Ripple Price Prediction: Exchange inflows surge as XRP slides, what comes next?

- Volatility strikes the crypto market, causing XRP to test the $2.00 support level.

- Exchange inflows soar above 55 million XRP, suggesting investors are preparing to sell the token.

- An increase in long position liquidations to $5.10 million in the past 24 hours suggests traders are reducing their exposure to XRP.

- Improving market dynamics could significantly improve the chances of XRP spot ETF approval - Kaiko Research.

Ripple (XRP) corrected along with other major digital assets, including Bitcoin (BTC) and Ethereum (ETH), and traded at $2.08 at the time of writing on Wednesday. The drawdown cut across the crypto market, causing the total capitalization to drop 3.2% to $2.736 trillion. XRP faces a combination of factors, including global macroeconomic uncertainty, volatility and the apparent increase in exchange inflows.

Trade tensions between the United States (US) and China stood out as a major factor, especially after President Donald Trump's administration banned exports of H20 chips to the Asian economic giant—a move likely to hit NVIDIA's financial status by $5.5 billion in the company's fiscal first quarter, ending April 27.

The US stock market resumed the correction after a week of sustained gains, with S&P futures falling by 0.85%, Dow futures by 0.33% and Nasdaq futures by 1.42%.

Soaring exchange inflows trigger volatility

XRP edged higher from the middle of last week as traders made a comeback buoyed by sentiment hinged on President Trump pausing tariffs for 90 days, except for China. The token reclaimed the critical $2.00 level before advancing to $2.25, accentuated by news that Ripple's CEO Brad Garlinghouse had reached an agreement with the Securities and Exchange Commission (SEC) staff over the settlement and dismissal of the long-standing lawsuit.

As reported on Tuesday, following the agreement, the staff is expected to make recommendations to the agency's commissioners, who will vote on the matter.

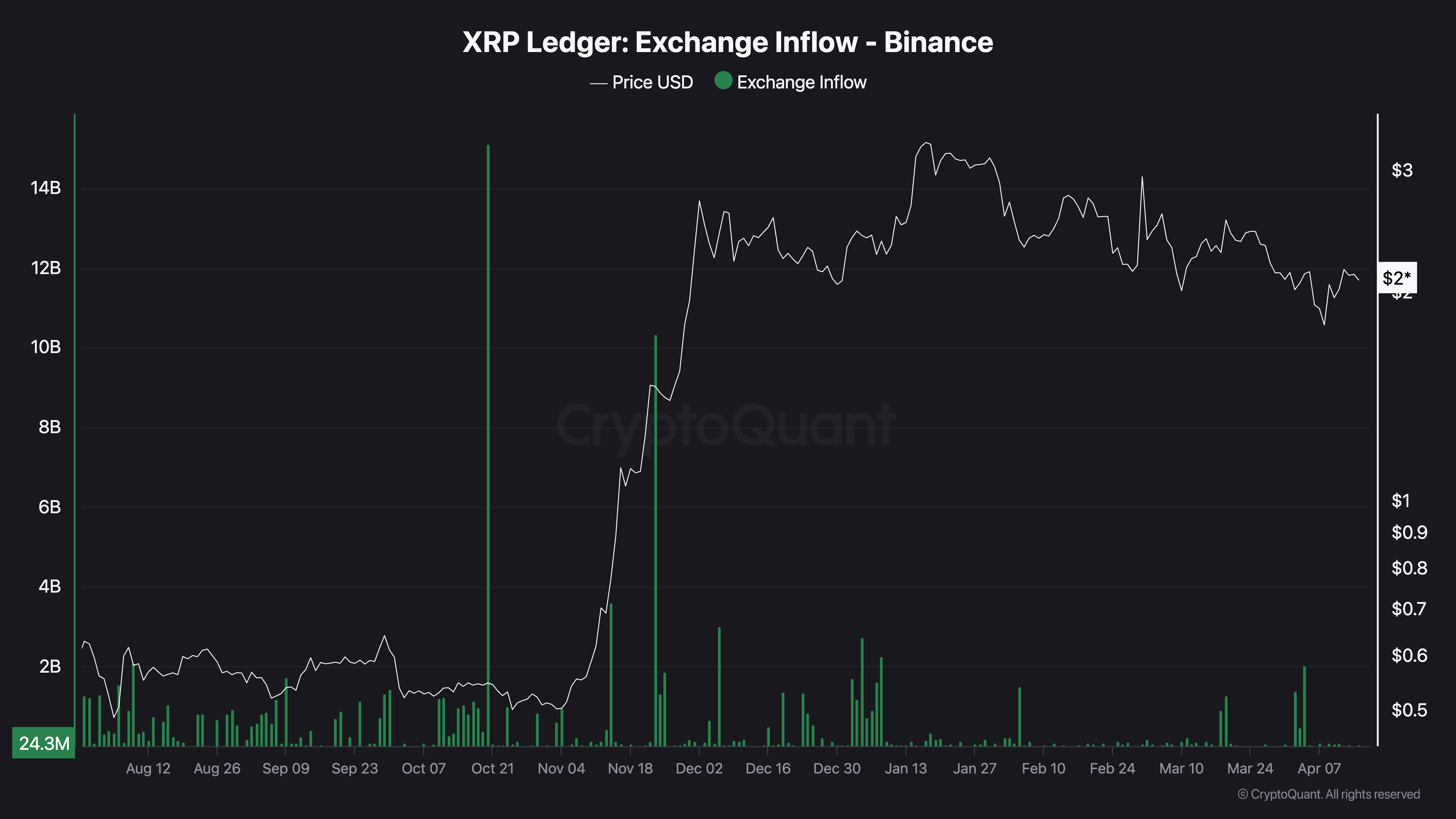

Meanwhile, XRP experienced a spike in liquidity during the Asian session on Wednesday, caused by, among other factors, a surge in exchange inflows from 28 million on April 8 to 55.6 million XRP on Wednesday, per CryptoQuant data.

XRP exchange inflow data | Source: CryptoQuant

When investors deposit tokens on exchanges, it signals potential selling pressure, likely driving the price down. The surge could also correlate with a spike in whale-to-exchange transactions and prevailing market sentiment, which is shaky and worth watching.

Liquidation data from Coinglass could help shape the direction of market sentiment, especially with $5.1 million wiped out in long positions compared to $1.25 million in short positions in the last 24 hours. Moreover, a negative long-to-short ratio of 0.938 suggests that investors prefer to reduce exposure to XRP, possibly expecting more retracement.

XRP derivatives data | Source: Coinglass

Can XRP bulls defend $2.00 support?

The XRP price hovers at $2.08 at the time of writing. After extending the gap from the confluence resistance, bulls have been fighting to break at $2.24, formed by the 50-day and 100-day Exponential Moving Averages (EMA). If XRP loses the immediate $2.00 support, losses could extend to the 200-day EMA at $1.95 and the next support area at $1.61, tested on Monday last week.

XRP/USD daily chart

Despite the drawdown, the Moving Average Convergence Divergence (MACD) indicator upholds a buy signal, reinforced by green histograms. The Relative Strength Index (RSI) indicator could signal where XRP is heading, with a sustained move above the descending trend affirming the bullish grip. At the same time, movement toward the oversold region would suggest that the trend is flipping bearish.

The potential approval of XRP ETF applications is a key factor likely to shape XRP's price trend in 2025. However, investors must temper their expectations, considering that soon-to-be-sworn-in SEC Chair Paul Atkins might delay the process as he gets acquainted with his new role.

According to Kaiko Research, "May 22 is an important date to watch in light of the recent ETF approval of a 2x XRP ETF from Teucrium, as the SEC must respond to Grayscale's XRP spot filing by then."

Kaiko outlined in the report that XRP ETFs are more likely to be approved than Solana ETFs, thanks to the token's significantly improved market depth since the end of 2024.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.