TRUMP token leads $906 million in unlocks this week with over $330 million release

- According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days.

- Wu Blockchain says the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

- Traders should be cautious as token unlocks frequently generate negative sentiment among investors, weighing down prices.

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million. Traders should be cautious, as token unlocks frequently generate negative sentiment among investors. They represent an increase in circulating supply, weighing down prices.

Token unlocks to watch this week

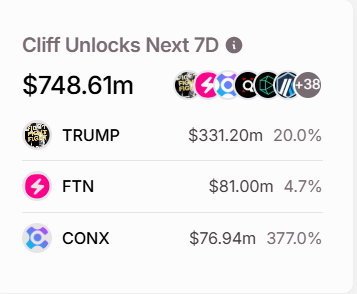

Tokenomist data shows that over 38 altcoins worth $748.04 million will cliff-unlock in the next 7 days. The cliff unlock allows a certain number of tokens to be unlocked immediately after a certain period.

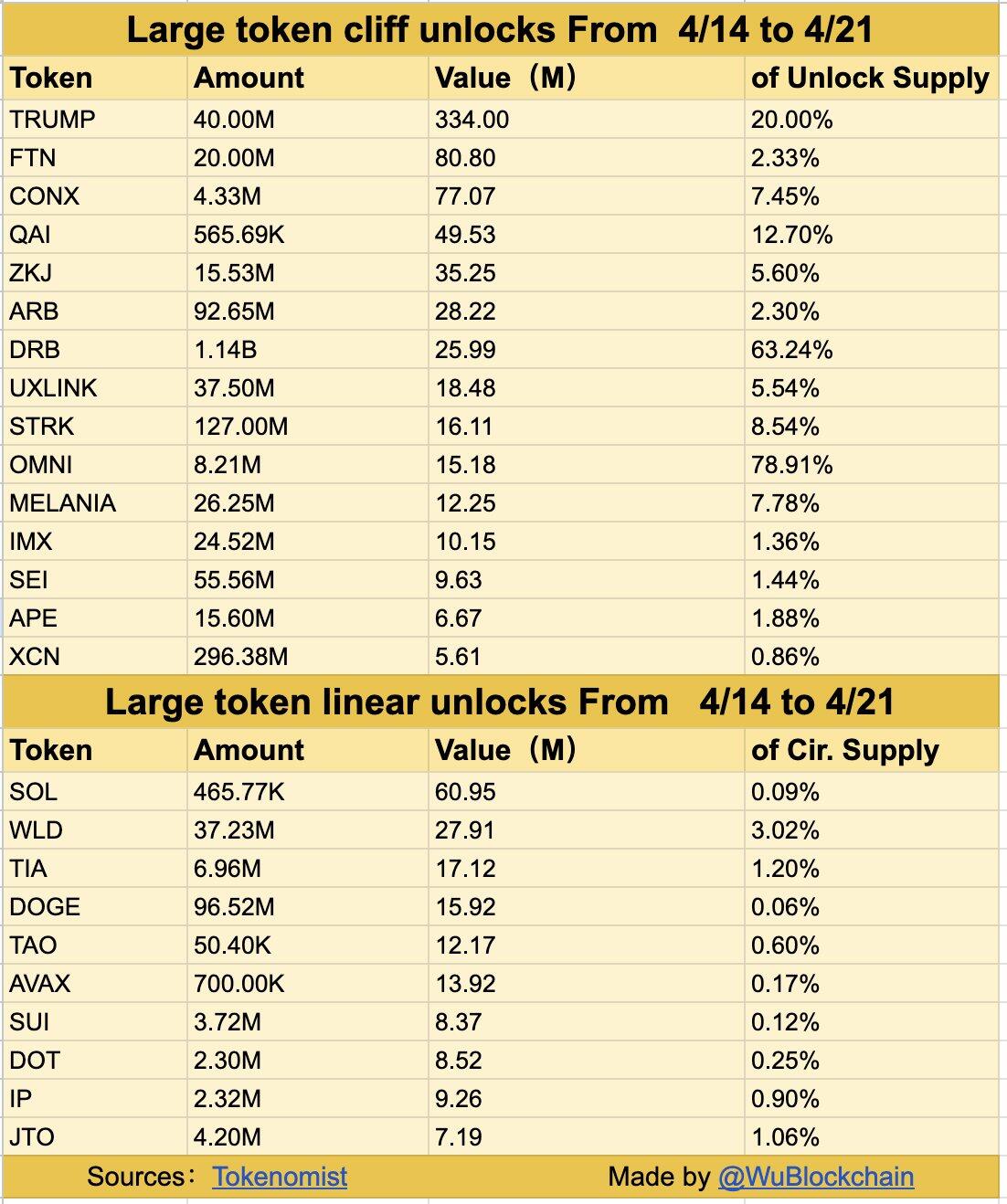

Out of these, 15 altcoins will unlock over $5 million. The table below shows the list of coins with over $5 million in token value. The list includes Official Trump (TRUMP), Fasttoken (FTN), Connex (CONX), QuantixAI(QAI), Arbitrum (ARB), deBridge (DRB), UXLINK (UXLINK), Starknet (STRK), Omni Network (OMNI), Melania Meme (MELANIA), Immutable (IMX), Sei (SEI), ApeCoin (APE), Onyxcoin (XCN), etc.

OMNI, DRB, TRUMP and QAI unlock the largest percentage of their circulating supply with 78.91%, 63.24%, 20% and 12.70%, respectively. Typically, when a token unlocks accounts for over 1% of the crypto’s circulating supply, it will likely impact the price negatively. Therefore, traders must watch these four assets for higher volatility this week.

Moreover, the large token linear unlocks this week include Solana unlocks 465,770 SOL tokens, worth $60.95 million; Worldcoin 37.23 million WLD tokens, worth $27.91 million; and Celestia will release 6.96 million TIA tokens worth $17.12 million. While an increase in a cryptocurrency’s circulating supply is typically bearish, planned unlock schedules may have less impact since the community of traders anticipates the unlock and likely positions themselves accordingly.

However, traders should remain cautious as the increased supply from token unlocks frequently generates negative sentiment among investors, which can weigh down prices.