH — increased their collective balance by a net 149K ETH over the past week, per CryptoQuant's data.

After spearheading the distribution in previous weeks, these whales returned to fuel the buy-side pressure in an attempt to push ETH's price toward their average cost basis near $2,000.

ETH Realized Price by Balance Cohorts (10K-100K). Source: CryptoQuant

Reclaiming the $2,000 level could mark a turnaround toward recovery as whales may defend prices from falling below their cost basis again. Conversely, it could spark selling pressure as some whales may be looking to break even.

In addition to whales, institutional investors also turned bullish on ETH, triggering weekly net inflows of $183 million across Ethereum investment products last week. The inflows ended an eight-week streak of outflows, according to CoinShares data. Notably, US spot Ether ETFs dominated the flows, pulling in $157.1 million in net inflows.

Meanwhile, ETH's Network Realized Profit/Loss has slowed compared to earlier in the month. Despite last week's price rise, profit/loss realization remained modest, indicating investors are leaning toward more bullish outcomes for the top altcoin.

[18-1745864292362.42.04, 28 Apr, 2025].png)

ETH Network Realized Profit/Loss. Source Santiment

Ethereum Price Forecast: ETH faces rising bearish pressure at $1,800 barrier

Ethereum saw $56.54 million in futures liquidations in the past 24 hours, per Coinglass data. The total amount of liquidated long and short positions is $42.70 million and $13.84 million, respectively.

ETH has been struggling to sustain a firm move above the $1,800 resistance level, with bear traders mounting pressure at the upper boundary of a descending channel and the 50-day Simple Moving Average (SMA). The rejection at $1,800 in the past few hours marks a sixth consecutive day of failure to overcome the resistance at the descending channel’s upper boundary.

ETH/USDT daily chart

As a result, ETH is beginning to develop a bullish flag pattern. A high volume move above $1,800 could see ETH rally to tackle the $2,100 key level. However, if the recent price decline persists, ETH could bounce off the $1,688 level. A decline below $1,688 could send ETH toward the $1,500 key level.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are above their neutral levels but trending downwards. A decline below their neutral levels — with the RSI crossing below its moving average yellow line — will accelerate the bearish momentum.