Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

- Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week.

- ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

- The technical outlook for these altcoins indicates a rally ahead as momentum indicators show bullish projections.

Algorand (ALGO), Decentraland (MANA), and JasmyCoin (JASMY) hovers around $0.19, $0.27, and $0.015 at the time of writing on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels, while the technical outlook suggests a rally ahead as momentum indicators show bullish projections.

Algorand Price Forecast: ALGO bulls aim for $0.27 mark

Algorand price found support around the lower trendline of a falling wedge pattern (drawn by connecting multiple highs and lows with two trendlines from early December) and recovered 12.69% last week. On Monday, ALGO extended its gains by 3.36%. At the time of writing on Tuesday, it trades slightly above $0.19, approaching the 50-day Exponential Moving Average (EMA) at $0.20.

If ALGO breaks above the 50-day EMA and closes above its daily resistance level at $0.21, it would extend the rally to retest its weekly resistance level at $0.27.

The Relative Strength Index (RSI) on the daily chart reads 52, pointing upward above its neutral level of 50, indicating an increase in bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also showed a bullish crossover last week, giving a buy signal and indicating an upward trend. It also shows a rising histogram above its neutral zero level, suggesting bullish momentum.

ALGO/USDT daily chart

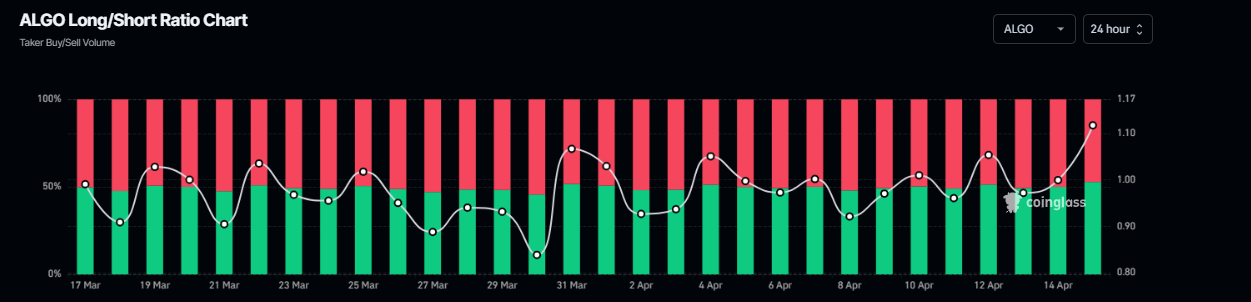

Coinglass’s long-to-short ratio data for Algorand reads 1.15, the highest level over a month. This ratio above one reflects bullish sentiment in the markets as more traders are betting for the asset price to rise.

ALGO long-to-short ratio chart. Source: Coinglass

Decentraland Price Forecast: MANA could rally if it closes above $0.28

Decentraland price broke above the descending trendline (drawn by joining multiple highs since mid-February) on Saturday, retested and found support the next day, and rose nearly 3% on Monday. At the time of writing on Tuesday, it trades slightly down, facing resistance from the 50-day EMA at $0.27.

If MANA breaks above the 50-day EMA and closes above its weekly resistance level at $0.28, it would extend the rally to retest the 50% Fibonacci retracement (drawn from the January 31 high of $0.46 to the April 7 low of $0.19) at $0.32.

The RSI on the daily chart reads 55, indicating bullish momentum. The MACD indicator also showed a bullish crossover last week, giving a buy signal and indicating an upward trend. It also shows a rising histogram above its neutral zero level, suggesting bullish momentum.

MANA/USDT daily chart

Santiment’s Supply Distribution metric shows that the whales holding between 100,000 and 1 million MANA tokens dropped from 123.69 million on April 3 to 123.02 on Tuesday. Meanwhile, wallets holding 1 million, 10 million and 10 million to 100 million surged from 622.76 million to 641.70 million and 504.46 million to 603.61 million, respectively, in the same period.

This development shows that the first cohort of whales could have fallen prey to the capitulation event. In contrast, the second set of wallets seized the opportunity and accumulated Decentraland at a discount during the recent price dip, bolstering investors’ confidence in MANA.

[10-1744702311836.53.44, 15 Apr, 2025].png)

MANA Supply Distribution chart. Source: Santiment

JasmyCoin Price Forecast: JASMY remains strong if $0.015 is maintained

JasmyCoin price broke above the descending trendline (drawn by joining multiple highs since mid-December) and closed above the 50-day EMA at $0.014 on Saturday. However, JASMY found rejection around its weekly level of $0.017 the next day and declined slightly. At the time of writing on Tuesday, it continues its decline, approaching its daily support level of $0.015.

If the daily support level at $0.015 holds and JASMY recovers to close above $0.017, it could extend the rally to retest its March 2 high of $0.020.

The RSI on the daily chart reads 60, indicating bullish momentum. The MACD indicator also showed a bullish crossover last week, giving a buy signal and indicating an upward trend. It also shows a rising histogram above its neutral zero level, suggesting bullish momentum.

JASMY/USDT daily chart

JasmyCoin's Open Interest (OI) further supports the bullish outlook. Coinglass’s data shows that the futures’ OI in JASMY at exchanges rose from $22.14 million on Friday to $50.15 million on Sunday, the highest level since early February. An increasing OI represents new or additional money entering the market and new buying, which suggests a rally ahead in the JASMY price.

JASMY open interest chart. Source: Coinglass